Supply Chain Design and Planning

- Details

- Category: Supply Chain Management

- Hits: 26,379

One of the important issues in supply chain management is to design and plan out the overall architecture of the supply chain network and the value-adding flows that go through it. This means that managers should step back and looks at the supply chain as a whole and formulates strategies and processes that maximize the total supply chain value-adding and minimizes the total supply chain costs.

The key contents of such architecture design and planning include configuration, the extent of vertical integration, strategic outsourcing, location decisions, capacity planning, and dealing with bullwhip effect. There are also other aspects of the design and planning such as relationship posture which will be covered in a separated chapter.

Supply Chain Configuration

Supply chain configuration represents how the participating company members of the chain are connected with each other to deliver the product or service to the end customer. To an OEM, how many suppliers it uses, how the suppliers are grouped or categorized or tiered, where do they geographically located, the ownership and independence of the suppliers, the choice of distribution channels are all the configuration issues for the supply chain.

The fact is that companies do have the choice to configure their supply chains in the way they believe are most appropriate and beneficial. However, there is no single ‘best’ configuration for all supply chains. It all depends on the industry sectors, market environment, stages of the product cycle and so on.

The evolution of global multinationals’ network could be an interesting example to understand the relevance of supply chain configuration. In the pre-second World War era of the 1930s and 1940s, the mostly European multinational companies including Unilever, Royal Dutch/Shell, ICI, and Philips were the pioneers of global supply chain development and created their tentacles such as subsidiaries all over the continent.

Each national subsidiary was permitted a high degree of operational independence from the parent company; understanding its own product development, manufacturing and marketing. It is a semidetached ‘loose’ configuration. This ‘hands-off’ approach was a response to the conditions at the time when international transport and communication were slow, costly and unreliable; and the national markets were highly differentiated.

During the 1950s and 1960s, the world appears to be dominated mostly by American multinationals, including GM, Ford, IBM, Coca-Cola, Caterpillar, Procter & Gamble. The configuration of those multinationals with their wholly-owned subsidiaries took an evolved form. Although the subsidiaries were operated with a high degree of autonomy from the parent company, the US-based parent companies occupy a dominant position in terms of strategic guidance and resource support. It was partly because at that time the US was the largest and most affluent market in the world. The US base acted as the source of new products and process technology. The primary competitive advantage of the subsidiaries was the ability to utilize the resource.

The 1970s and 1980s saw the Japanese challenges all over the world. Her multinationals like Toyota, Honda, Matsushita, NEC, and Sony completed a long journey from exporting to globalization and established a concrete market base. A distinguished configuration feature of the Japanese multinationals was their pursuit of global strategies from the centralized domestic bases. While overseas subsidiaries were initially for sales, distribution, and customer support. By building plants of unprecedented scale to service growing world demand Japanese companies were able to exploit substantial scale and experience advantage.

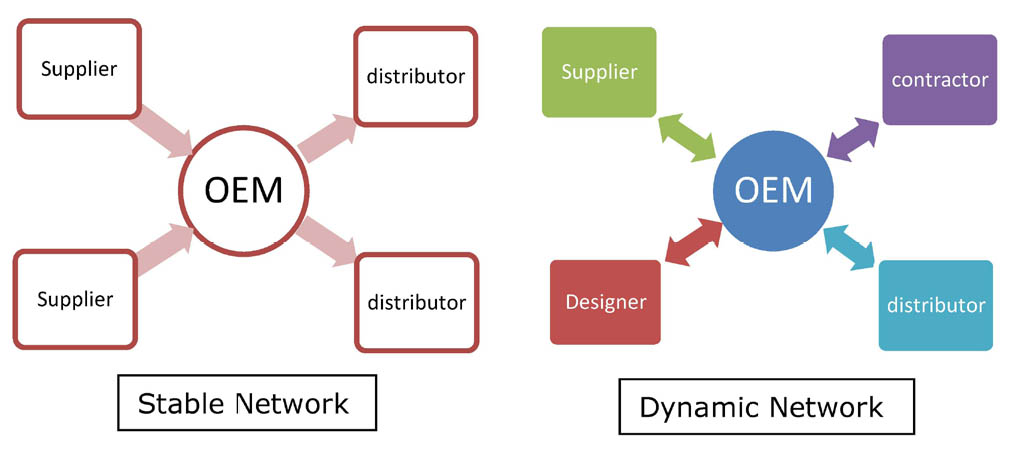

Supply chain configuration can also be observed from the network relationship perspective. When the OEM forms its supply network through tiered suppliers and tiered distributors with medium and long term stability, it can be called the ‘Stable Network.’ When the OEM does not have many of those long terms tiered suppliers and customers but instead uses dynamic and mostly short term suppliers and distributors to achieve high level of operational flexibility and strategic agility, it can be called the ‘Dynamic Network’ The two broad types of network configuration can be illustrated in figure x.

In comparison, the tiered stable network has more control over its suppliers and distributors’ operations than the dynamic network. An unexpected misunderstanding in the dynamic network may result in unrecoverable product defects. Along with it, there is higher risk in operational cost control and quality standard. However, the dynamic network is much more flexible than stable network in that it can quickly form a new network in the supply market to cater for the changed demand both in volume and in variety. It also has a better ability to upgrade technology and foster innovative processes. Which network configuration is better? It all depends on the objectives and desired characteristics of the network in the business context.

The extent of Vertical Integration

Much of the supply chain design is determined by the extent of vertical integration. Vertical integration is defined as the single ownership of consecutive activities along the supply chain. It must not be confused with the concept of supply chain integration. A well-integrated supply chain may not have a large extent of vertical integration (see definition of supply chain integration in section 2.3).

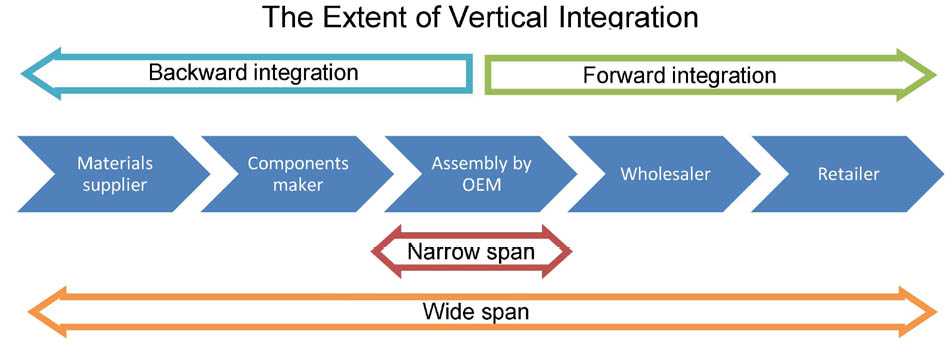

If an OEM does not have ownership of its suppliers and customers, it is regarded as having a narrow span of vertical integration. On the other hand, if it owns a number of tiers of suppliers and customers, it is regarded as having a large extent of vertical integration. Obviously it could also be a forward integrated one or backward integrated one as shown in figure 4.

Figure 4. The extent of vertical integration

In the 1930s, Ford Motor Corporation created a vastly vertically integrated automobile manufacturing empire the industry had even seen before or since. Instead of using independent suppliers and contractors to provide the materials and components for the Model T (one of Ford’s famous passenger car), Ford chooses to produce them by itself through creating extended Ford owned manufacturing suppliers and taking over some small and medium-sized suppliers.

It also bought steel mills to produce steels which goes into many parts of the automobile; and glass mills which made window screens for the cars. Ford also bought large pieces of land in Brazil and Southeast Asian countries to grow rubber trees that eventually supplied the rubber materials for making tires. In the end, Ford can proclaim that it did not really need any suppliers and everything built into his Model T is made by Ford. That story becomes the classical case of what today we call the vertical integration.

Obviously, the choice of such large extent of vertical integration of Ford Corporation was for a purpose not by an accident. Historian and academics believe, the purpose then was to exercise control, capture the profitability from the suppliers in the upstream of the supply chain, and obviously the market dominance. Such strategic configuration appeared to have fitted very well to the then business environment when market demand in volume looked to be permanent, and low price was the definitive market winner.

Ford’s sales reached a peak. However, a large extent of vertical integration has its own weaknesses. It was very rigid in its asset deployment, product line modification and introduction, no flexibility in responding to demand changes (due to fixed production capacity). As Henry Ford once said “Our customers can have any coloured cars they want, so long as it’s black.” This was a statement that acknowledged the system’s rigidity and inflexibility.

In the same period, but on the contrary, the second-largest American automobile company GM was pursuing a very different strategy on the extent of vertical integration. Under the leadership of Alfred Sloan (then CEO of GM), GM pursued a ‘full-line products’ strategy that aiming to produce a variety of models from small economical version to large luxury models; some models for family use other for business.

To illustrate his strategy, Sloan once put it: “We will build cars for every purse and purpose.” This is a statement of customer-oriented supply chain flexibility. GM saw the market was changing; people will not be satisfied with one model or one color. They demand variety, upgraded new versions and customization.

To maintain and further develop the company’s flexibility and dynamism, GM not only had chosen to use the independent suppliers for many of its materials and components, it even created so-called strategic profit unit within the vertically integrated part of the supply chain in order to maintain the drive for competitiveness. GM has never followed Ford to go anywhere near the complete vertical integration. The relatively small extent of vertical integration had given GM a competitive advantage in satisfying the customer’s needs for variety. Soon GM’s sale surpassed Ford and became the world’s biggest auto-maker in term of volume. Its world-leading position was kept until 2007 when Toyota took over became the biggest volume producer in the world.

The above cases show that a supply chain’s extent of vertical integration has always had a profound impact on its development. To a large extent a company’s strategy, operation and performance will depend on the right design of the supply chain configuration. Nevertheless, depending on the nature of the industry, product lifecycle and competitive environment, the architecture design of the supply chain can vary significantly. Generally speaking, process-based industry such as oil industry and chemical industry tends to be more vertically integrated; and the technology-intensive electronics industry tends to be less vertically integrated.

Outsourcing and Offshoring

On the opposite direction of vertical integration is vertical disintegration where the supply chain comprises of many independent participating members and the OEM does not have a large extent of vertically integrated consecutive operations. In fact for a vertically disintegrated supply chain, a considerable part of the OEM’s operations are outsourced to the independent external suppliers in order to achieve maximized value-adding and minimized the total cost for the supply chain. Hence, like vertical integration, outsourcing is also a supply chain architecture design issue.

Outsourcing or strategic outsourcing is commonly known as the “make-or-buy” decision. Organizations may want to contract some of its in house operations such as design, manufacturing and marketing to its external suppliers. Most often such decisions to ‘buy’ the operation instead of ‘make’ itself is aiming at a reduced cost. If a Chinese organization can produce the same components at a fraction of the usual cost, it will surely attract many OEMs to outsource the production of the components to it.

But it is also possible, that if some companies, say in India, may have a much better capability of developing state-of-the-art IT software it makes sense to outsource the software development operations to them in order to gain the supply chain value-adding. The decision and processes of moving any strategically significant operations out to the external suppliers is called outsourcing.

There are two points to clarify from the definition. First, outsourcing is not just a decision of make or buy, but also a process that including identifying the potential suppliers, contractual negotiation, regular evaluation and review of the outsourced operation. Second, not all operations that carried out by the external suppliers are suitable to be classified as outsourcing; only the strategically significant operations can be classified as outsourcing. For example, to a manufacturing supply chain, outsourcing some key components manufacturing operations is strategically significant; but the external catering service supply used by the same company is not. That’s why outsourcing is often interchangeably called strategic outsourcing.

Apart from maximizing the value-adding and minimizing the total cost discussed above, outsourcing has many other potential benefits which could form the prime motive for the decision-makers:

- Focus on and further developing the core competences

- Further differentiated competitive edge

- Increasing business flexibility, thus supply chain flexibility

- Improved supply chain responsiveness

- Raise the entry barrier through focused investment

- Enhanced ROI or ROE through downsizing the fixed asset

Case examples of outsourcing are all around us. Dell is computer manufacture. In order to develop its strategic competitiveness in customized product configuration, assemble to order, and distribution channel transformation, it decided to put its strategic emphasis on product design and downstream services. To this end they decided to outsource most of its manufacturing operations to Taiwan but retain the design and also vertically integrated downstream channels.

Another example is the Benetton Group which is a leading-edge garment supply chain in the world. It has the presence in over 120 countries. Its core business is fashion apparel. But, 80% of its manufacturing operation is outsourced to thousands of independent small manufactures. This helped the Benetton group to reduce its manufacturing cost, synchronize the supply chain capacity with the fluctuated market demand, and alleviate the bullwhip effects.

From an OEM perspective, the supply chain is less vertically integrated if more operations are outsourced. Similarly, less outsourcing means higher level of vertical integration. Across most of the manufacturing industries around world, the recent decades have seen a clearly increased level of outsourced activities, and thus the reduced extent of vertical integration for most of the supply chains. This is largely due to the continuous growth of global market volatility which drives the supply chains to become more flexible and agile, and the less vertically integrated supply chain offers precisely that flexibility.

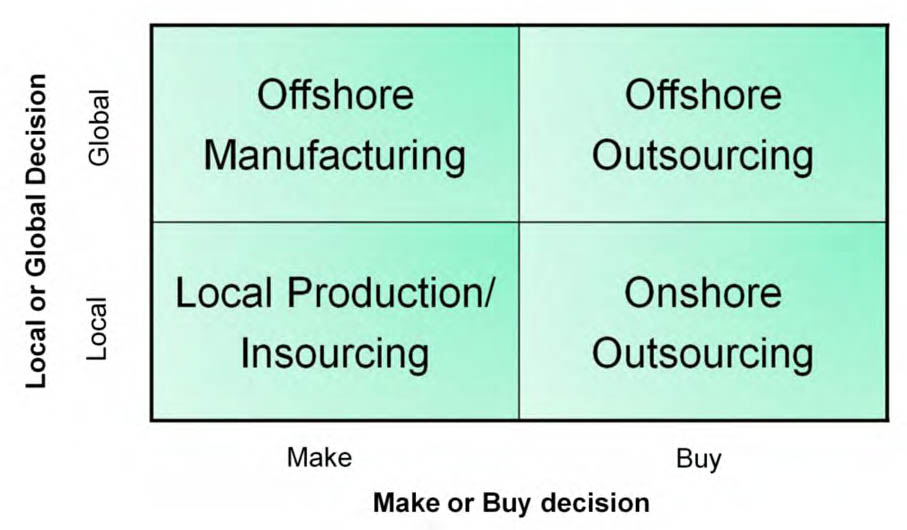

Another closely related concept in supply chain architecture design is called ‘offshoring’. Offshoring is defined as moving the on-shore operations to offshore locations in order to take the advantages of local resources and to reduce operating costs or create a market presence. However, offshoring does not necessarily mean outsourcing, especially when the ownership of the off-shored operation remains unchanged. There has been no outsourcing taken place. The interconnection of the two concepts can be illustrated in figure 5.

Figure 5. Outsourcing vs. off-shoring

The types of outsourcing business can be broadly observed in three categories.

Business process outsourcing (BPO)

- Marketing/call center outsourcing

- R & D process outsourcing

- Engineering process outsourcing (EPO)

- HR and recruitment process outsourcing

- Knowledge process outsourcing (KPO)

Business function outsourcing

- Financial auditing

- IT services

- Logistics services

Facility and man power outsourcing

- Capital equipment leasing

- Free length experts hiring

Outsourcing is relatively simple to understand as a concept but is difficult to implement in practice. The debate surrounding the outsourcing decisions can be lengthy and complicated. The decision often will involve many factors from all levels of management and are intricately inter-related. It is therefore recommended that managers should set up and follow an appropriate process to make the outsourcing decisions and execute the decisions.

Here is a set of common steps of outsourcing processes:

- Understand the competitive environment

- Clarify the strategic objectives and processes

- Analyzing the market needs

- Identify internal resources and competencies

- Make or buy decision making

- Identifying strategic suppliers

- Deciding on the relationships

- Performance evaluation and reviewing

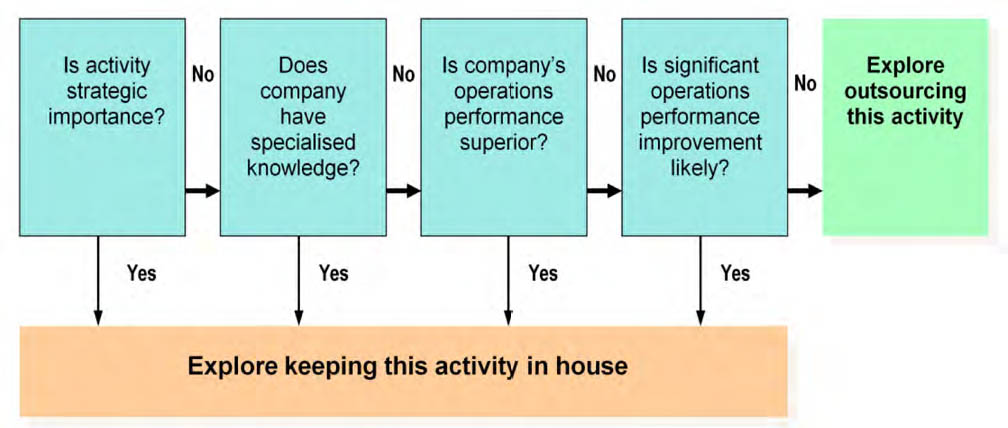

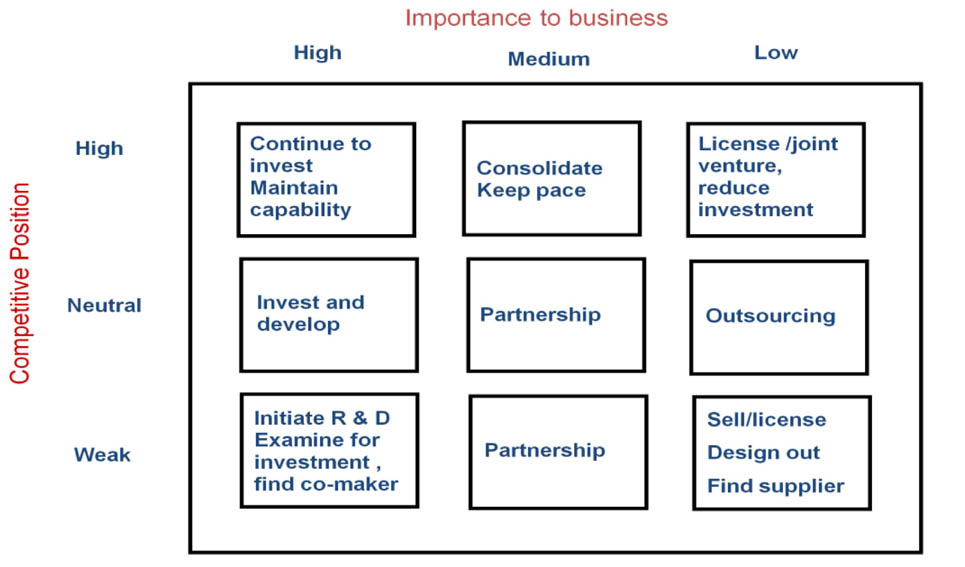

To give managers some hands-on support in outsourcing decision making. Many tools have been developed by academics and practitioners alike. They are very useful to get the managers started to create tools or frameworks that tailored to their own business cases. Those tools clarify the decision criteria, visualize the decision progress, communicate the ideas, and document the decision process. Two of those tools are shown in Figure 6 and Figure 7.

Figure 6. The logic decision tool for outsourcing

Figure 7. The matrix decision tool for outsourcing

Nevertheless, outsourcing like many other management activities is not without any risks. Far from it, the biggest concern of outsourcing is perhaps the risk that it brings about.

- Negative impact on the company’s personnel

- Loss control over key strategic design tasks, sub-system or components, resulting in a negative impact on the company’s competitiveness.

- Could creating tomorrow’s competition

- Risk of severe business disruption due to failed supply from single-sourced suppliers

- Tactical, short term approach to outsourcing may inhibit continuous improvement and long term investment

- Intellectual property right risks

- Foreign currency exchange risk if involves overseas suppliers

Therefore, an outsourcing decision and its executions must be regularly reviewed and assessed against those risks strategically. The review is essential because the changing business environment could easily make the originally right decision no longer justifiable. When the capital or financial circumstance changes like the one in the economic downturn, the outsourcing decision may have to be revised accordingly. Internal development of technologies and technical competences could also affect outsourcing decisions.

Location Decisions

The choice of geographical locations for supply chain operations is another important decision area for supply chain design and planning. The location decision is about the geographical positioning of the supply chain functions (such as assembly and distribution). It is normally done for the purpose of better serving the customers and further reducing the operational cost in the supply chain. Clearly, not all locations are suitable for supply chain operations.

But one thing is assured that when changing a location, many business-related factors change along with it. That makes the location change a powerful management instrument. Without doubt, a location decision will have a profound impact on labour cost, material cost, taxation, currency exposure, financial and legal regulations and so on. These will further lead toward significant changes in business outcomes, supply chain performance, and even environmental consequences.

It is important to understand that the operational considerations for the location decisions are not enough for the supply chain location design. Operational considerations for choosing a location are still valid and useful, but they are mainly the measures of the operations costs from many different dimensions. The operational location design, for example will take into account of multiple factors on the supply side of operations as well as on the demand side of operations as shown in figure 8.

Figure 8. factors influence operational location decisions.

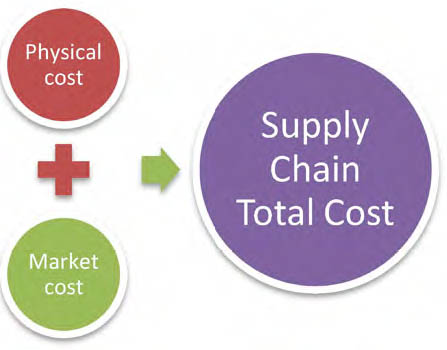

However, the location design for the whole supply chain will mainly consider two aspects of the whole supply chain. The single operation’s location decision has to be made in conjunction with the other operations’ locations decisions. In other words it is the combined effect of all locations together that matters for the supply chain. It has been well documented that the total supply chain cost consists broadly of two components: the physical cost and market cost (as shown in figure 9).

Figure 9. Supply chain total cost

The physical cost measures the supply chain operational efficiency as a whole. It looks at all the involved cost that are necessary for the supply chain to transform the raw materials to the end products for the consumer. It includes the production cost, logistics cost, material cost, labor cost, taxation cost, energy cost and so on. The market cost looks at all the loss or cost incurred by the inappropriate supply chain market mediation.

If a supply chain failed to produce the products that are the right quantity for the market at the season, delivered to the right location where customers find it convenient to access to, with right quality and functions that they expect, at the right prices that they are willing to pay for, the supply chain will make loss either on unsold products or unsatisfied customers. measured by the product delivery process (PDP) cost in general.

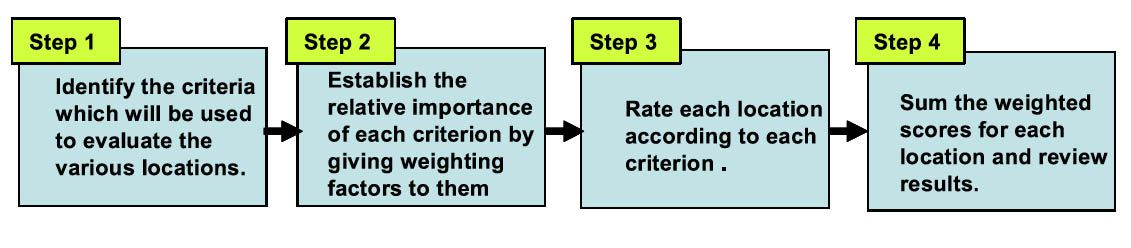

The location's decision for the supply chain, therefore, will have profound impact on both components of the supply chain cost, which in turn give rise to its importance in the supply chain design and planning. However, in practice, due to the complexity of many factors involved, making a decision could be difficult; or rather to justify the merit of one decision over another could be very tricky. To facilitate managers to make such decision, I would suggest to use the common weighted scoring method as shown in figure 10.

Figure 10. the weighted scoring method.

Step 1

Identifying the criteria which will be used to evaluate the various locations. Obviously, the criteria what are chosen must serve the strategic intention of the decision-maker, and depend on the specific circumstances surrounding the location.

Step 2

Establish the relative importance of each criterion through discussion and brainstorming. Then assign the weighting factors to each of them. The total sum of the weighting scores must equal to 100, thus the scores will conveniently represent the proportion of the weight in term of percentage.

Step 3

Rate each of the alternative locations against the criteria based on a defined scale. The scale could be between 1 to 9 or 0 to 100, where 1 or 0 represent the worst possible score and 9 or 100 the best. The scoring is normally subjective and hence it is more reliable if a group of people join the scoring together.

Step 4

Multiply the weighting allocated to each criterion by the score in each location. Then for each location the overall score becomes the sum of (score for each criterion x weight for each criterion). The highest overall scored location is regarded as the most appropriate one.

Capacity Planning

Business capacity planning is a big subject on its own. What I am going to talk about is the capacity related planning issues for supply chain architecture design. If one observes the supply chain from the spectrum of capacities of each and every participating member, then a usually uneven capacity ‘landscape’ emerges. The question then is that which form of the landscape is the most beautiful one for the supply chain.

The answer to this question surely cannot come from one company’s capacity planning, as the landscape is formed along with others. This means supply chain capacity planning differs from organizational capacity planning in that it is a coordinated endeavor.

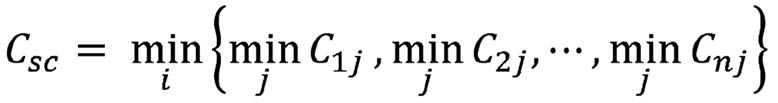

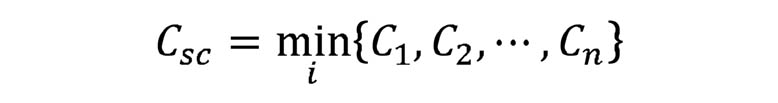

One can consider a single column supply chain with n (number) participating members. Each member has a known capacity Ci. Then a relevant question here would be ‘what is the capacity of the whole supply chain?’ The answer to this question is undoubtedly “the minimum of all the known capacities Ci"

One can imagine a supply chain as a piece of water pipe with different diameters at different sections. The overall flow of the pipe, which represents the total capacity of the supply chain, depends on the smallest diameter section. In the situation of networked tiered supply chain structure, the overall capacity of the supply chain becomes the double-layered minimum. For each tier i the overall capacity is, and the whole supply chain’s capacity becomes.

This capacity modeling analysis reveals a capacity bottleneck problem. Thus, to resolve the supply chain capacity planning problem, the key is to identify and open up the capacity bottleneck. To work on the other links of the supply chain, which do not form the bottleneck, is unnecessary and futile as it will not affect the total capacity of the supply chain. However, when one bottleneck capacity has been increased, logically the next smallest capacity link will become the bottleneck instead; and it will then become the focus of capacity management subsequently.

There are already well-established theories on the bottleneck problems, called ‘the theory of constraint’. In supply chain management, not only the capacity planning can apply the theory of constraint, so does the quality management, technology management, lead-time management, because every part of the supply chain do have bottlenecks big or small in theory at least.

To carry out the capacity planning in the real-world supply chain, however, one needs to deal with it in three levels. The first is the company’s internal capacity planning and management, which could be understood as the internal supply chain capacity management. The second level is the company’s external capacity coordination and synchronization with the other members of the same supply chain, which can also be understood as the supply chain’s internal capacity planning. The third level is the supply chain’s capacity responsiveness to the market demand changes, which can be understood as the capacity synchronization between the supply chain and customer demand.

At level 1

Managers will have to manage the company's internal capacity synchronization to achieve capacity planning objectives. This is because the desired capacity for the supply chain will eventually to be executed and implemented by each and every individual participating member of the supply chain.

Thus for an organization to achieve supply chain capacity planning, it must also be able to manage and synchronize the organizational internal capacities. This simply means that each functional silo will need to be coordinated with each other to avoid bottlenecks or over-capacity throughout. This also means to make use of the safety inventories, manage smaller batch sizes and keep synchronized flows of materials.

At level 2

The key to achieved optimized capacity for a supply chain lies in its external synchronization. The need for synchronise the capacities of each participating member is very simple. It is to reduce and eliminate the waste incurred by the redundant capacities and to eliminate possible risks of short supply due to the bottlenecks. However, when it comes to actually achieve these supply chain-wide capacity synchronization, difficulties cannot be underestimated.

First, a truly synchronized capacity can only be achieved when the involving members are strategically aligned and operationally integrated with each other. Second, to achieve a synchronized capacity for the supply chain, the participating organization may have to restructure its assets and even make some capital investment; without a committed long term close partnership, such capital investment and asset re-deployment is unlikely to be achieved swiftly. Third, capacity synchronization can only be a result of matured, culturally embedded and technically compatible operating systems across the supply chain.

At level 3

The whole supply chain’s capacity must be synchronized with the market demand changes, and market demand change is often unknown or uncertain. Forecasting has long been used to assist the planning of the supply chain’s capacity but with limited successes. The credential of the analytical forecasting methods has not lived to its promises. As a result forecasting is either lucky or wrong.

Thus supply chain managers must resort to other more effective means of managing capacity synchronization and ultimately the supply chain responsiveness. The last two decades have seen some encouraging progress in achieving a high level of supply chain responsiveness. Today, supply chains are more active in creating and developing flexible capacity and flexible structure through outsourcing, vertical disintegration, virtual networks, and sharing and pooling resources, to name just a few. But so far there is no single silver bullet discovered in this respect. The ways that industries manage their own capacity and responsiveness varies significantly.

Bullwhip Effect

Capacity synchronization has another major beneficial effect. It helps to alleviate the Bullwhip Effects in the supply chain, and the bullwhip effect is a very common phenomenon that has many negative impacts on the supply chain performances. Understanding the bullwhip effect is therefore essential to the supply chain design and planning.

Bullwhip effect refers to a supply chain-wide phenomenon thatmodest change of customer demand is distorted and amplified towardthe upstream end of the supply chain resulting in large variations oforders placed upstream.

The bullwhip effect is also known as Forrester Effect as Jay Forrester (1961) showed that this was so by modeling supply chain mathematically and he called it industrial dynamics. What happened basically is that when the small demand ripple in the market place is felt by the retailer at the end of the supply chain, the retailer will then start adjusting their orders to the wholesalers, and the wholesaler in turn will adjust its orders to the distributor, and the distributer to the factory.

One would imagine when the factory receives the orders, it will have equally small changes. Unfortunately, it could not be farther from the truth. The small ripples have been significantly amplified stage by stage towards the upstream of the supply chain. When it reaches the factory or components manufacture the magnitude of fluctuation becomes unrecognizable. Figure 11 shows such changes.

| Period 1 | Period 2 | Period 3 | |

| Retail Sales | +10% | -10% | + 10% |

| Distribution Orders from Retail | +17% | -21% | +32% |

| Factory Orders from Distributor | +30% | -40% | +48% |

| Manufacturing Orders from Factory | +45% | -66% | +80% |

| Factory output | +39% | -60% | +72 |

Figure 11, Example of the bullwhip effect

Such phenomena have been observed repeatedly and reliably through all types of supply chains. It is, therefore, appropriate to generalize it and theorize it as a universal ‘effect’ model, through which analysis and simulations can be applied. Basically, the bullwhip effect has three key characteristics. The first is the oscillation. The demand, orders or inventories move up and down in an alternative pattern.

The second is the amplification. The magnitude of the alteration and fluctuation increases as it travels to the upstream end of the supply chain. The third is the phase lag. The cycle of peaks and troughs of one stage also tends to lag behind the one in the previous stage. Those characteristics can be clearly demonstrated by a supply chain simulation game.

The Beer Game

To illustrate the bullwhip effect in the supply chain dynamics, MIT Sloan School of Management created a so-called Beer Distribution Game or just Beer Game. The Beer Game is the most widely played game in business schools around the world. Many modified versions have also been developed and used extensively, but the one shown in this book is the original version. Despite the variation of the games played around the world, the key features and the learning points remain largely the same.

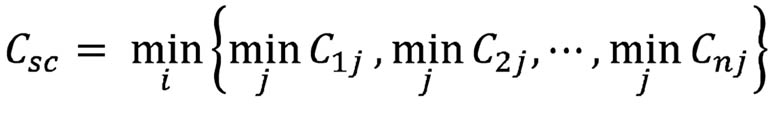

The game is a role-playing simulation of a supply chain originally developed by Jay Forrester in the late 1950s to introduce students of the concept of system dynamics and its management. The game is played on a board portraying a typical supply chain (figure 12).

The supply chain distributes beers and has four sectors: retailer, wholesaler, distributor, and factory. One or two persons manage each sector. A deck of cards represents customer demand. Each week, customers demand beers from the retailer; the retailer fills the order out of inventory. The retailer in turn orders beer from the wholesaler, who ships the requested beer from the wholesale stocks. Likewise, the wholesaler orders and receives beer from the distributor, who in turn orders and receives beer from the factory, and the factory produces beer. At each stage, there are order processing and shipping delays. Each link in the supply chain has the same structure.

Figure 12. The beer game board

The players’ objective is to minimize the total cost for their company. Inventory holding costs are usually set to $0.50 per case per week, and stock out costs (costs for having a backlog of unfilled orders) are $1.00 per case per week. The task facing each player is a typical example of the stock management problem. Players must keep their inventory as low as possible while avoiding backlogs. To fulfill the incoming orders the inventory has to be depleted, so the players must place replenishment orders in order to adjust their inventory to the desired level.

There is a delay between placing and receiving orders, just like in a real-world business case, creating unfilled orders. There are also shipping delays that even the supplier despatched the goods it will take time to arrive, which is often the case in the real-world. This results in the inability to adjust the inventory level quick enough to avoid the backlogs.

Clearly, the game is far simpler than any real supply chain. There are no random events - no machine breakdowns, and transport problems, or strikes. There are no capacity constraints or financial limitations. Above all the structure of the supply chain is visible to all, which is rarely the case in real life. Players can readily inspect the board to see how much inventory is in the transit or held by their teammates. The game is typically played with a very simple pattern of customer demand. Starting from 4 cases per week for the first few weeks and then jumped to 8 cases per week and stays there until the end.

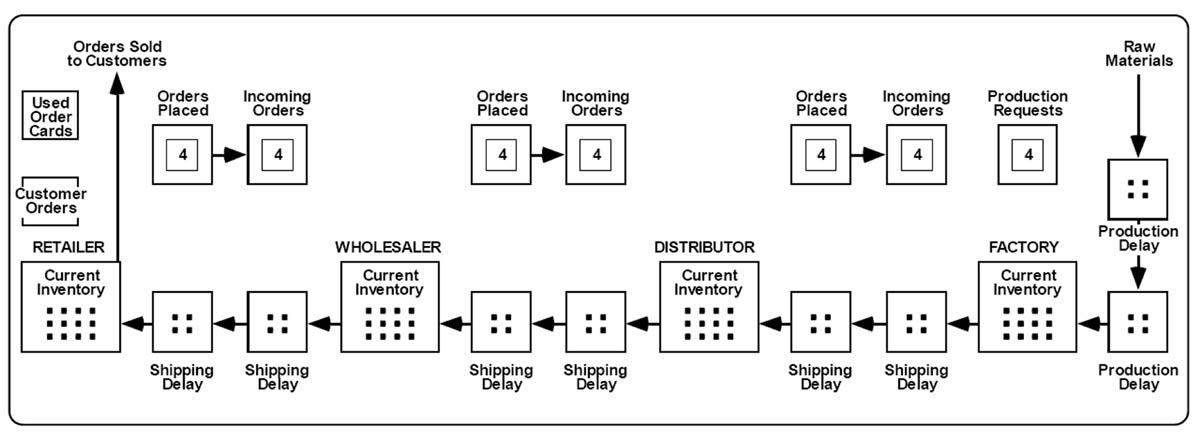

Despite the apparent simplicity of the game, people do extremely poorly. For most of the first time player average costs are typically an astonishing 10 times greater than optimum. Figure x shows the typical results of the game. In all cases, customer orders are essentially constant except for the small step increase near the start. In all cases the response of the supply chain is unstable. The oscillation, amplification and phase lag observed in real supply chains are clearly visible in the displayed result. In the period of 20-25 weeks, the average amplification ratio of factory production relative to customer order is a factor of 4.

Figure 13. Typical results of the Beer Game.

Most interesting, the patterns of behavior generated in the game are remarkably similar. Starting with the retailer, in the 20 weeks or so, inventories decline throughout the supply chain, and most players developed a backlog of unfilled orders (negative net inventory). In response, a wave of orders moves through the chain, growing larger at each stage. Eventually, factory production surges and inventories throughout the supply chain start to rise. But inventory does not stabilize at the cost-minimizing level near zero. Instead, inventory significantly overshoots.

Players responded by slashing orders, often cutting them to zero for extended periods. Inventory eventually peaks and starts to decline again. These behaviors are all the more remarkable because there is no oscillation in customer demand. The oscillation arises as to the consequence of the players' activities. Although plays are free to place orders in any way they wish, the vast majority behave in a remarkably uniformed fashion.

The causes of the bullwhip effect are systemic.

They are a combination of structured delays both in order processing and shipping, over-ordering and ignoring the incoming good in the pipeline, under ordering and failing to see the build-up of downstream demand, panic and over react, lack of coordination, poor forecasting and so on. In real-world supply chain operations, there will be even more factors that worsening the bullwhip effect, such as batching, facility breakdown, poor maintenance, inappropriate scheduling and communication, poor capacity coordination, market disruptions and many more.

How to alleviate the bullwhip effect?

There is no single cure-all recipe. But there are some commonly agreeable countermeasures to the bullwhip effect:

- Improve information sharing through EDI (electronic data interchange), POS (point of sale systems), and web-based IS (information systems).

- Reducing batch ordering

- Coordinating capacity and production planning

- Apply appropriate safety stocks to insulate the oscillation

- Reducing inventory level through JIT (just in time), VMI (vendor managed inventory), QR (quick response).

All those approaches must be executed cohesively in an integrated manor. A bullwhip effect proof supply chain will also call for a very high degree of inter-organizational collaboration by which systematic coordination in capacity planning, inventory management, cost-to-serve, lead-time reduction and responsiveness can be effectively achieved.