Corporate Equity Accounting

- Details

- Category: Accounting

- Hits: 9,310

The Corporate Form of Organization

Corporations are separate legal entities having existence separate and distinct from their owners (i.e., stockholders). In essence, they are artificial beings existing only in contemplation of law. In the United States, a corporation is typically created when one or more individuals file “articles of incorporation” with a Secretary of State in the particular home state in which they choose to become domiciled.

The articles of incorporation will generally specify a number of important features about the purpose of the corporate entity and how general governance of ongoing operations will be structured. After reviewing the articles of incorporation, the Secretary of State will issue a charter (or certificate of incorporation) authorizing the corporate entity to “come into being.”

The persons who initiated the filing (the “incorporators”) will then call a meeting to collect the shareholders’ initial investment (this start-up money will be placed into the corporate accounts) in exchange for the “stock” of the corporation (the “stock” is the financial instrument evidencing a person’s ownership interest in the corporation). Once the initial stock is issued, a shareholders’ meeting will be convened to adopt bylaws and elect a board of directors.

These directors will then appoint the corporate officers who will be responsible for commencing the operations of the business. Of course, in a small start-up venture, the initial incorporators may become the shareholders, then select themselves to the board, and finally appoint themselves to become the officers. Which leads one to wonder why go to all the trouble of incorporating?

The reasons for incorporating can vary, but there are certain unique advantages of this form of organization that have led to its popularity:

Perhaps the first and most obvious advantage of the corporate form of organization is that it permits otherwise unaffiliated persons to join together in mutual ownership of a business entity. This objective can be accomplished in other ways like a partnership, but the corporate form of organization is arguably one of the better vehicles. Large amounts of venture capital can be drawn together from many individuals and concentrated into one entity under shared ownership.

The stock of the corporation provides a clear and unambiguous point of reference to identify who owns the business and in what proportion. Further, the democratic process associated with shareholder voting rights (typically one vote per share of stock) permits a shareholder’s “say so” in selecting the board of directors to be commensurate with the number of shares held. In addition to electing the board, shareholders may vote on other matters such as selection of an independent auditor, stock option plans, and corporate mergers. The voting “ballot” is usually referred to as a “proxy.”

A great feature of corporate stock is transferability of ownership. Corporate stock is easily transferable from one “person” to another. In this context, a “person” can be an individual or another corporation. Transferability provides liquidity to stockholders as it enables them to quickly enter or exit an ownership position in a corporate entity. And, although a corporation may become very complex (e.g., buying real estate, entering contracts, etc.), the ability of one shareholder to step out and allow a successor to take their place can be done quite simply; there is not a need for the holdings and agreements of the corporate entity to be revised.

As a corporation grows, it may bring in additional shareholders by issuing even more stock. At some point, the entity may become sufficiently large that its shares will become “listed” on a stock exchange and the shareholder group expanded to become large and dispersed. You have probably heard of an “IPO,” which is the “initial public offering” of the stock of a corporation. Rules require that such IPOs be accompanied by regulatory registrations and filings, and that potential shareholders be furnished with a “prospectus” detailing corporate information.

The pricing of IPOs can vary based on market conditions, and sometimes get “wild” for a hot company that seemingly everyone wants to own. “Publicly traded” (in contrast to “closely held”) corporate entities are subject to a number of continuing regulatory registration and reporting requirements that are aimed at ensuring full and fair disclosure.

Another benefit of a corporation is its perpetual existence. A corporate entity is typically of unlimited duration enabling it to effectively outlive its shareholders. Changes in stock ownership do not cause operations to cease even when the change in ownership is brought about by the death of a shareholder. Many corporate entities are over one-hundred years old. What would cause a corporation to cease to exist? At some point, a corporation may be acquired by another and merged in with the successor. Or, a corporation may become a business failure and cease operations (typically accompanied by a request to the Secretary of State to “dissolve” the legal existence).

Of course, not all dissolutions are the result of failure. Some businesses may find that liquidating operating assets and distributing substantial residual monies to the creditors and shareholders is a preferable strategy to continued operation.

Not to be overlooked in considering why a corporation is desirable is the feature of limited liability for stockholders. If you buy the stock of a corporation, you normally do so with the understanding that you can lose the amount of your investment, but no more.

Stockholders are not liable for debts and losses of the company beyond the amount of their investment. There are exceptions to this rule. In some cases, shareholders may be called upon to sign a separate guarantee for corporate debt.

And, shareholders in closely held companies can inadvertently get drawn into having to satisfy corporate debts where they commingle their personal finances with those of the company or fail to satisfy the necessary legal procedures to maintain a valid corporate existence.

Corporations are not without certain notable disadvantages:

Corporations in the United States are taxable entities, and their income is subject to taxation. This “income tax” is problematic as it oftentimes produces double taxation. This effect occurs, because when shareholders receive cash dividends on their corporate investments, they must include the dividends in their own calculation of taxable income.

Thus, a dollar earned at the corporate level is reduced by corporate income taxes (at a rate that is likely about 35%); to the extent the remaining after-tax profit is distributed to shareholders as dividends, it is again subject to taxes at the shareholder level (at a rate that will vary in the 15% to 35% range). So, as much as half or more of the profits of a dividend-paying corporation are apt to be shared with governmental entities because of this double taxation effect. Governments are aware that this double-taxation outcome can limit corporate investment and be potentially damaging to the economic wealth of their nation. Within the

United States, various measures of relief are sometimes available, depending on the prevailing political climate (including “ dividends received deductions” for dividends paid between affiliated companies, lower shareholder tax rates on dividends, and S-Corporation provisions that permit closely held corporations to attribute their income to the shareholders thereby avoiding one level of tax). Outside of the United States, some countries adopt “tax holidays” that permit newer companies to be exempt from income taxes, or utilize different approaches to taxing the value additive components of production by an entity.

Another burden on the corporate form of organization is costly regulation. Larger (usually public) companies are under scrutiny of federal (The Securities and Exchange Commission (SEC) and other public oversight bodies) and state regulatory bodies. History tells us that the absence or failure of these regulators will quickly foster an environment where rogue business persons will launch all manner of stock fraud schemes (not the least of which is inflated profits to attract and rob unsuspecting investors). Worse, these frauds quickly corrupt public confidence in stock investments and destroy wealth and opportunity for everyone. Without a willingness on the part of investors to join together via a corporate vehicle, new ideas, products, and innovations go undeveloped.

Therefore, it seems almost unavoidable that governmental regulation must be a part of the corporate scene. However, the cost of compliance with such regulation is heavy indeed. Public companies must prepare and file quarterly and annual reports with the SEC, along with a myriad of other documents. And, many of these documents must be certified or subjected to independent audit.

Further, requirements are in place that requires companies to have strong internal controls and even ethical training. As a result, one cannot simply dismiss this regulatory cost as a nuisance; indeed, it must be considered as a potential barrier to opting to become a public company. Historic events (the stock market crash of 1929 and the Enron/WorldCom debacles of 2001 and 2002, are two USA examples of precipitating events) have been catalysts for significant legislation intended to protect public investors.

Common and Preferred Stock

Companies may issue different types of stock; notably common stock and preferred stock. Being familiar with the word preferred may lead you to conclude it is the better choice, but such is not necessarily the case. The customary features of common and preferred differ, providing some advantages and disadvantages for each. As you shall soon see, preferred stock is ordinarily in a better position for dividends and any liquidation proceeds, but it can be left out of significant opportunities for share value appreciation.

Before digging into the specifics, be advised that the following discussion relates to general features, and the applicability of these general features can be modified on a company by company basis. Before investing in any company’s common or preferred stock, you should carefully examine the specific provisions that might be unique to that company.

Typical Common Stock Features

The right to share in a portion of dividends that are declared and issued by the company to its common shareholders.

- An option to buy a proportional part of any additional shares that may be issued by the company. This “preemptive right” is intended to allow a shareholder to avoid dilution by being assured a place in line to acquire a fair part of any corporate stock expansion. (Numerous companies have done away with this provision.)

- The right to vote on certain general governance matters like election of the Board ofDirectors, employee stock award plans, mergers, and similar major items.

- The right to share in proceeds of liquidation after all creditors and other priority claims are settled.

- The right to periodic financial reports about corporate performance.

Some companies go to the added trouble of having multiple classes of common stock -- Class A, Class B, etc. A good example is a “family business” that has grown very large and become a public company. Such situations may be accompanied by the creation of Class A stock (held by the family members) and Class B stock (held by the public), where only the Class A stock can vote. Thus, the family has raised needed capital but preserved the ability to control and direct the company.

You might also find it interesting that one can be forced out (in exchange for a fair price) of a stock ownership interest; this can occur when a company is bought out by another, and most of the other shareholders (oftentimes as high as 80 to 90%) have consented to the transaction. Non controlling shareholders (those who hold stock in a company where another party owns more than half of the corporation) are sometimes called the “minority interest.” Minority shareholders are in a treacherous position, and governing laws vary considerably in how much protection is afforded to prevent the majority from engaging in transactions and activities that disadvantage the minority.

Possible Preferred Stock Features

A preferred position for dividends

Preferred stock is paid a dividend prior to any distribution to common stockholders, and the dividend is more or less expected each period. The amount of the dividend is usually stated as a percentage of the preferred stock’s “par value.” Furthermore, preferred stock is frequently cumulative; if the annual dividend requirement cannot be satisfied, it will become a dividend in arrears, and all dividends in arrears must be paid before any dividends can be paid to common shareholders (in contrast to “noncumulative” where a missed dividend is not required to be made up in the future).

The absence of voting rights

A preferred position in liquidation. In the event of a corporate liquidation, preferred stock isunderstood to be “paid-off” before common shareholders. Of course, creditors must first be satisfied before any funds will flow to either the preferred or common stockholders.

A call feature, which means that the company can force the preferred shareholders to cash out of their position in exchange for a pre agreed “call price” that is oftentimes set at a certain percentage of “par value” (e.g., callable at 105, would mean the company can buy back the preferred stock at 105% of its par value). You don’t have to think too long to see that this call provision can effectively limit the upside value of an investment in preferred stock, no matter how attractive its dividend might appear.

A convertible feature, which means that the preferred shares may be exchanged for common stock at a preagreed ratio (e.g., 3 shares of common for one share of preferred). This conversion provision can effectively provide significant upside value for an investment in preferred stock, no matter how bad its dividend might appear.

A maturity date, at which time the preferred will be bought back by the company(“mandatory redeemable”).

Even a casual review of the above features will quickly lead you to conclude that preferred has its merits and its detractions depending on how the individual features are implemented for a particular company. Obviously, every company has different financing (and tax!) considerations and will tailor its package of features to match those issues. For instance, a company can issue preferred that is much like debt (cumulative, mandatory redeemable), because a fixed periodic payment must occur each period with a fixed amount due at maturity. On the other hand, some preferred will behave more like common stock (noncallable, noncumulative, convertible).

What is Par?

In the preceding discussion, there were several references to “par value.” Many states require that stock have a designated par value (or in some cases “stated value”). Thus, par value is said to represent the “legal capital” of the firm. In theory, original purchasers of stock are contingently liable to the company for the difference between the issue price and par value if the stock is issued at less than par. However, as a practical matter, par values on common stock are set well below the issue price, negating any practical effect of this latent provision. It is not unusual to see common stock carry a par value of $1 per share or even $.01 per share. In some respects, then, par value is merely a formality.

But, it does impact the accounting records, because separate accounts must be maintained for “par” and “paid in capital in excess of par.”

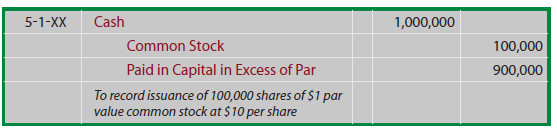

To illustrate the issuance of par value stock, assume that Godkneckt Corporation issues 100,000 shares of $1 par value stock for $10 per share. The entry to record this stock issuance would be:

- Occasionally, a corporation may issue no-par stock, which is simply recorded by debiting Cash and crediting Common Stock for the issue price. A separate Paid-in Capital in Excess of Par account is not needed.

By the way, the above entry assumed the stock was issued for cash. Sometimes, stock is issued for land or other tangible assets, in which case the above debit would be to the specific asset account (e.g., Land instead of Cash). When stock is issued for noncash assets, the amount of the entry would be based upon the fair value of the asset (or the fair value of the stock if it can be more clearlydetermined).

A Closer Look at Cash Dividends

Let’s begin by assuming that a company has only common shares outstanding. There is no mandatory dividend requirement, and the dividends are a matter of discretion for the Board of Directors to consider. Of course, to pay a dividend, the company must have sufficient cash and a positive balance in retained earnings (companies with a “deficit” (negative) Retained Earnings account would not pay a dividend unless it is part of a corporate liquidation action).

Many companies pride themselves in having a longstanding history of regular and increasing dividends; a feature that many investors find appealing. Other companies view their objective as one of continual growth via reinvestment of all earnings; their investors seem content relying on the notion that their investment value will gradually increase due to this earnings reinvestment activity.

Whatever the case, a company has no obligation to pay a dividend, and there is no “ liability” for dividends until such time as they are actually declared. A “declaration” is a formal action by the Board of Directors to indicate that a dividend will be paid at some stipulated future date. On the date of declaration, the following entry is needed on the corporate accounts:

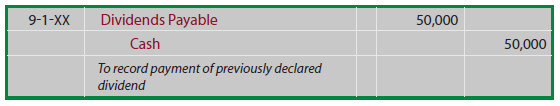

In observing the above entry, it is imperative to note that the declaration on July 1 establishes a liability to the shareholders that is legally enforceable. Therefore, a liability is recorded on the books at the time of declaration. Recall (from much earlier chapters) that the Dividends account will directly reduce retained earnings (it is not an expense in calculating income -- it is a distribution of income)! On September 1, when the above dividends are paid, the appropriate entry is:

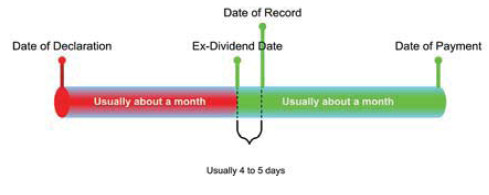

Some shareholders may sell their stock between the date of declaration and the date of payment.

- Who is to get the dividend?

- The former shareholder or the new shareholder?

To resolve this question, the Board will also set a “date of record;” the dividend will be paid to whomever the owner of record is on the “date of record.” In the preceding illustration, the date of record might have been set as August 1, for example. To further confuse matters, there may be a slight lag of just a few days between the time a share exchange occurs and the company records are updated. As a result, the date of record is usually slightly preceded by an ex-dividend date.

The practical effect of this is simple: if a shareholder on the date of declaration continues to hold the stock at least through the ex-dividend date, that shareholder will get the dividend -- but if the shareholder sells the stock before the ex-dividend date, the new shareholder can expect the dividend. In the time line at right, if you were to own stock on the date of declaration, you must hold the stock at least untilthe “green period” to be entitled to receive payment.

The Presence of Preferred Stock

Recall that preferred dividends are expected to be paid before common dividends, and those dividends are usually a fixed amount (e.g., a flat percentage of the preferred stock’s par value). In addition, recall that cumulative preferred requires that dividends that are not paid become “dividends in arrears.” Dividends in arrears must also be paid before any distributions to common can occur. Another illustration will likely provide the answer to questions you may have about how these concepts are to be implemented.

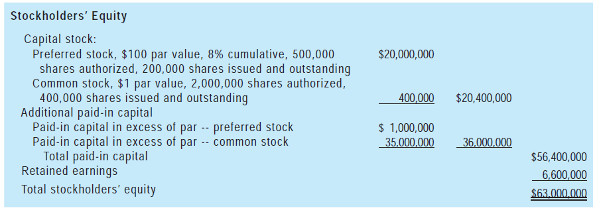

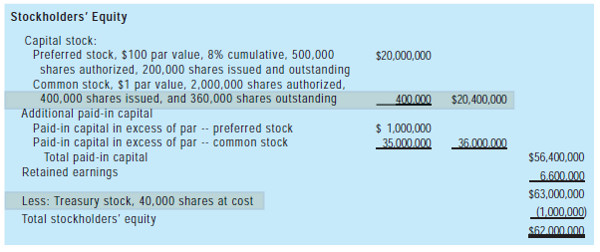

To develop the illustration, let’s begin by looking at the equity section of Embassy Corporation’s balance sheet. You will note that this section of the balance sheet has grown considerably. A corporation’s stockholders’ equity (or related footnotes) should include rather detailed descriptions of the type of stock outstanding and its basic features. This will include mention of the number of shares authorized (permitted to be issued), issued (actually issued), and outstanding (issued minus any shares reacquired by the company). In addition, you should be aware of certain related terminology -- “legal capital” is the total par value ($20,400,000 below), and “total paid in capital” is the legal capital plus amounts paid in excess of par values ($56,400,000 below).

In examining this stockholders’ equity section, note that the par value for each class of stock is the number of shares issued multiplied by the par value per share (e.g., 200,000 shares X $100 per share = $20,000,000).

For Embassy Corporation, note that the preferred stock description makes it clear that the $100 par stock is 8% cumulative. This means that each share will pay $8 per year in dividends, and any “missed” dividends become dividends in arrears. Let us further assume that the notes to the financial statements appropriately indicate that Embassy has not managed to pay its dividends for the preceding two years. If Embassy desired to pay $5,000,000 of total dividends during the current year, how much do you suppose would be available to the common shareholders?

The answer is only $200,000 (or $0.50 per share for the 400,000 common shares). The reason is that the preferred stock is to receive annual dividends of $1,600,000 ($8 per share X 200,000 preferred shares), and three years must be paid consisting of the two years in arrears and the current year requirement ($1,600,000 X 3 years = $4,800,000 to preferred, and leaving only $200,000 for common).

Treasury Stock

Treasury stock is the term that is used to describe shares of a company’s own stock that it has reacquired. A company may buy back its own stock for any number of reasons. The most frequently cited reason is a belief by the officers and directors that the market value of the stock is unrealistically low. As such, the decision to buy back stock is seen as a way to support the stock price and utilize corporate funds to maximize the value for shareholders who choose not to sell back stock to the company.

Other times, a company may buy back public shares as part of a reorganization that contemplates the company “going private” or delisting from some particular stock exchange market. Further, a company might buy back shares, and in turn issue them to employees pursuant to some employee stock award plan. And, a company might buy back stock from a dissident shareholder who is making overtures to overthrow the current board (sometimes called “greenmail” since cash is extracted from the company in exchange for shares and a “standstill” agreement with the dissident).

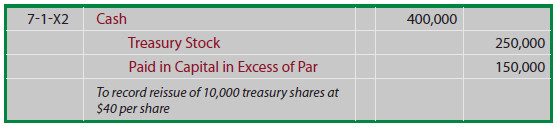

Whatever the reason for a treasury stock transaction, the company is to account for the shares as a purely equity transaction, and no gains and losses are reported in income (except in the case of “greenmail” where some expense may be recorded for any premiums paid to “quiet” the dissident).

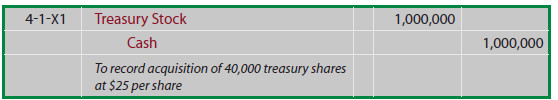

Procedurally, there are several ways the record the “debits” and “credits” associated with treasury stock. I will focus on the “cost method” as it is very direct and perfectly acceptable in each case. Under this approach, acquisitions of treasury stock are accounted for by debiting Treasury Stock and crediting Cash for the cost of the shares reacquired:

Treasury Stock is a contra equity item. It is not reported as an asset; rather, it is subtracted from stockholders’ equity. The presence of treasury shares will cause a difference between the number of shares issued and the number of shares outstanding. On the following page is Embassy Corporation’s equity section, modified (see highlights) to reflect the treasury stock transaction portrayed by the entry.

The effect of treasury stock is very simple -- cash goes down and so does total equity by the same amount. This result occurs no matter what the original issue price was for the stock. Accounting rules do not recognize gains or losses when a company issues its own stock, nor do they recognize gains and losses when a company reacquires its own stock. This may seem odd, because it is certainly different than the way you or I think about stock investments. But remember, this is not a stock investment from the company’s perspective -- it is instead an expansion or contraction of its own equity.

Corporations in the United States are taxable entities, and their income is subject to taxation. This “income tax” is problematic as it oftentimes produces double taxation. This effect occurs, because when shareholders receive cash dividends on their corporate investments, they must include the dividends in their own calculation of taxable income.

Thus, a dollar earned at the corporate level is reduced by corporate income taxes (at a rate that is likely about 35%); to the extent the remaining after-tax profit is distributed to shareholders as dividends, it is again subject to taxes at the shareholder level (at a rate that will vary in the 15% to 35% range). So, as much as half or more of the profits of a dividend-paying corporation are apt to be shared with governmental entities because of this double taxation effect.

Governments are aware that this double-taxation outcome can limit corporate investment and be potentially damaging to the economic wealth of their nation. Within the United States, various measures of relief are sometimes available, depending on the prevailing political climate (including “dividends received deductions” for dividends paid between affiliated companies, lower shareholder tax rates on dividends, and S-Corporation provisions that permit closely held corporations to attribute their income to the shareholders thereby avoiding one level of tax).

Outside of the United States, some countries adopt “tax holidays” that permit newer companies to be exempt from income taxes, or utilize different approaches to taxing the value additive components of production by an entity.

Stock Splits and Stock Dividends

Stock splits are events that increase the number of shares outstanding and reduce the par or stated value per share. For example, a two-for-one stock split would double the number of shares outstanding and halve the par value per share. Existing shareholders would see their shareholdings double in quantity, but there would be no change in the proportional ownership represented by the shares (i.e., a shareholder owning 1,000 shares out of 100,000 would then own 2,000 shares out of 200,000).

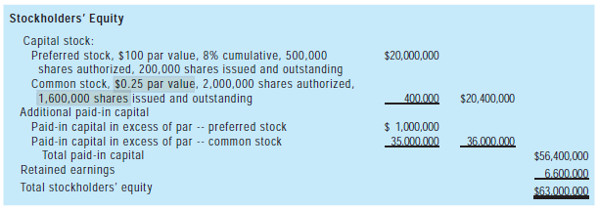

Importantly, the total par value of shares outstanding is not affected by a stock split (i.e., the number of shares times par value per share does not change). Therefore, no journal entry is needed to account for a stock split. A memorandum notation in the accounting records indicates the decreased par value and increased number of shares. If the initial equity illustration for Embassy Corporation was modified to reflect a four-for-one stock split of the common stock, the revised presentation would appear as follows (the only changes are highlighted):

By reviewing the changes, you can see that the par has been reduced from $1.00 to $0.25 per share, and the number of issued shares has quadrupled from 400,000 shares to 1,600,000 (be sure to note that $1.00 X 400,000 = $0.25 X 1,600,000 = $400,000). None of the account balances have changes.

Given the paucity of financial statement effect, why would a company bother with a stock split? The answer is not in the financial statement impact, but in the financial markets. Since the same company is now represented by more shares, one would expect the market value per share to suffer a corresponding decline.

For example, a stock that is subject to a 3-1 split should see its shares initially cut in third. But, holders of the stock will not be disappointed by this share price drop since they will each be receiving proportionately more shares; it is very important to understand that existing shareholders are getting the newly issued shares for no additional investment.

The benefit to the shareholders comes about, in theory, because the split creates more attractive opportunities for other future investors to ultimately buy into the larger pool of lower priced shares. Rapidly growing companies often have share splits to keep the per share price from reaching stratospheric levels that could deter some investors. In the final analysis, you should understand that a stock split is mostly cosmetic as it does not change the underlying economics of the firm.

And, splits can come in odd proportions: 3 for 2, 5 for 4, 1,000 for 1, and so forth depending on the scenario. A reverse split (1 for 5, etc.) is also possible, and will initially be accompanied by a reduction in the number of issued shares along with a proportionate increase in share price. Reverse splits are often seen when a stock’s price has dropped below a minimum threshold level for continued listing on some stock exchanges.

Shareholders who suffer a reverse split are usually not too happy to see their number of shares reduced; however, they still own the same proportionate share of the company, as the reductive impact falls evenly on all shareholders. Again, the reverse split does not change the underlying economics of the firm.

Stock Dividends

In contrast to cash dividends discussed earlier in this chapter, stock dividends involve the issuance of additional shares of stock to existing shareholders on a proportional basis. Stock dividends are very similar to stock splits. For example, a shareholder who owns 100 shares of stock will own 125 shares after a 25% stock dividend (essentially the same result as a 5 for 4 stock split). Importantly, all shareholders would have 25% more shares, so the percentage of the total outstanding stock owned by a specific shareholder is not increased.

Although shareholders will perceive very little difference between a stock dividend and stock split, the accounting for stock dividends is unique -- stock dividends require journal entries. Stock dividends are recorded by moving amounts from retained earnings to the paid-in capital accounts.

The amount to move depends on the size of the distribution; (1) a small stock dividend (generally less than 20-25% of the existing shares outstanding) is accounted for at market price on the date of declaration, and (2) a large stock dividend (generally over the 20-25% range) is accounted for at par value.

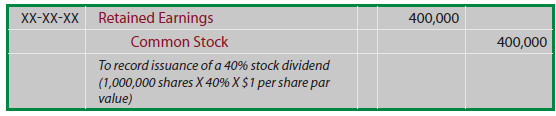

To illustrate, assume that Childers Corporation had 1,000,000 shares of $1 par value stock outstanding. The market price per share is $20 on the date that a stock dividend is declared and issued:

Small Stock Dividend: Assume Childers Issues a 10% Stock Dividend

Small Stock Dividend: Assume Childers Issues a 10% Stock Dividend Large Stock Dividend: Assume Childers Issues a 40% Stock Dividend

Large Stock Dividend: Assume Childers Issues a 40% Stock Dividend

Additional “temporary” equity accounts might be introduced if the declaration and distribution occurred on different dates, but the final outcome after the distribution was complete would be identical to the result produced above. Those details are left for more advanced accounting courses. Before moving on, it may seem odd that accounting rules require different treatments for stock splits, small stock dividends, and large stock dividends.

There are some conceptual underpinnings for these differences, but it is primarily related to bookkeeping issues. For example, the total par value needs to correspond to the number of shares outstanding. To test your understanding, which transaction (split, small stock dividend, or large stock dividend) causes a change in total stockholders’ equity? The answer is none of them; each merely rearranges existing equity in some fashion, but none of them change the bottom line total equity balance

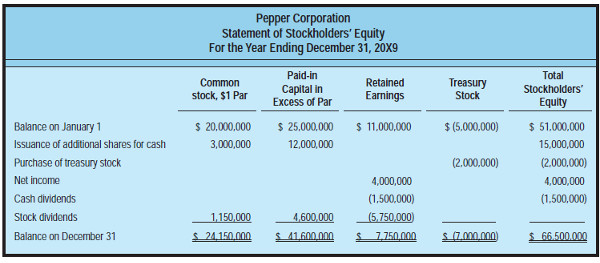

Statement of Stockholders’ Equity

Remember that a company must present an income statement, balance sheet, statement of retained earnings, and statement of cash flows. However, it is also necessary to present additional information about changes in other equity accounts. This may be done by notes to the financial statements or other separate schedules. However, most companies will find it preferable to simply combine the required statement of retained earnings and information about changes in other equity accounts into a single Statement of Stockholders’ Equity. Following is an example of such a statement.

This statement does fulfill the requirement for a statement of retained earnings and additional equity account information disclosures. From the illustration, you can see that the company had several equity transactions during the year, and the retained earnings column roughly corresponds to a statement of retained earnings. In actuality, companies are apt to expand this presentation to include comparative data for multiple years and potentially include information about all other equity accounts (such as the other comprehensive income accounts you learned about in the long-term investments accounting chapter).

To close this chapter, I would encourage you to examine the above statement of stockholders’ equity, and be sure you can prepare a journal entry that corresponds to Pepper’s share issuance, treasury stock transaction, cash dividend, and stock dividend. You will find it helpful to review the various journal entries illustrated in this chapter as you undertake this effort.