Study Resources

Find study resources

Latest News and Articles

Supply chain management (SCM) plays a critical role in modern business operations. Effective supply chain objectives ensure seamless production, efficient distribution, and improved customer satisfaction. In this article, we explore key supply chain objectives and how businesses can optimize their strategies to achieve success.

Supply Chain Management (SCM) is a crucial aspect of modern business operations, ensuring that products and services reach consumers efficiently and cost-effectively. It involves the coordination and integration of various activities, from raw material procurement to final delivery. In this blog, we will explore what supply chain management is, its key components, benefits, challenges, and emerging trends shaping the industry.

When we have studied equilibria so far, it has always been so-called partial equilibria. (A partial equilibrium is one where we assume that “everything else is unchanged.”) However, we have also seen that a change in one variable can lead to changes in many other variables, so the restriction that everything else is unchanged may not be very realistic.

An agile supply chain is designed to be highly flexible, responsive, and adaptive to market changes and customer demands. Unlike traditional supply chains, which focus on efficiency and cost reduction, an agile supply chain emphasizes speed, innovation, and resilience. In this article, we will explore the concept of an agile supply chain, its key benefits, and the strategies businesses can implement to enhance agility.

A well-defined procurement organization structure is essential for businesses to optimize purchasing, reduce costs, and enhance operational efficiency. The structure determines how procurement activities are managed, ensuring alignment with overall business objectives. In this article, we will explore different procurement organization structures, their benefits, and best practices for selecting the right one for your business.

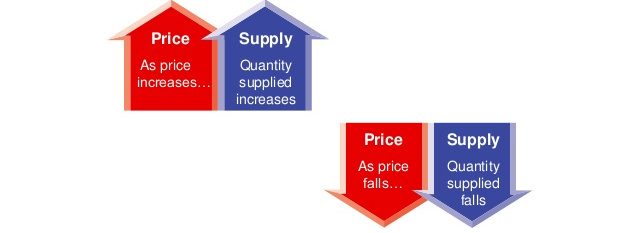

The Law of Supply is a fundamental principle in economics that states:

- As the price of a good or service increases, the quantity supplied also increases.

- As the price decreases, the quantity supplied decreases.

This happens because higher prices make production more profitable, encouraging businesses to produce and sell more. Conversely, when prices drop, suppliers may reduce production because it becomes less profitable.

When you borrow money, you usually have to pay a fee for the loan. This fee is often called interest, particularly if the fee is proportional to the amount you borrow. The interest rate is commonly expressed as a percentage of the size of the loan per unit of time, typically per year.

There are two major types of credit—using credit cards and borrowing directly from a financial institution. Although they differ in their services, they all charge interest on the funds they lend. In this section, you’ll learn about financial institutions, charge accounts, and credit cards—and why you should be aware of the high interest rates they sometimes charge.

Investing in the stock market offers tremendous potential for financial growth, but it also carries inherent risks. To navigate these complexities successfully, investors must develop a fundamental understanding of stocks, bonds, and derivatives. This comprehensive guide explores the essential concepts that can help both novice and experienced investors make more informed decisions.

The disciplines of geoeconomic and geopolitics are closely intertwined. The discipline of geopolitics has a burden full past and can only progress through self-critique: that is through criticism of the discipline itself. For instance, it must be made clear what in geopolitics is objective and what is normative. So far this criticism has come mostly from outside, from its opponents, whether they represent critical geopolitics, political geography, or mainstream political science.

Perfect Competition

So far, we have discussed how the consumers make their decisions, and what the producers’ production possibilities and cost of production look like. The consumers often take prices as given and choose quantities based on the prices. The question is how prices arise. One factor is, of course, the cost of production.

When searching for the best accounting software, we looked for solutions that are affordable and easy to use. We also looked for time-saving features that take the headache out of small business accounting, such as automated entries, invoicing, bill payments, expense reports, financial reports and reconciliations. Additionally, we looked for software that make it simple to perform advanced tasks, such as built-in financial reports and data syncing, for instance, with point of sale (POS) systems and bank accounts.