Introduction to Accounting

- Details

- Category: Accounting

- Hits: 13,467

Accounting Information

You likely have a general concept of what accountants do. They capture information about the transactions and events of a business and summarize that activity in reports that are used by persons interested in the entity. But, you likely do not realize the complexity of accomplishing this task. It involves a talented blending of technical knowledge and measurement artistry that can only be fully appreciated via the extensive study of the subject.

The best analogy is to say that you probably know what a heart surgeon does, but you no doubt appreciate that considerable knowledge and skill is needed to successfully treat a patient. If you were studying to be a surgeon, you would likely begin with some basic anatomy class. In this chapter, you will begin your study of accounting by looking at the overall structure of accounting and the basic anatomy of reporting.

Be advised that a true understanding of accounting does not come easily. It only comes with determination and hard work. But, if you persevere, you will be surprised at what you discover about accounting. Knowledge of accounting is very valuable to business success. And, once you conquer the basics, accounting is actually quite an interesting subject.

Accounting Defined

It seems fitting to begin with a more formal definition of accounting: Accounting is a set of concepts and techniques that are used to measure and report financial information about an economic unit. The economic unit is generally considered to be a separate enterprise. The information is potentially reported to a variety of different types of interested parties.

These include business managers, owners, creditors, governmental units, financial analysts, and even employees. In one way or another, these users of accounting information tend to be concerned about their own interests in the entity. Business managers need accounting information to make sound leadership decisions. Investors hold out hope for profits that may eventually lead to distributions from the business (e.g., “dividends”).

Creditors are always concerned about the entity’s ability to repay its obligations. Governmental units need the information to tax and regulate. Analysts use accounting data to form their opinions on which they base their investment recommendations. Employees want to work for successful companies to further their individual careers, and they often have bonuses or options tied to enterprise performance.

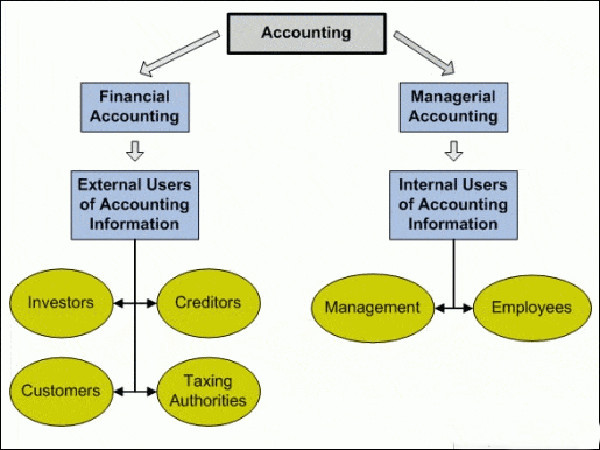

Accounting information about specific entities helps satisfy the needs of all these interested parties. The diversity of interested parties leads to a logical division in the discipline of accounting: financial accounting and managerial accounting. Financial accounting is concerned with the external reporting of information to parties outside the firm. In contrast, managerial accounting is primarily concerned with providing information for internal management. You may have some trouble seeing why a distinction is needed; after all, aren’t we just reporting financial facts? Let’s look closer at the distinctions.

Financial Accounting

Consider that financial accounting is targeted toward a broad base of external users, none of whom control the actual preparation of reports or have access to underlying details. Their ability to understand and have confidence in reports is directly dependent upon the standardization of the principles and practices that are used to prepare the reports. Without such standardization, reports of different companies could be hard to understand and even harder to compare.

As a result, there are well-organized processes to bring consistency and structure to financial reporting. In the United States, a private-sector group called the Financial Accounting Standards Board (FASB) is primarily responsible for developing the rules that form the foundation of financial reporting. With the increase in global trade, the International Accounting Standards Board (IASB) has been steadily gaining prominence as a global accounting rule setter.

Financial reports prepared under the generally accepted accounting principles (GAAP) promulgated by such standard-setting bodies are intended to be general-purpose in orientation. This means they are not prepared especially for owners, or creditors, or any other particular user group. Instead, they are intended to be equally useful for all user groups. As such, attempts are made to keep them free from bias (neutral).

Managerial Accounting

In sharp contrast to financial accounting, managerial accounting information is intended to serve the specific needs of management. Business managers are charged with business planning, controlling, and decision making. As such, they may desire specialized reports, budgets, product costing data, and other details that are generally not reported on an external basis. Further, management may dictate the parameters under which such information is to be accumulated and presented.

For instance, GAAP may require that certain research costs be deducted immediately in computing business’s externally reported income; on the other hand, management may see these costs as a long-term investment and stipulate that internal decision making be based upon income numbers that exclude such costs. This is their prerogative. Hopefully, such internal reporting is being done logically and rationally, but it need not follow any particular set of guidelines.

A Quality Information System

Both financial accounting and managerial accounting depend upon a strong information system to reliably capture and summarize business transaction data. Information technology has radically reshaped this mundane part of the practice of accounting during the past 30 years. The era of the “green eye-shaded” accountant has been relegated to the annals of history. Now, accounting is more of a dynamic, decision-making discipline, rather than a bookkeeping task.

Inherent Limitations

Accounting data is not absolute or concrete. Considerable amounts of judgment and estimation are necessary to develop the specific accounting measurements that are reported during a particular month, quarter, or year (e.g., how much pension expense should be reported now for the future benefits that are being earned by employees now, but the amounts will not be known with certainty until many years to come?).

About the only way around the problem of utilizing estimation in accounting is to wait until all facts are known with certainty before issuing any reports. However, by the time any information could be reported, it would be so stale as to lose its usefulness. Thus, in order to timely present information, it is considered to be far better to embrace reasonable estimations in the normal preparation of ongoing financial reports.

In addition, accounting has not yet advanced to a state of being able to value a business (or a business’s assets). As such, many transactions and events are reported based upon the historical cost principle (in contrast to fair value). This principle holds that it is better to maintain accountability over certain financial statement elements at amounts that are objective and verifiable, rather than opening the door to random adjustments for value changes that may not be supportable.

For example, land is initially recorded in the accounting records at its purchase price. That historical cost will not be adjusted even if the fair value is perceived as increasing. While this enhances the “reliability” of reported data, it can also pose a limitation on its “relevance.”

The Accounting Profession and Careers

To decide to be an accountant is no more descriptive than deciding to be a doctor. Obviously, there are many specialty areas. Many accountants engage in the practice of “public” accounting, which involves providing audit, tax, and consulting services to the general public. To engage in the practice of public accounting usually requires one to be licensed as a CPA (Certified Public Accountant). Auditing involves the examination of transactions and systems that underlie an organization’s financial reports, with the ultimate goal of providing an independent report on the appropriateness of financial statements.

Tax services relate to the providing of help in the preparation and filing of tax returns and the rendering of advice on the tax consequences of alternative actions. Consulting services can vary dramatically, and include such diverse activities as information systems engineering to evaluating production methods. Many accountants are privately employed directly by small and large businesses (i.e., “ industry accounting”) and not-for-profit agencies (such as hospitals, universities, and charitable groups).

They may work in areas of product costing and pricing, budgeting, and the examination of investment alternatives. They may focus on internal auditing, which involves looking at controls and procedures in use by their employers. Objectives of these reviews are to safeguard company resources and assess the reliability and accuracy of accounting information and accounting systems. They may serve as in house tax accountants, financial managers, or countless other occupations.

And, it probably goes without saying that many accountants work in the governmental sector, whether it be local, state, or national levels. You would expect to find many accountants at the Internal Revenue Service, General Accounting Office, Securities and Exchange Commission (“SEC” - - the USA governmental agency charged with regulating accounting and reporting by companies whose shares of stock are bought and sold in public markets), and even the Federal Bureau of Investigation.

Accounting and Professional Ethics

Because investors and creditors place great reliance on financial statements in making their investment and credit decisions, it is imperative that the financial reporting process be truthful and dependable. Accountants are expected to behave in an entirely ethical fashion, and this is generally the case. To help insure integrity in the reporting process, the profession has adopted a code of ethics to which its licensed members must adhere. In addition, checks and balances via the audit process, government oversight, and the ever-vigilant “plaintiff’s attorney” all serve a vital role in providing additional safeguards against the errant accountant.

If you are preparing to enter the accounting profession, you should do so with the intention of behaving with honor and integrity. If you are not planning to enter the profession, you will likely rely upon accountants in some aspect of your personal or professional life. You have every right to expect those accountants to behave in a completely trustworthy and ethical fashion. After all, you will be entrusting them with your financial resources and confidential information.

The Fundamental Accounting Equation

The basic features of the accounting model we use today trace their roots back over 500 years. Luca Pacioli, a Renaissance-era monk, developed a method for tracking the success or failure of trading ventures. The foundation of that system continues to serve the modern business world well, and is the entrenched cornerstone of even the most elaborate computerized systems.

The nucleus of that system is the notion that a business entity can be described as a collection of assets and the corresponding claims against those assets. The claims can be divided into the claims of creditors and owners (i.e., liabilities and owners’ equity). This gives rise to the fundamental accounting equation:

Assets = Liabilities + Owners’ Equity

Assets

Assets are the economic resources of the entity and include such items as cash, accounts receivable (amounts owed to a firm by its customers), inventories, land, buildings, equipment, and even intangible assets like patents and other legal rights and claims. Assets are presumed to entail probable future economic benefits to the owner.

Liabilities

Liabilities are amounts owed to others relating to loans, extensions of credit, and other obligations arising in the course of business.

Owners’ Equity

Owners’ equity is the owner’s “interest” in the business. It is sometimes called net assets because it is equivalent to assets minus liabilities for a particular business. Who are the “owners?” The answer to this question depends on the legal form of the entity; examples of entity types include sole proprietorships, partnerships, and corporations. A sole proprietorship is a business owned by one person, and its equity would typically consist of a single owner’s capital account.

Conversely, a partnership is a business owned by more than one person, with its equity consisting of a separate capital account for each partner. Finally, a corporation is a very common entity form, with its own interest being represented by divisible units of ownership called shares of stock. These shares are easily transferable, with the current holder(s) of the stock being the owners. The total owners’ equity (i.e., “stockholders’ equity”) of a corporation usually consists of several amounts, generally corresponding to the owner investments in the capital stock (by shareholders) and additional amounts generated through earnings that have not been paid out to shareholders as dividends (dividends are distributions to shareholders as a return on their investment). Earnings give rise to increases in “retained earnings,” while dividends (and losses) cause decreases.

Balance Sheet

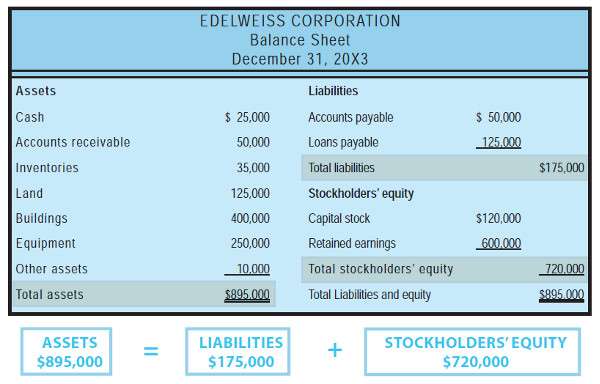

The fundamental accounting equation is the backbone of the accounting and reporting system. It is central to understanding a key financial statement known as the balance sheet (sometimes called the statement of financial position). The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors are owed $175,000, leaving $720,000 of stockholders’ equity. The stockholders’ equity section is divided into the $120,000 that was originally invested in Edelweiss Corporation by stockholders (i.e., capital stock), and the other $600,000 that was earned (and retained) by successful business performance over the life of the company.

Does the stockholders’ equity total mean the business is worth $720,000? No! Why not? Because many assets are not reported at current value. For example, although the land cost $125,000, the balance sheet does not report its current worth. Similarly, the business may have unrecorded resources to its credit, such as a trade secret or a brand name that allows it to earn extraordinary profits. If one is looking to buy stock in Edelweiss Corporation, they would surely give consideration to these important non-financial statement based valuation considerations. This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions.

How Transactions Impact the Accounting Equation

The preceding balance sheet for Edelweiss was static. This means that it represented the financial condition at the noted date. But, each passing transaction or event brings about a change in the overall financial condition. Business activity will impact various asset, liability, and/or equity accounts; but, they will not disturb the equality of the accounting equation. So, how does this happen? To reveal the answer to this question, let’s look at four specific transactions for Edelweiss Corporation. You will see how each transaction impacts the individual asset, liability, and equity accounts, without upsetting the basic equality of the overall balance sheet.

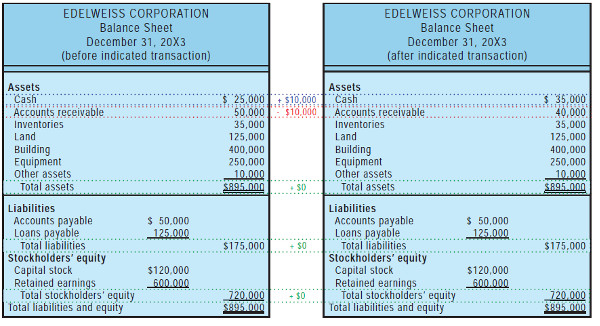

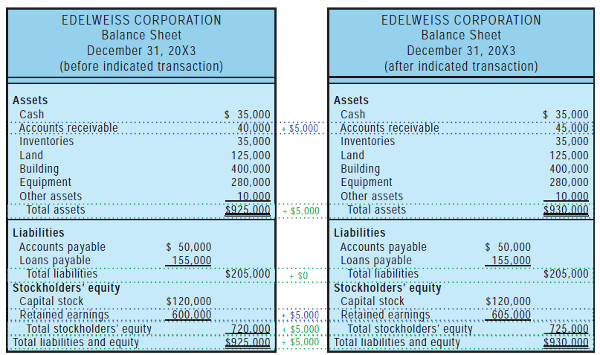

Edelweiss Collects an Account Receivable

If Edelweiss Corporation collected $10,000 from a customer on an existing account receivable (i.e., not a new sale, just the collection of an amount that is due from some previous transaction), then the balance sheet would be revised as follows:

The illustration plainly shows that cash (an asset) increased from $25,000 to $35,000, and accounts receivable (an asset) decreased from $50,000 to $40,000. As a result, total assets did not change, and liabilities and equity accounts were unaffected. Thus, assets still equal liabilities plus equity.

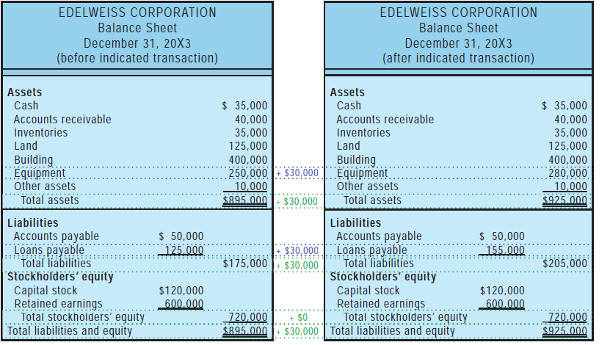

Edelweiss Buys Equipment With Loan Proceeds

If Edelweiss Corporation purchased $30,000 of equipment, agreeing to pay for it later (i.e. taking out a loan), then the balance sheet would be further revised as follows.

This illustration shows that equipment (an asset) increased from $250,000 to $280,000, and loans payable (a liability) increased from $125,000 to $155,000. As a result, both total assets and total liabilities increased by $30,000, but assets still equal liabilities plus equity.

Edelweiss Provides Services to a Customer on Account

What would happen if Edelweiss Corporation did some work for a customer in exchange for the customer’s promise to pay $5,000? This requires further explanation; try to follow this logic closely! You already know that retained earnings is the income of the business that has not been distributed to the owners of the business. When Edelweiss Corporation earned $5,000 (which they will collect later) by providing a service to a customer, it can be said that they generated revenue of $5,000. Revenue is the enhancement to assets resulting from providing goods or services to customers. Revenue will bring about an increase to income, and income is added to retained earnings.

Can you follow that? As you examine the balance sheet on the top of the next page, notice that accounts receivable and retained earnings went up by $5,000 each, indicating that the business has more assets and more retained earnings. And, guess what: assets still equal liabilities plus equity.

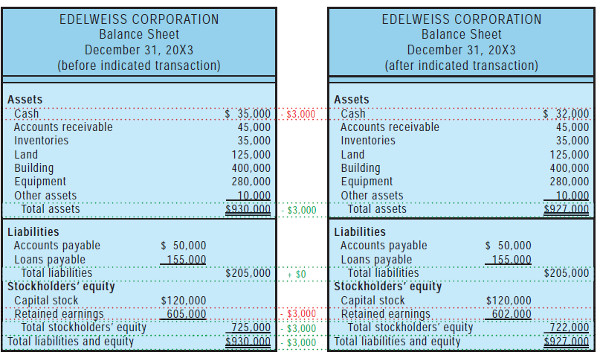

Edelweiss Pays Expenses With Cash

It would be nice if you could run a business without incurring any expenses. However, such is not the case. Expenses are the outflows and obligations that arise from producing goods and services.

Imagine that Edelweiss paid $3,000 for expenses. The lower set of balance sheets on the following page shows this impact.

Generalizing About the Impact of Transactions

There are countless types of transactions that can occur, and each and every transaction can be described in terms of its impact on assets, liabilities, and equity. What is important to know is that no transaction will upset the fundamental accounting equation of assets = liabilities + owners’ equity.

Services to a customer on account:

Pays expenses:

Distinguishing Between Revenue and Income

In day-to-day conversation, some terms can often be used casually and without a great deal of precision. Words may be treated as synonymous, when in fact they are not. Such is the case for the words “income” and “revenue.” Each term has a very precise meaning, and you should accustom yourself to the correct usage. It has already been pointed out that revenues are enhancements resulting from providing goods and services to customers. Conversely, expenses can generally be regarded as costs of doing business. This gives rise to another “accounting equation”:

Revenues - Expenses = Income Revenue is the “top line” amount corresponding to the total benefits generated from business activity. Income is the “bottom line” amount that results after deducting the expenses from revenue. In some countries, revenue is also referred to as “turnover.”

The Core Financial Statements

Your future will undoubtedly be marked by numerous decisions about investing money in the capital stock of some corporation. Another option that will present itself is to lend money to a company, either directly, or by buying that company’s debt instruments known as “bonds.” Stocks and bonds are two of the most prevalent financial instruments of the modern global economy. The financial press and television devote seemingly endless coverage to headline events pertaining to large public corporations. Public companies are those with securities that are readily available for purchase/sale through organized stock markets.

Many more companies are private, meaning their stock and debt is in the hands of a narrow group of investors and banks. If you are contemplating an investment in a public or private entity, there is certain information you will logically seek to guide your decision process. What types of information will you desire? What do you want to know about the companies in which you are considering an investment? If you were to prepare a list of questions for the company’s management, what subjects would be included? Whether this challenge is posed to a sophisticated investor or to a new business student, the listing almost always includes the same basic components.

What are the corporate assets? Where does the company operate? What are the key products? How much income is being generated? Does the company pay dividends? What is the corporate policy on ethics and environmental responsibility? Many such topics are noted within the illustrated “thought cloud.” Some of these topics are financial in nature (noted in blue). Other topics are of more general interest and cannot be communicated in strict mathematical terms (noted in red).,

Financial accounting seeks to directly report information for the topics noted in blue. Additional supplemental disclosures frequently provide insight about subjects such as those noted in red. But, you would also need to gain additional information by reviewing corporate web sites (many have separate sections devoted to their investors), filings with the securities regulators, financial journals and magazines, and other such sources. Most companies will have annual meetings for shareholders and host webcasts every three months (quarterly).

These events are very valuable in allowing investors and creditors to make informed decisions about the company, as well as providing a forum for direct questioning of management. You might even call a company and seek “special insight” about emerging trends and developments. Be aware, however, that the company will likely not be able to respond in a meaningful way. Securities laws have very strict rules and penalties that are meant to limit selective or unique disclosures to any one investor or group (in the United States: Regulation Full Disclosure/Reg. FD). It is amusing, but rarely helpful, to review “message boards” where people anonymously post their opinions about a company.

Financial Statements

Financial accounting information is conveyed through a standardized set of reports. You have already been introduced to the balance sheet. The other fundamental financial statements are the income statement, statement of retained earnings, and statement of cash flows. There are many rules that govern the form and content of each financial statement. At the same time, those rules are not so rigid as to preclude variations in the exact structure or layout. For instance, the earlier illustration for Edelweiss was first presented as a “horizontal” layout of the balance sheet. The subsequent Edelweiss examples were representative of “vertical” balance sheet arrangements. Each approach and others are equally acceptable.

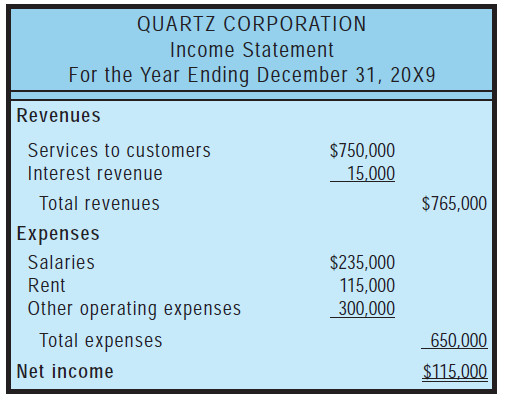

Income Statement

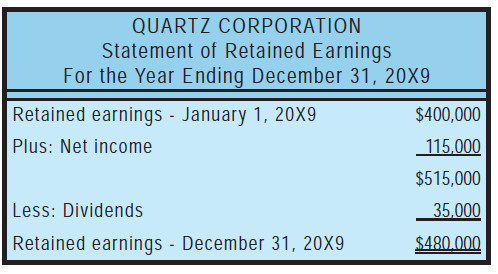

A summary of an entity’s results of operation for a specified period of time is revealed in the income statement, as it provides information about revenues generated and expenses incurred. The difference between the revenues and expenses is identified as the net income or net loss. The income statement can be prepared using a single-step or a multiple-step approach and might be further modified to include a number of special disclosures relating to unique items. These topics will be amplified in a number of subsequent chapters. For now, take careful note that the income statement relates to activities of a specified time period (e.g., year, quarter, month), as is clearly noted in its title:

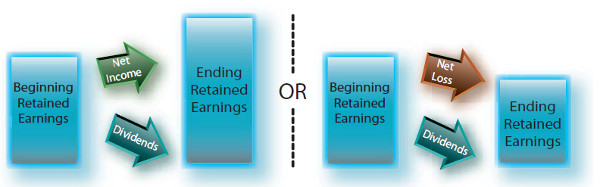

The Statement of Retained Earnings

The example balance sheets for Edelweiss revealed how retained earnings increased and decreased in response to events that impacted income. You also know that retained earnings are reduced by dividends paid to shareholders.

The statement of retained earnings provides a succinct reporting of these changes in retained earnings from one period to the next. In essence, the statement is nothing more than reconciliation or “birds-eye view” of the bridge between the retained earnings amounts appearing on two successive balance sheets.

If you examine very many sets of financial statements, you will soon discover that many companies provide an expanded statement of stockholders’ equity in lieu of the required statement of retained earnings. The statement of stockholders’ equity portrays not only the changes in retained earnings but also changes in other equity accounts such as capital stock. The expanded statement of stockholders’ equity is presented in a subsequent chapter.

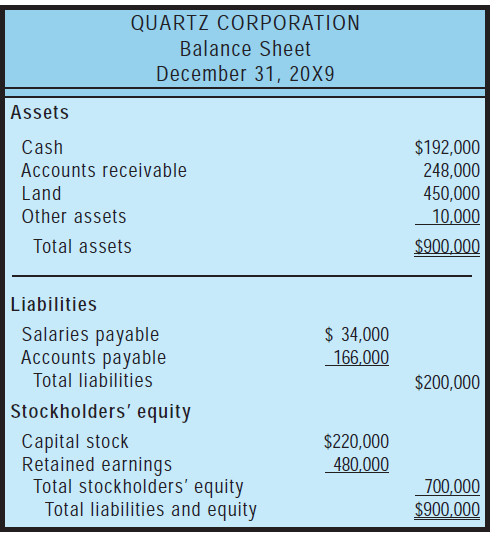

Balance Sheet

The balance sheet focuses on the accounting equation by revealing the economic resources owned by an entity and the claims against those resources (liabilities and owners’ equity). The balance sheet is prepared as of a specific date, whereas the income statement and statement of retained earnings cover a period of time. Accordingly, it is sometimes said that balance sheets portray financial position (or condition) while other statements reflect results of operations. Quartz’s balance sheet is as follows:

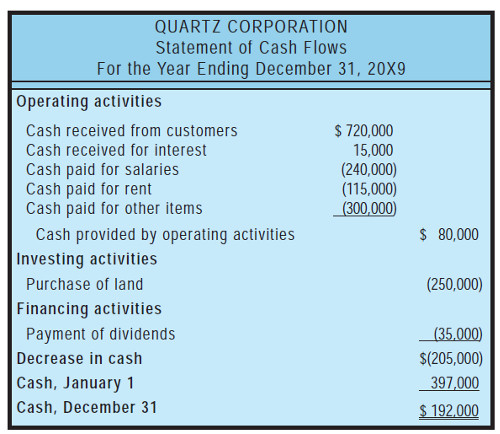

Statement of Cash Flows

The statement of cash flows details the enterprise’s cash flows. This operating statement reveals how cash is generated and expended during a specific period of time. It consists of three unique sections that isolate the cash inflows and outflows attributable to:

- operating activities

- investing activities

- financing activities

Notice that the cash provided by operations is not the same thing as net income found in the income statement. This result occurs because some items hit income and cash flows in different periods. For instance, remember how Edelweiss (from the earlier illustration) generated income from a service provided on account. That transaction increased income without a similar effect on cash. These differences tend to even out over time.

Suffice it to say that the underpinnings of the statement cash flows require fairly complete knowledge of basic accounting. Do not be concerned if you feel like you lack a complete comprehension at this juncture. A future chapter is devoted to the statement.

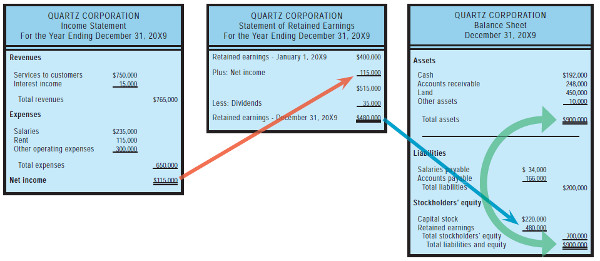

Articulation

It is important for you to take note of the fact that the income statement, statement of retained earnings, and balance sheet articulate. This means they mesh together in a self-balancing fashion. The income for the period ties into to the statement of retained earnings and the ending retained earnings ties into the balance sheet. This final tie-in causes the balance sheet to balance. These relationships are illustrated in the following diagram.

Unlocking the Mystery of Articulation

It seems almost magical that the final tie-in of retained earnings will exactly cause the balance sheet to balance. This is reflective of the brilliance of Pacioli’s model and is indicative of why it has survived for centuries.