Exchange rate

- Details

- Category: Macroeconomics

- Hits: 5,705

The exchange rate is defined as the price of one unit of currency in terms of another currency. If one euro costs 1.5 USD then 1 USD costs 1/1.5 = 0.667 euro. If the exchange rate is stated in terms of the euro (for example, 1.5 USD/euro) then the euro is called the base currency or the unit currency.

In most countries, the exchange rate is expressed using foreign currency as the base currency. For example, in Denmark, the USD exchange rate would be expressed as 4.8 Danish kronor (DKK) per USD while, in the U.S., the same exchange rate would be expressed as 0.208 USD/DKK (or 20.8 USD/100DKK). This way of specifying the exchange rate is called the direct method as you can immediately figure out how much you have to pay for one unit of foreign currency.

In some countries, the exchange rate is expressed using the home currency as the base currency. In the UK for example, the Danish exchange rate would be expressed as 9.2 DKK/GBP. Thus, you have to invert the exchange rate if you want to figure out how much one unit of foreign currency costs in the UK. This method is called the indirect method of specifying the exchange rate and the notation is sometimes called British notation.

Exchange rate systems

Different countries have different exchange rate systems. The most important characteristic of an exchange rate system is to what degree the country is trying to control the exchange rate.

- A country may have a completely flexible exchange rate. The exchange rate is then determined solely by supply and demand in a free market without the intervention of the government or the central bank.

- A country may have a completely fixed exchange rate by pegging the exchange rate to another currency or to an average of several currencies. A country may, for example, decide that one unit of its currency will be exchanged for exactly 0.2 euro. One euro will then cost 5 of the domestic currency.

- A country may also have an exchange rate system in between these two extremes, called a “managed float”. In this system, the central bank only intervenes under special circumstances when it wants to influence the exchange rate one way or the other.

- A country may also be part of a monetary union where all the countries in the union share the same currency. There is then no exchange rate between the countries in the union. The union must itself select an exchange rate system vis-a-vis other currencies. The largest monetary union is the EMU, the European Monetary Union with its currency the euro. The euro is flexible against other currencies (except those that are pegged to the euro).

The most common exchange rate system in the western world during the previous century was the fixed exchange rate system. Up to the 1930s, most currencies were pegged to the price of gold (the gold standard). After the Second World War a new system was created, the so-called Bretton Woods system, where each currency in the system was pegged to the US dollar (USD). After the collapse of this system in the 1970s, many currencies, for example, the USD, have been flexible.

Changes in the exchange rate

Suppose that the United States is our home country and that the current euro exchange rate in direct notation is SD = 1.5 (euro/USD). In indirect notation, SI = 0.667 (USD/euro). If the euro becomes more expensive in terms of the USD we say that the USD has depreciated against the euro (lost in value).

This means that SD has increased (to say SD = 1.6) and that SI has fallen (to 0.625). If the euro becomes less expensive we say that the USD has appreciated against the euro. In such a case, SD will fall and SI will increase. Of course, when the USD depreciates against the euro, the euro appreciates against the USD.

Foreign currency is more expensive -> the domestic currency has depreciated

Foreign currency is less expensive -> the domestic currency has appreciated

Also keep in mind that when a currency depreciates, S will increase if we use the direct notation and decrease if we use indirect notation. If a country has a fixed exchange rate (say against a particular currency), the government or the central bank may change this fixed exchange rate.

Suppose that Hong Kong is our home country and that the Hong Kong dollar (HKD) is fixed against the USD at the exchange rate 7.8 HKD/USD (direct notation). If the central bank in Hong Kong changes this exchange rate to say 8.2 HKD/USD it makes the foreign currency more expensive and the HKD cheaper. In this case we say that the HKD has been devalued. However, if the exchange rate is changed to say 8.6 HKD/USD we say that the HKD has been revalued.

The euro against the US dollar

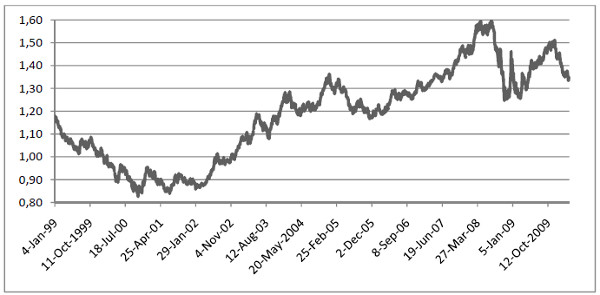

Figure 2.1 The price of one euro in US dollars 1999 – 2010. Source: IMF.

As an example, Figure 2.1 shows the exchange rate between the USD and the euro with the euro as the base currency.

Effective exchange rate

Suppose that we are interested in the external competitiveness of a country, say Japan. To do this we could look at the evolution of a particular exchange rate, say the exchange rate between the Japanese yen (JPY) and the USD.

The problem with this idea is that this exchange rate will reflect the external competitiveness and events in the US as much as in Japan. If we want to isolate Japan without including events in other countries, we look at the effective exchange rate instead.

The effective exchange rate is the price of a basket of currencies where each currency is weighted in relation to its importance to the country. Such a price level is then divided by a constant such that its value is exactly 100 at a given point in time. If, for example, the price index is 110 one year after the base year, then the currency has depreciated by an average of 10% against other currencies that year.