Americans and Credit

- Details

- Category: Economics

- Hits: 5,554

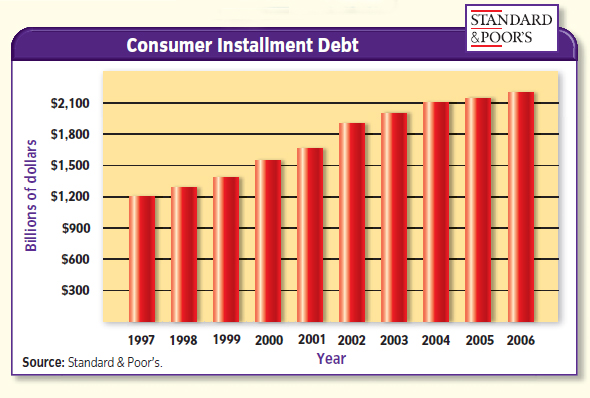

Americans rely on credit for everyday purchases, major investments, and financial flexibility. Each year, billions of dollars are borrowed and lent, fueling economic growth at both individual and governmental levels. The ability to access credit is a fundamental driver of the U.S. economy, allowing consumers and businesses to make essential purchases and investments.

What is Credit and Why Do People Use It?

Credit is the ability to receive funds now in exchange for a promise to repay later. When you use credit, you are borrowing money and accumulating debt. The total amount you owe includes both the principal (the original amount borrowed) and interest (the cost of borrowing, charged by lenders such as banks, credit unions, and credit card companies).

Every time you take out a loan or buy something on credit, you are leveraging someone else’s funds to increase your purchasing power. However, borrowing comes with costs—interest rates, repayment terms, and long-term financial implications.

Understanding Installment Debt

One of the most common forms of credit is installment debt, where borrowers repay loans in equal monthly payments over a set period. This type of debt is used to finance durable goods, such as:

- Automobiles

- Home appliances (refrigerators, washers, and more)

- Electronics (TVs, laptops, etc.)

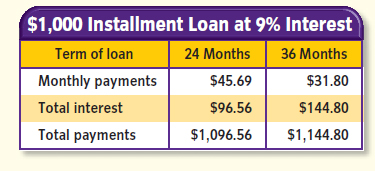

For example, if you finance a $1,000 flat-screen TV over 36 months, your monthly payments will be lower than if you choose a 24-month repayment plan. However, a longer repayment term means paying more in total interest.

Figure 1 Increase in Borrowing

Mortgage Loans: The Largest Form of Installment Debt

Figure 2 Pay Now or Pay Later?

A mortgage is a long-term installment loan used to purchase homes, buildings, or land. Unlike other debts, many people view mortgages as a necessary expense rather than a financial burden. However, like any loan, mortgages accrue interest, meaning the longer the repayment term, the more you’ll ultimately pay.

Why Do Consumers Choose Credit Over Cash?

The biggest advantage of credit is the ability to buy now and pay later. This is particularly important for big-ticket items such as cars, home improvements, or major electronics. Instead of saving for years, credit allows consumers to access products and services immediately while spreading payments over time.

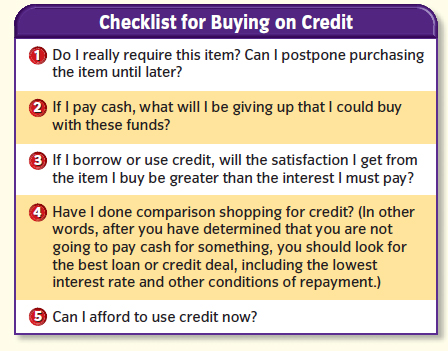

However, credit usage should always involve a cost-benefit analysis. While borrowing enables instant gratification, it comes with financial trade-offs, including:

- Interest payments that increase the total cost of the purchase

- Opportunity costs of missing out on other investments or savings

Figure 3 Buying on Credit

Making Smart Credit Decisions

Before using credit, ask yourself:

- Do I truly need this item now, or can I save and pay in full later?

- Can I afford the monthly payments without straining my budget?

- Will the benefits of borrowing outweigh the total interest costs?

For example, financing a $15,000 pickup truck today means making payments for 3 to 5 years, but you get to use the truck immediately. On the other hand, saving for several years before purchasing in cash allows you to avoid interest payments altogether.

Key Credit Terms to Know

- Credit – The ability to receive funds now with a promise to repay later

- Principal – The original amount borrowed

- Interest – The cost of borrowing, paid to the lender

- Installment Debt – A loan repaid in equal payments over time

- Durable Goods – Long-lasting manufactured items (3+ years lifespan)

- Mortgage – A loan used to purchase real estate

Final Thoughts

Credit is a powerful financial tool when used wisely. Understanding how installment debt, interest rates, and repayment terms affect your financial health can help you make informed borrowing decisions. Whether financing a new car, purchasing a home, or buying appliances, always weigh the benefits of immediate access against the long-term cost of borrowing.