Consumption, Income and Decision Making

- Details

- Category: Economics

- Hits: 7,950

Do you spend a lot of money on small, day-to-day items such as coffee, fast food, and candy, or do you prefer to save up your money for larger purchases? Either way, wise buying decisions will help you get the most out of the products you buy now and will enable you to meet your long-term financial goals. In this post, you’ll learn how to spend—or not spend—your income wisely.

Disposable and Discretionary Income

After people pay taxes, their remaining income may be saved or spent on essential or nonessential items.

Economics & You What do you plan to do after high school? How important is money to you when you consider your career plans? Read on to learn about the factors that affect how much income a person earns.

You and everyone around you are consumers and, as such, play an important role in the economic system. A consumer is any person or group that buys or uses goods and services to satisfy personal needs and wants. Consumers spend on a wide variety of things—food, clothing, housing, automobiles, and movie tickets, for example. A person’s role as a consumer depends on his or her ability to consume.

This ability to consume, in turn, depends on available income and how much of it a person chooses to spend now or save. Income can be both disposable and discretionary. Disposable income is the money income a person has left after all taxes have been paid. People spend their disposable income on many kinds of goods and services.

First, they buy the necessities: food, clothing, and housing. Any leftover income, which can be saved or spent on extras such as luxury items or entertainment, is called discretionary income.

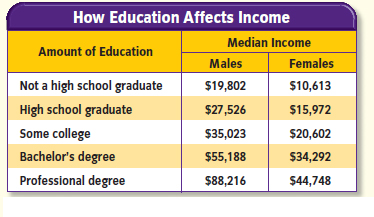

Education, occupation, experience, and health can all make differences in a person’s earning power and thus in his or her ability to consume. Figure 3.1, for example, shows how education level affects income. Where a person lives can also influence how much he or she earns—wages in some regions of the country are higher than in other regions. Inheriting money or property also affects earning power.

Decision Making as a Consumer

Consumer decisions involve comparing available alternatives.

Economics & You Think about a recent purchase you made. What were your reasons for buying the item? Read on to learn the steps to making good consumer decisions.

Spending choices involve several decisions. The initial decision a consumer must make is whether to buy an item in the first place. This may sound so basic as to be unnecessary to mention, but how many times do you actually think about the reasons for the purchase you are about to make? When deciding how to spend your money, do you concentrate on items you need first, and then consider items you want? Do you consider the trade-offs involved? As we will see, consumer decisions involve three main considerations.

Scarce Resources

After you have decided to make a purchase, at least two scarce resources are involved—income and time. Before you spend your money, you need to invest time in obtaining information about the product you wish to buy. Suppose, for example, that you wish to buy a mountain bike. How can you obtain information about the characteristics of the numerous brands and models and the prices of each? You should first visit retail stores and do some research on the Internet to compare prices.

The time spent researching online or visiting stores to check models and prices is a cost to you. This time, and the money you eventually spend on the mountain bike, cannot be used for anything else.

Figure 3.1 Earning Power

Several factors can influence how much income a person has. One important factor is education. As you can see, the number of years of education you have has a direct effect on your income.

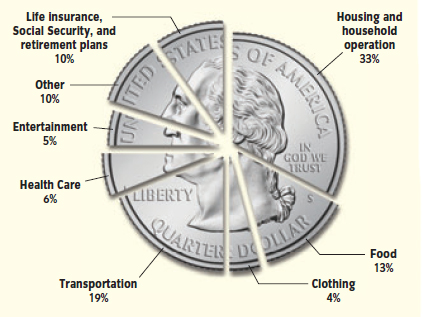

Figure 3.2 Consumer Spending

This circle graph shows how Americans, as a whole, spend their income. Note that both needs, like food, and wants, like entertainment, are included in consumer spending.

Opportunity Cost

How U.S. consumers spend their income is shown in Figure 3.2 above. Almost all of the steps in consumer decision making, like the choices represented in the graph, involve an opportunity cost. Remember from Chapter 1 that opportunity cost is the value of the highest alternative choice that you did not make. When considering this cost, you should think not only about whether you should buy an item in the first place, but also about the quality of the item if you do choose to buy it.

In general, a high-quality product costs more than a medium- or low-quality product. Suppose that you want to buy new cross-training shoes and are trying to decide between two different pairs. One model has a pump system that allows you to get a closer fit on your ankle, and the other does not. The pump system model costs $80 more than the other model. If you choose the higher-priced shoe, you will sacrifice $80.

The opportunity cost of the pump model over the lesser-quality model shoe is whatever else you would have chosen to buy with that $80. When considering opportunity costs, you should think carefully about whether the features of the higher-quality product are important to you, or whether you would rather spend the extra money elsewhere. In our training shoes example, for instance, think about whether a pump system is really something you need or want in a shoe. Is this feature really important to you? Or would you rather spend the $80 on something else?

Rational Choice

When you make consumer decisions based on opportunity cost, you are engaging in rational choice. Economists define rational choice as the alternative that has the greatest perceived value.

Rational choice involves choosing the best-quality item that is the least expensive from among comparable quality products. As a consumer, you will make rational choices when you purchase the goods and services you believe can best satisfy your wants. Do not get the impression that wise consumers will all make the same choices.

Remember the definition: A rational choice is one that generates the greatest perceived value for any given expenditure.

Each person’s value system for his or her expenditures is different. Rational choices that are based on careful consumer decision making will still lead to billions of different consumer choices yearly.

- consumer: any person or group that buys or uses goods and services to satisfy personal needs and wants

- disposable income: income remaining for a person to spend or save after all taxes have been paid

- discretionary income: money income a person has left to spend on extras after necessities have been bought

- rational choice: choosing the alternative that has the greatest value from among comparable-quality products

- Spending Choices: Discretionary income can be spent on entertainment, such as movie tickets.

- Buying Decisions: If you choose the higher-priced product, you must believe that the opportunity cost for the higher quality is worth it—that nothing else at that instant will give you as much value.