Agile supply chain management

- Details

- Category: Supply Chain Management

- Hits: 47,573

An agile supply chain is designed to be highly flexible, responsive, and adaptive to market changes and customer demands. Unlike traditional supply chains, which focus on efficiency and cost reduction, an agile supply chain emphasizes speed, innovation, and resilience. In this article, we will explore the concept of an agile supply chain, its key benefits, and the strategies businesses can implement to enhance agility.

What is an Agile Supply Chain?

An agile supply chain is a dynamic and flexible supply chain model that enables businesses to quickly adapt to changes in demand, supply disruptions, and evolving market conditions. It prioritizes responsiveness, collaboration, and digital integration to maintain a competitive edge.

Key Benefits of an Agile Supply Chain

1. Faster Response to Market Changes

An agile supply chain enables businesses to quickly adjust production, distribution, and sourcing based on real-time data.

Advantages:

- Reduces lead times and enhances customer satisfaction.

- Prevents excess inventory or shortages.

- Enhances competitiveness in dynamic markets.

2. Improved Customer Satisfaction

By swiftly responding to customer needs, businesses can offer personalized experiences and timely deliveries.

Advantages:

- Greater customer loyalty and retention.

- Higher customer service levels.

- Enhanced brand reputation.

3. Resilience Against Disruptions

Agility in the supply chain helps mitigate risks and ensure business continuity in the face of unexpected disruptions.

Advantages:

- Quickly recovers from supply chain shocks.

- Reduces financial losses during crises.

- Strengthens supplier collaboration and risk management.

4. Enhanced Collaboration and Visibility

An agile supply chain fosters real-time communication and data sharing across all supply chain partners.

Advantages:

- Enables proactive decision-making.

- Improves efficiency through better coordination.

- Increases transparency across the supply chain.

Understanding Agile Supply Chain

Having understood the impact and the indisputable success of the lean philosophy applied in many organizations world over. Can we come to a conclusion that the next milestone, after the craft production and mass production, is going to be the lean production? To answer this question, one needs to first establish whether the lean approach can fit all business environments now and in the future. Researches and literature so far appear to believe the otherwise.

The critical argument here is that the lean system was developed from a forecasting based volume production industrial sector where the market differentiator is reliability and cost, and today a large part of our global market is variety dominated and the differentiator is speed and responsiveness. Hence, lean probably is not a cure-all approach after all.

Apparently, the focus in an agile supply chain is on being fast and also on being smart in how you aligning with the increasingly demanding customers. But the tenet is still that supply chains are driven by the end-consumers in the dynamic market places. The need for supply chain agility ultimately comes from the consumer. However, the customer behaviors could be driven by uncertainties caused possibly by world oil prices, terrorism-related demand change or by the impact of new technological advancement.

The unpredictability is not so much the result of one customer ad hoc behavior; it is combined effect of an uncertain world rippling up and down the supply chain. Often the longer the supply chain the more complexity and increased risk of the bullwhip effect. In industries such as fashion and consumer technology, the plethora of products seems to increase exponentially while in the same time the product life cycles in the market are getting shorter.

It will come as no surprise that the dominant buying behavior of customers in an agile supply chain operated environment is that of demanding a quick response. The known business models of make-to-order or assemble-to-order are critical for catering such demand. Hewlett-Packard has long adopted the practice of postponing the final assembly of its printers until the exact market demand in terms of product configurations are known.

Thus what it produced are almost guaranteed to be sold and not overproduction or redundant finished goods inventories are created. Similarly, Dell Computer is a master at assembling to order, and often the assembly was carried out during the distribution and delivery process so that the customer can have their bespoke computer delivered in just a few days. And for Dell, the generic components in the up part of the supply chain were produced by the make-to-forecast model where efficiency and low cost can be achieved; the assemble-to-order at the final sector of the supply chain delivers the speed and responsiveness.

Agile Supply Chain Concept

Agility is a supply chain-wide capability that embraces organizational structures, value chain configurations, information systems, logistics processes and in particular mindset and culture. A key characteristic of an agile supply chain is flexibility, which should be interpreted from two side of the supply chain.

From the inside of the supply chain, such flexibility means configurations and structures are not fixed. They may transform quickly as the needs arises. From outside, i.e. from market and consumer perspective, the supply chain must deliver timely products and services; and deliver them at the beginning of the usually short profit widows; often to be innovative and to be the market leader.

Thus agile supply chain is essentially a practical approach to managing supply networks and developing flexible capabilities to satisfy the fast changing customer demand. It is about moving and transforming a supply chain that is structured around the focal company and its product categories to the one that is centred on end-consumers and their requirement. As the Chairman of Li and Fung Group - the largest export trader in Hong Kong, says that one of the key features of his approach is to organise for customer, not on country units that may end up competing against each other.

The capabilities of an agile supply chain is created and measured from the ‘outside-in’ as opposed to pushing product offerings into the market - the ‘inside out’. The strategic focus of an agile supply chain is a relentless pursuit of customer value in every part of its fabric. The operational planning of agile supply chain is focused on the capabilities for responsiveness and constantly in anticipation of unpredictable sudden changes in demand. Such capability building and customer attention cannot be achieved without a cost.

Typically, in order to ensure availability, extra production and service capacity need to be reserved; this will incur the additional cost of overcapacity. However, when the strategic positioning of the supply chain is rightly set, the gains from the agility are worth the effort and cost. This actually raised an important question. In which business circumstances that the agile supply chain is worthwhile?

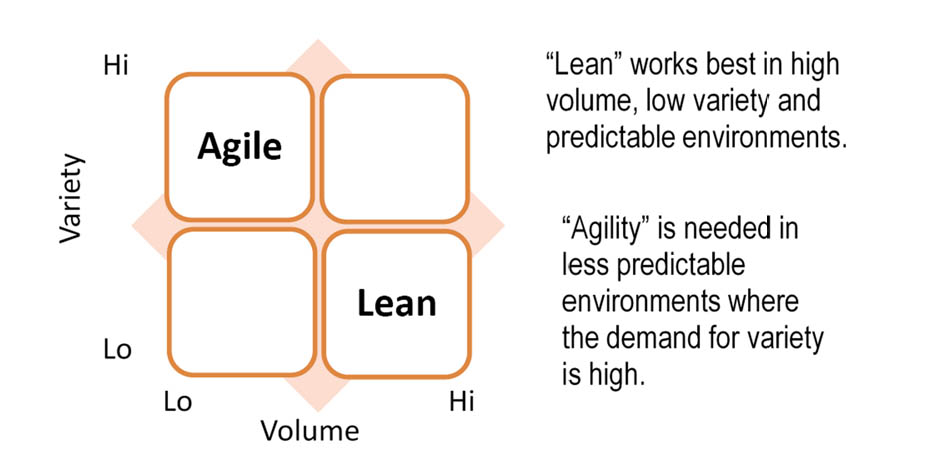

To answer this question, we may do some comparative observations between lean and agile by looking at some most common variables in supply chain management. First, we can make an observation on the volume and variety of the product that the supply chain produces. As shown in Figure 25, lean works best for high volume, low variety and more predictable operating environment; whilst agility is needed in less predictable environment where the demand for variety and choice is a dominant feature.

The new breed of enterprises such as Zara, Dell, Cisco and Li & Fung are certainly demonstrating apparently different success models when it come to responding to customers in a fast-moving environment, where life cycles are short and variety reigns. The winners in this environment are those that can respond quickly and efficiently. This renewed competitive arena calls for more nimble businesses and more agile supply chains.

Figure 25, Volume and variety observation.

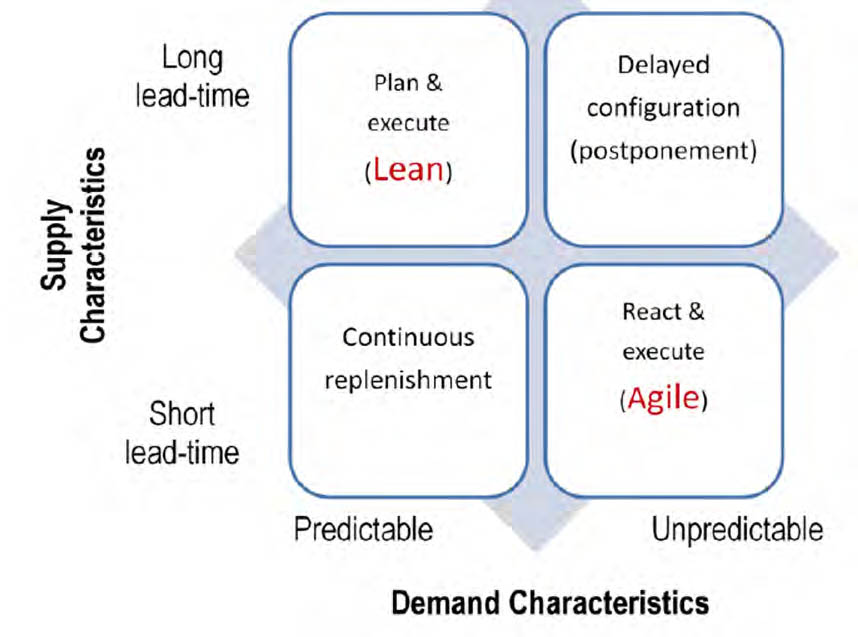

We can also make an observation from some specific characteristics of demand and supply. As shown in Figure 26 the supply characteristics in lead-time can be long or short; whilst the predictability of market demand can be categorized into either predictable or unpredictable. It then become intuitive that in the case of long supply lead-time with predictable customer demand, the plan and execution-style of lean model works the best; while in the case of short supply lead-time with unpredictable demand, the Agile responsiveness works the best.

Figure 26. Demand characteristics observation

More comprehensively, Mason-Jones et al. (1999) developed a comparative analysis between lean and agile by observing a whole host of supply chain attributes as shown in Table 1. This list clearly mapped out two distinctively different attributive profiles for both lean and agile supply chain to home in.

Table 1. Comparison of lean supply with agile supply

| Distinguishing Attributes | Lean Supply | Agile Supply |

|---|---|---|

| Typical products | Commodities | Fashion goods |

| Market place demand | Predictable | Volatile |

| Product variety | Low | High |

| Product life cycle | Long | Short |

| Customer drivers | Cost | Availability |

| Profit margin | Low | High |

| Dominant cost | Physical cost | Marketability cost |

| Stock-out penalties | Long-term contractual | Immediate and volatile |

| Purchasing policy | Buy materials | Assign capacity |

| Information enrichment | Highly desirable | Obligatory |

| Forecasting mechanism | Algorithmic | consultative |

Agile Supply Chain Framework

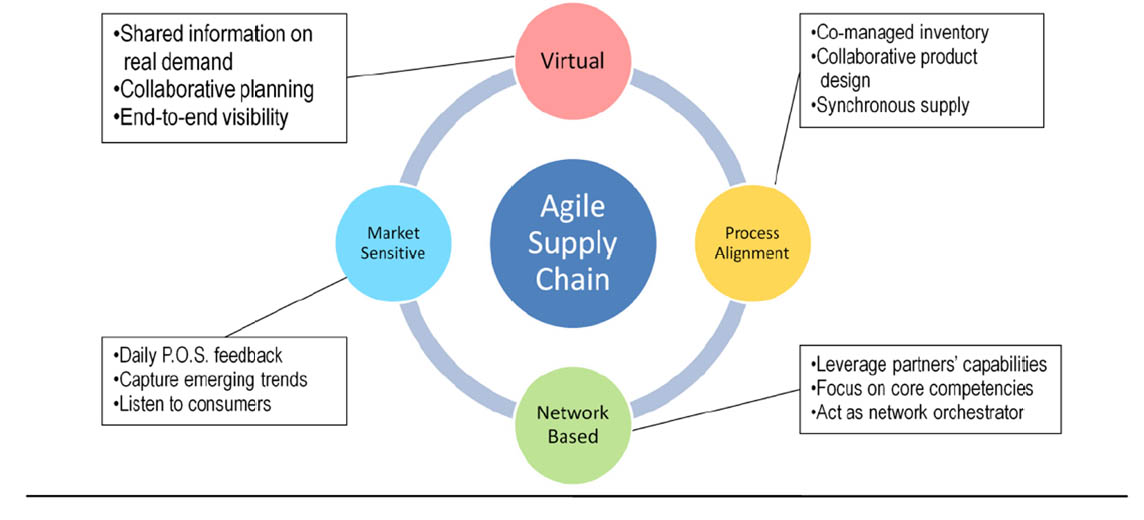

The comparison of lean and agile, have certainly helped to make some intuitive sense about the concept of the agile supply chain. But it would be more useful if some theoretical underpinning of the agile supply chain model can be provided. Professor Alan Harrison of Cranfield University proposed a framework (Harrison, 1999) for agile supply chain, which was perhaps the earliest theoretical attempt to the framework. The four key components of the framework can be interpreted as follows.

Figure 27. Agile supply chain framework

Agile supply chain is about virtual integration

Agility implies that the supply chain is able to respond to the changes in the local market requirements and much of these can perhaps be the opportunities. To do this, the agile supply chain must be able to leverage skills, assets and other resources across the divisional units in the local region in which they operate. This means they need to establish the shared goals and communicate them across the supply chain and work toward them jointly in harmony. The bound between organizations created by the shared goals does not necessarily vertical where the ownership consolidates. In fact, typically, it creates virtual integration - vertical integration without being so.

Virtual integration is characterized by informal and flexible and dynamic relationships between the divisional units and different sectors of the supply chain. The governance of such integration explicitly does not get involved with initiatives that are specific to an individual business. It does not centrally control the supply chain operations, but rather it supports and facilitates larger or overall supply chain initiatives from which many parts of the supply chain can and should benefit.

The virtual integration also provides senior management with a method for supporting and steering direction on the most important direction. As the structure and processes have been kept minimum in the virtual integration, and individual unit involvement remains fully empowered, the supply chain becomes more agile and responsive.

Agile supply chain relies on market sensitivity

Market sensitivity means that the supply chain’s internal measures, whatever it may be, are sourced directly from and linked closely with the external market that the supply chain is operated in. All too often, we see performance measures and business assessments are based on the data, information from with the internal operation and mostly generated within the supply chain. This will most probably misguide the management and drive the supply chain away from its ultimate objective of serving the market.

What a truly agile supply chain do in terms of performance measure and operational improvement is to set up a very high level of market sensitivity. Such market sensitivity has two implications. The first is to the internal performance measure. Every measure must be immediately or ultimately linked to the consumers in the market place. This means linking internal customers and external customers all to the ultimate end-consumers.

To do this, a causal map from what really customer care about to every operation the business delivers must be meticulously drawn out. Second, is to quick responsiveness. How quick can a supply chain respond to the market change is a primary measure for the agility of the supply chain. Its attainment is largely dependent on how closely the supply chain is able to sense the sudden changes of the market behavior. Zara is able to have market sensitivity because they created process of online market feedback from their stores through PDF units. Dell is able to have their market sensitivity by creating a web-based distribution and service channel.

The agile supply chain needs improved process integration

The agile supply chain will require higher level of integration between internal operational processes, such as sales, forecasting, production planning, sourcing, and delivery. The logic behind is straight forward. When sales operation sensed any change of market trends it will trigger a chain reaction of responsive or corrective changes through many other operations in the supply chain. How fast the supply chain can react to the market change is dependent on the speed of changes in many other internal processes. Thus, it makes sense that the internal processes must be integrated and perform as if they a one entity.

There are number of things that the supply chain managers can do to make a difference. First, forecast by market not by business units. The forecast generated by business units often shows huge variance and inconsistency. What an agile supply chain can do is to create a so-called market lead team which will be responsible to all the forecasting required by the supply chain and the business units wherein.

Second, set out to create the capability of coordinating the three prime sectors source-make-deliver. It is all too easy to assume the ERM system will look after everything. The matter of fact is that they don’t. Third, managers must link forecasting to improvement goals. This is so because forecasting is a process that can take the market sentiment and give indications as which directions the market is moving to. Business improvement will only make sense when it responses to the changing directions of the market.

The agile supply chain is often dynamic network-based

Looking at the agile supply chain’s architecture, managers need to clarify how the participating members of the agile supply chains are best connected with each other. As discussed in Chapter 3 the supply chain configuration can be divided broadly into two types of networks: stable network and dynamic network.

A stable network is a normal form of supply chain configuration where the suppliers and buyers are formed in tiers along the supply chain. The suppliers’ involvement in the supply chain is more or less fixed. The operational guidelines are formalized with the OEM. The technical role and competence positioning in the supply chain is also predefined. The style of operation of this type of network is mainly mechanical in nature that is displayed in its physical functions.

However, the dynamic network is preferred by the agile supply chain and it has a set of very different characterizes. In the dynamic network, the ties between suppliers and buyers, and amongst the suppliers themselves, are much looser than that of a stable network. Short term contracts or virtual relations are more often the cases. Some even strategically important functions such as product design and marketing can be undertaken by independent organizations on a short term basis.

Market forces rather than formalized structures are the means by which the parties are bonded together. The network relies on more sophisticated information systems with high level of information disclosure between the parties, whereby instant switch of connection can be easily established if required by the sudden change of market. For those reasons, the dynamic network is undoubtedly a more superior form of networking for agile operations.

Strategies to Build an Agile Supply Chain

1. Leverage Digital Technology

Utilizing AI, IoT, and cloud-based solutions helps businesses track, analyze, and respond to supply chain changes in real time.

2. Adopt Demand-Driven Planning

Businesses should focus on real-time demand data rather than relying solely on historical trends to enhance forecasting accuracy.

3. Foster Strong Supplier Relationships

Collaborating closely with suppliers ensures flexibility in sourcing and manufacturing.

4. Implement Flexible Logistics and Distribution

Using multiple fulfillment centers, dynamic routing, and hybrid transportation models improves adaptability.

5. Encourage Cross-Functional Teams

A culture of collaboration across departments ensures a unified approach to managing supply chain agility.

Competing on Responsiveness

Ultimately, the validity of the agile model is to be tested, not by a formula, but by the competition in the market place. The market place to test the agile supply chain is presumed to be volatile and fast-changing in nature. The top measure for the fitness of a supply chain is responsiveness. Typically high responsiveness cannot be achieved for minimal cost. Customers and suppliers have to make a choice. The trade-off can be tough at times.

For any agile supply chain, there is always an incremental cost associated with servicing the changing demand. Those who genuinely need urgent service will pay a premium. If the customer’s demand is not urgent, they perhaps can wait or chose the alternative cheaper version which is often offered by lean supply chains.

The market place to test agile supply chain is presumed to be volatileand fast changing in nature.

The top measure for the fitness of a supply chain is responsiveness.

The unique value proposition of agile supply chains is that they can respond rapidly and with high priority in unpredictable supply and demand conditions. To do this sometimes means holding spare or redundant capacity to cope with the sudden surges in the pipeline. That is part of the cost the agile supply chain has to pay. Zara has two very large distribution centres at La Coruna and Zaragoza in Spain which sometimes may only be 50% utilised. This is not an oversight on the capacity management, but a deliberated strategy. Zara management know the cost of redundancy, but they also know the benefit and indeed the necessity of having transient capacity available to support their rapid-fire replenishment business model.

The levels of responsiveness a supply chain can deliver do make a significant difference in terms of winning the market share. In the immediate aftermath of Hurricane Katrina, which swept through the US state of Louisiana in September 2005, one of the most affected companies was a major oil company, which lost all of its computing equipment in its service centres.

The company contacted Hewlett Packard, its regular hardware supplier, with a priority request to replace 1,000 specially configured PCs as quickly as possible. HP got back a few days later with a commitment to deliver the replacements by Christmas. This was not the answer that the company wanted to hear, so it called Dell which had not previously been a preferred supplier and asked the same question. Back came the answer almost immediately: “Is Monday Okey?” Dell got the business won a new major customer.

It is quite telling that the supply chain that can respond quickly wins.

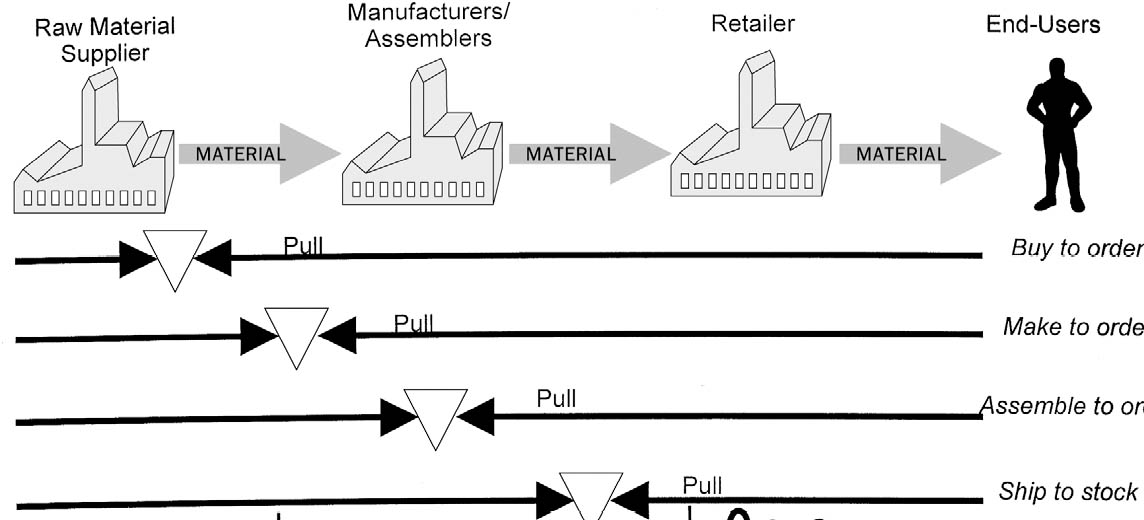

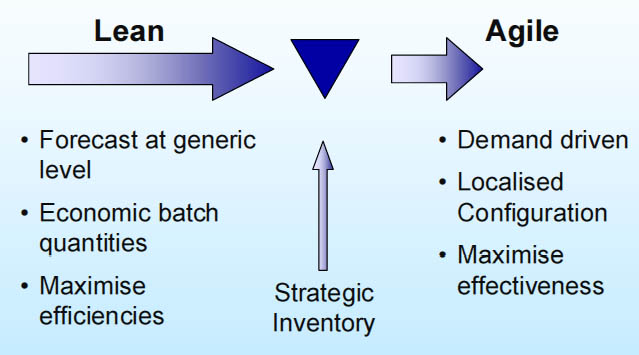

How to create the structured supply chain responsiveness? The most commonly used strategy is called postponement, or delayed configuration. Postponement is not just an operational trick, it requires the supply chain to configure in a particular way which may or may not be so obvious at the first sight. To illustrate the concept of postponement, we must first understand the concept of ‘order decoupling point’ in the supply chain.

As shown in figure 28 the order decoupling point determines how far the customer orders will enter into the supply chain. It is the point (marked by the inverted triangle in the figure) beyond which the customer-specific order is no longer visible to the supply chain. Different supply chains have different design for where the order decoupling point sits.

For a supply chain that is mainly ship-to-stock, the decoupling point tends to be very much at the downstream end of the supply chain; while for the supply chain that is mainly make-to-order, the decoupling point is usually at the manufacturing stage in the middle part of the supply chain. It is therefore clear that on the downstream side of the decoupling point the supply chain operating model is customer ‘pull’ - responding to demand changes. On the upstream side of the decoupling point the supply chain is operating in a ‘push’ mode, where one the generic components are produced based on amalgamated forecast and schedule.

Figure 28. Supply chain order de-coupling point

The postponement strategy is aiming to achieve market responsiveness in terms of producing the right variety and right product portfolio at the right quantity, but do it efficiently at a mass production price. To achieve this, the order decoupling point is postponed to a later, or as later as possible, stage close to product delivery.

The resultant supply chain will have most part its operation under scheduled generic components manufacturing, which is based on the aggregated demand and in a volume production mode leading to low cost and high efficiency. Reflecting what we have leant about the lean supply, understandably this part of supply chain (before the decoupling point) is predominantly lean. Then at the end of this lean section, there will be a stockpile of the inventory of those generic components called strategic inventory.

Figure 29. Postponement strategy

After the strategic inventory, the orders from customers are visible to the supply chain, and the supply chain operation is focused on configuring (assembling to order) the products to satisfy the demand. Because it is driven by demand, this part of the supply chain is primarily agile.

The critical design point of postponement strategy is based on the understanding of the market. When operated in an uncertain and volatile market environment the actual customer demand on the variety of products is largely uncertain, unpredictable or volatile.

The supply chain could make all the possible variety of products in sufficient volume to stock in order to satisfy the unknown demand, but the redundant products cost will be too high and supply chain marketability would be too poor. Instead, the supply chain could reconfigure the material flows and make a more predicable volume of generic components ready at the strategic inventory point, but postpone the product configurations to the very last stage when the demand is a lot clearer and the specific volumes of each variety become more predictable.

In this way, not only the specific customer demand can be fulfilled very quickly because all the generic components are ready and only need to be assembled to the required configurations, also there will be no redundant finished products because the volume is produced in such a short span before delivery that it is matched to the exact demand.

Getting It Right from Within.

To develop the agile capability for your supply chain, you must start from within. There number of things the organizations in the supply chain need to get it right before they can become competitive in the agility dominated operating environment. This may include organizational structure change, process reengineering, cultivating appropriate culture, developing KPI, and investing in the IT system. The top-level executives' commitment and direct involvement is the transformation is critical. It may also down to the right style of leadership.

Structure Change

As mentioned earlier, agile supply chain differs from the lean one from its structure to say the least. The structure change required for developing an agile supply chain applies to two aspects. One is the supply chain architecture; another is the organizational internal structure. It has to be said here that we assume business and supply chain strategies have been and will be developed appropriately to support the structure decision making.

For the supply chain structure, it all about the organization's external connections and how the whole supply chain is networked together. The first consideration is the extent of vertical integration. For an agile supply chain, the broad guidance is to have small or narrow span of vertical integration. This will give the supply chain a great deal of flexibility without feeling bogged down by the fixed assets.

The second aspect to consider might be outsourcing alternatives. To have a network of capable suppliers that can take outsourcing contracts from you, will materially improve the agility of the supply chain. The other one to consider is the location of the suppliers. Long-distance and poor infrastructure will certain impede the supply chain’s fast reaction and thus need to be pruned in the network.

From the organizational internal structure point of view, agile supply chain also demands some structure changes. Some historically centralized operations may need to be decentralized to cut the bureaucracy and respond to local conditions. The multi-divisional structure may be advisable to concentrate on the product, service, and geographical area and allowing units to adapt to local needs. Agile operations would also prefer more flat structures not tall hierarchies. High degree of empowerment and less formal rules are also positive factors to the agile structure.

Process Change

In the agile supply chain, processes are still necessary, but they are fewer by definition. Any process slows down the response time should be considered for reengineering. It is likely that some process short-cuts are necessary for the agile operation and the level of operational risks may rise. But the top priority is still the responsiveness, so long as the safety is not compromised.

Ways may be found to by-pass the regulations and opportunistic flair could play a role in achieving unanticipated profit. However, this does not mean to create any expansive purchasing or costly deliveries. Quite the contrary, the process that drives and support agile supply chain are often the unique combinations of standard or modular process which is the key to containing the cost while delivering the service to unexpected demand.

The postponement process discussed in the previous section is a widely applied process to achieve higher agility. It is also important that the business processes are aligned through the supply chain. Thus a coordinated process development for agile response is essential.

IT Systems

Agile supply chains are best underpinned by an ERP system similar to those used in other supply chain types. An array of additional applications designed to optimise the agile capabilities including process alignment and joint forecasting and planning. Zara’s achievement of remarkable responsiveness was due no small measure of its IT systems. The centralized design teams for man’s ware, woman’s ware and children’s ware are hardwired with the retail stores around the world.

Using on-line market information the teams will be able to change or creating new designs quickly ahead of the competition. Anecdotally, if as few as three people have come to the store and asked something that Zara don’t have. Zara’s design team will take it on and design it for them.

Nevertheless, investing in applications does not necessarily mean investing in large lump of capital equipment. In fact, investing in hardware may even hinder the agility development. Hardware is generally rigid and non-transferable between markets, once invested it will only depreciate, and it depreciates much faster when new updated equipment are coming onto the market. Renting or buying the service without taking ownership of the hardware appears to be a better choice for agile supply chains.

Key Performance Indicators

The agile supply chain will also need a set of its own unique key performance indicators (KPI). The commonly used KPI in a predominantly lean supply chain operating environment will not fit and often misguide the management. On top of the most frequently used KPI for agile supply chains are:

- Design to market time

- Customer satisfaction and delight

- Production throughput

- Delivery lead-time

- Product availability in the market

- Capacity synchronization and optimization

- Cost-to-serve

- Frequency of product up-grading

- Service innovation and flexibility

Fundamentally the KPI for the agile supply chain is the market responsiveness in terms of speed product range and service quality. But the detailed KPI for a specific organization, however, must be aligned with its top level business strategies and related with the industry sector and product categories.

Conclusion

An agile supply chain is essential for businesses that want to stay competitive in today’s fast-changing market environment. By prioritizing flexibility, customer responsiveness, and technology integration, companies can enhance efficiency, reduce risks, and improve overall supply chain performance. Implementing the right strategies will enable businesses to build a resilient and future-ready supply chain.

FAQ About Agile supply chain management

1. What is an agile supply chain?

An agile supply chain is a flexible, fast-adapting model designed to quickly respond to market changes, customer demands, and supply disruptions.

2. How does an agile supply chain improve customer satisfaction?

By rapidly adapting to customer needs and market demands, agile supply chains enhance personalization, ensure faster deliveries, and boost brand loyalty.

3. What are the main differences between agile and lean supply chains?

Agile supply chains focus on responsiveness and flexibility for volatile markets, while lean supply chains prioritize efficiency and cost control in stable environments.

4. Which businesses benefit most from an agile supply chain?

Industries with high demand volatility and short product life cycles—like fashion, tech, and consumer goods—gain the most from agile supply chain models.

5. What strategies help build an agile supply chain?

Leveraging digital technology, demand-driven planning, flexible logistics, strong supplier partnerships, and cross-functional collaboration drive supply chain agility.