Investing: Taking Risks With Your Savings

- Details

- Category: Economics

- Hits: 7,845

People often save their money in banks and savings institutions to earn a stable interest rate. However, for those seeking higher returns, investing in stocks and bonds can be a lucrative alternative—though it comes with varying levels of risk.

What Are Stocks and Bonds?

Stocks and bonds are two of the most common investment options. Stocks offer the potential for high returns but come with greater risk, while bonds provide more stability and consistent interest payments.

-

Stocks represent ownership in a corporation. Shareholders can earn money through dividends and by selling stocks at a higher price.

-

Bonds are loans made to corporations or governments in exchange for periodic interest payments and the return of the initial investment upon maturity.

How Stocks Generate Returns

Investors in stocks can profit in two main ways:

-

Dividends – Some companies distribute profits to shareholders in the form of dividends.

-

Capital Gains – Investors can sell stocks at a higher price than they originally paid, earning a profit known as a capital gain.

However, stocks also carry risks. If the market declines or a company underperforms, investors may experience losses.

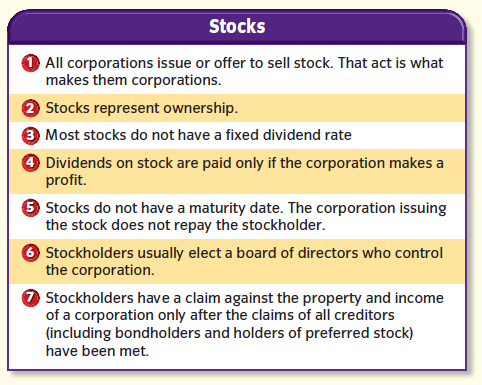

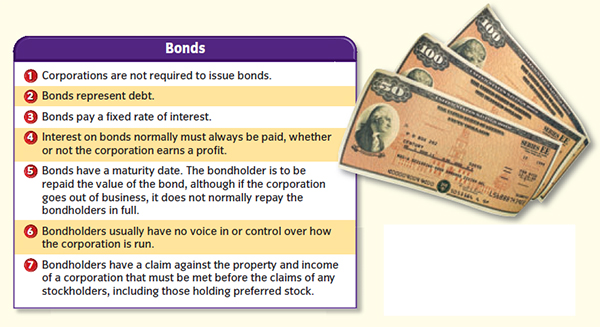

Figure 1 Differences Between Stocks and Bonds

Understanding Capital Gains and Losses

A capital gain occurs when an investor sells a stock for more than its purchase price, while a capital loss happens when a stock is sold for less than its initial cost. Similarly, bond prices fluctuate based on market conditions, impacting potential gains or losses for investors.

The Role of Stockholders in Corporations

Stockholders are partial owners of a company and often have voting rights on corporate decisions. Companies typically hold annual stockholders’ meetings to discuss financial performance and future strategies.

Investing in Bonds: A Secure Alternative

Bonds are often considered a safer investment compared to stocks. When an investor buys a bond, they are essentially lending money to a corporation or government entity in exchange for interest payments over a specified period.

-

Corporate Bonds – Issued by businesses to raise capital.

-

Government Bonds – Issued by federal, state, or local governments; these may offer tax-exempt interest income.

-

Savings Bonds – U.S. government-issued bonds that grow in value over time and provide a low-risk investment option.

-

Treasury Securities – These include Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds), each with different maturity periods.

Stock and Bond Markets Explained

Investors can buy and sell stocks and bonds in different markets:

-

Stock Exchanges – Centralized platforms like the New York Stock Exchange (NYSE) and Nasdaq facilitate stock trading.

-

Over-the-Counter (OTC) Market – An electronic marketplace where stocks not listed on formal exchanges are traded.

-

Bond Markets – Bonds are traded on platforms such as the New York Exchange Bond Market and American Exchange Bond Market.

Online Investing and Brokerage Firms

With the rise of online trading platforms, investors can now buy and sell stocks and bonds with just a few clicks. Online brokerage firms often offer lower transaction fees compared to traditional brokers, making investing more accessible.

Mutual Funds and Money Market Funds

For those who prefer diversified investments, mutual funds and money market funds provide an alternative to individual stocks and bonds.

-

Mutual Funds – Pool funds from multiple investors to buy a mix of stocks and bonds, reducing risk through diversification.

-

Money Market Funds – Invest in short-term, low-risk securities, offering stability and liquidity.

Bull vs. Bear Markets: Understanding Market Trends

-

Bull Market – A period of rising stock prices, often driven by economic growth and investor confidence.

-

Bear Market – A period of declining stock prices, usually triggered by economic downturns or uncertainty.

Regulations and Investor Protection

The stock and bond markets are regulated to protect investors. The Securities and Exchange Commission (SEC) enforces laws that promote transparency and fairness in financial markets. Investors should research securities and consult financial experts before making investment decisions.

Conclusion: Making Smart Investment Choices

Investing in stocks and bonds offers opportunities for wealth growth, but understanding market trends, risks, and investment options is crucial. Whether you're looking for high returns with stocks or stability with bonds, diversifying your portfolio can help balance risk and reward.