Applying for Credit

- Details

- Category: Economics

- Hits: 4,091

How do you apply for credit? What factors determine whether or not you will be approved for credit? Perhaps more importantly, how can you dig yourself out of debt if your payments are more than you can handle? In this section, you’ll learn what makes a person eligible for credit. You’ll also learn ways to handle your debts before they get out of control.

Will You Be Able to Get Credit?

Lenders determine creditworthiness by evaluating a borrower’s credit history.

Economics & You If a friend wanted to borrow money, would you lend it to him or her? Read on to learn about how a borrower’s creditworthiness is determined.

Several factors determine a person’s creditworthiness. When you apply for credit, you usually will be asked to fill out a credit application. Then the lender will hire a credit bureau, a private business, to do a credit check. This investigation will reveal your income, any current debts, details about your personal life, and how well you have repaid debts in the past.

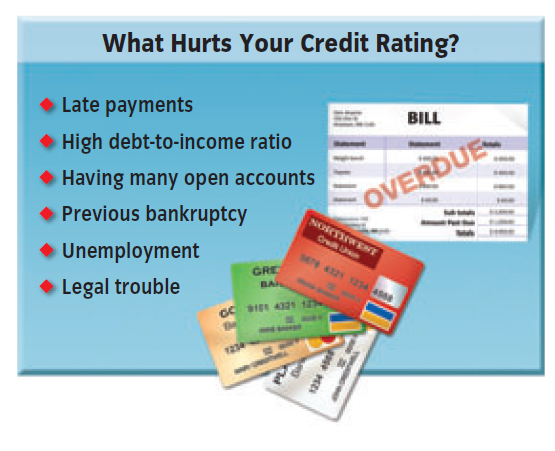

The information supplied by the credit bureau provides the creditor with a credit rating for you. This is a rating of the risk—good, average, or poor—involved in lending funds to a specific person or business. (See Figure 4.5.)

Though past history of credit use is important in deciding a person’s creditworthiness, the creditor also looks at three other factors: your capacity to pay, your character, and any collateral you may have.

Capacity to pay considers how much debt you have in relation to your income. If you have changed jobs frequently or been unemployed for long periods, your capacity to pay will be considered questionable. Character refers to a person’s reputation as a reliable and trustworthy person. Lenders also considercollateral, or the size of your capital or personal wealth. Collateral is important because it indicates your past ability to save and accumulate. It also indicates your present ability to pay off a loan, because even if you lose your job, you could sell off some collateral in order to make the payments.

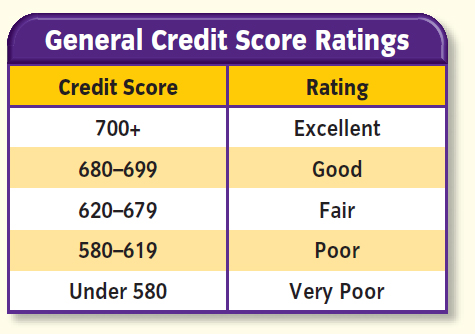

Figure 4.5 Your Credit Score

A credit score is a mathematical model that evaluates many types of information in a credit file. It is used by a lender to help determine whether a person qualifies for a particular credit card, loan, or service. Generally, the higher the score, the less risk the person represents. People with higher scores are also able to get better interest rates than people with low scores. How can you obtain your credit score?

- Step 1

One easy way to find out your credit score is to log on to AnnualCreditReport.com and request a free copy of your credit report. Federal law states that you can receive one free credit report every 12 months from each of the three national consumer credit reporting companies: Equifax, TransUnion, and Experian.

- Step 2

When you order your credit report from one of the three reporting companies, you may purchase your credit score at the same time. Credit scores generally range from 300 to 850. This table shows where your credit stands depending on your credit score. Any score above 620 is considered respectable.

Usually when a financial institution makes a loan, it will ask for collateral from the borrower. The collateral may be the item being purchased or something of value the borrower already owns. The borrower then signs a legal agreement allowing the lender to claim the collateral if the loan is not repaid. A loan that is backed up with collateral in this way is called a secured loan.

Sometimes financial institutions will lend funds on a person’s reputation and a promise to repay. Such a loan is called an unsecured loan. The interest rate charged on unsecured loans is usually much higher than the rate for secured loans. A bank will also sometimes lend funds to a person if he or she has a cosigner. A cosigner is a person who signs a loan contract along with the borrower and promises to repay the loan if the borrower does not.

Responsibilities as a Borrower

Maintaining a good credit rating is important for obtaining credit at favorable interest rates.

Economics & You Have you ever borrowed from a friend or parent and not paid them back? What were the consequences? Read on to learn about your responsibilities as a borrower.

Credit use carries responsibilities. If you do not pay your debts on time, the lender may have to hire a collection agency to help recover the funds. If you never pay, the lender has to write it off and take a loss. These costs are passed on to all consumers in the form of higher interest rates. Also, you will get a bad credit history. You will then have a difficult time when you really need credit in the future—to buy a house, for example.

Another responsibility as a borrower is to keep a complete record of all the charges you have made. You also must notify the credit-card issuer immediately if your card is lost or stolen.

What if you’ve lost control of your debt? Financial planners advise you to make a list of everything you owe, what the interest rate is, and what the payments are. Concentrate on paying the high-interest credit cards first, and pay more than the minimum payment, or it will take you years to reduce the debt.

- credit bureau: private business that investigates a person to determine the risk involved in lending to that person

- credit check: investigation of a person’s income, current debts, personal life, and past history of borrowing and repaying debts

- credit rating: rating of the risk involved in lending to a specific person or business

- collateral: something of value that a borrower lets the lender claim if a loan is not repaid

- secured loan: loan that is backed up by collateral

- unsecured loan: loan guaranteed only by a promise to repay it