Public Goods

- Details

- Category: Microeconomics

- Hits: 7,908

Definition of Public and Private Goods

A public good is a good that fulfills both of the following two criteria: Nonrival. One individual’s consumption of the good does not affect any other individual’s consumption of the same unit of the good. Examples include lighthouses, television, parks, military defense, and streets with little traffic.

Nonexclusive . It is not possible to exclude anyone from consuming the good. The examples above are usually nonexclusive. A private good is, instead, a good that does not fulfill any of the two criteria, i.e. one that is both rival and exclusive. Most goods are private goods.

The Aggregate Willingness to Pay

To find the market’s demand curve for a public good we must know each individual’s demand for it.

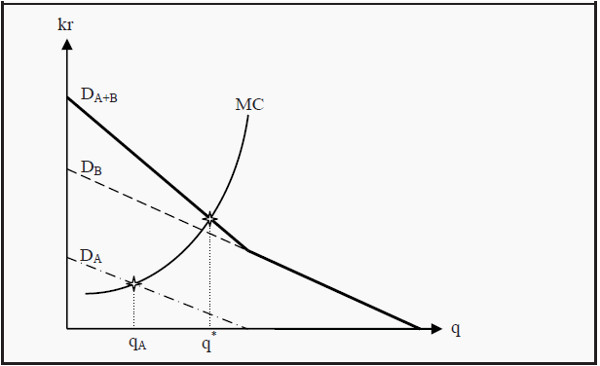

Suppose we have two individuals, A and B, and that they each have an individual demand curve regarding, say, a park, corresponding to DA and DB in Figure 1. When we, in Market Demand, derived the market demand for a private good, we summed the individuals’ demand curves horizontally. For public goods we, instead, have to sum them vertically.

Figure 1: Public Goods

To see why this is the case, think of what a public good is. Suppose we produce one unit of the good and that A value that unit to 10, whereas B values it to 15. Had it been a private good, only one of them could have consumed it. However, since a public good is nonrival, both A and B can consume it at the same time.

Consequently, the aggregate willingness to pay for this unit is 10 + 15 = 25. Similarly for the second, third, and all following units, and we sum the demand curves in Figure 19.1 vertically. The market demand in this case, corresponds to the thick demand curve DA+B.

We see that, the optimal quantity, q*, is at the point where the marginal aggregate willingness to pay is equal to the marginal cost. As a comparison, we have also indicated what would happen if only one of the individuals had decided on the quantity. If A had done so, the quantity qA would have been produced. As compared to the optimum, q*, we would have seen a much smaller quantity.

Free Riding

In the last section, we derived the demand curve for the public good by summing the individuals’ willingness to pay. The problem is that we usually do not know their willingness to pay. For private goods, this is not a problem, since it is optimal for the consumers to pay a price up to their willingness to pay. For instance, if the price of milk is 10 and an agent buys three liters of milk, her marginal willingness to pay for the last unit is at least 10 and her marginal willingness to pay for additional units is less than 10. We do not need to know it beforehand, as she will reveal it by her behavior.

However, for public goods it is not optimal for consumers to reveal their willingness to pay. If she will later have to pay an amount equal to the one she states, it is often individually better for her to understate her willingness to pay.

If the good is still produced, she will make a sort of profit: She receives more utility than she has paid for. She is then said to be free riding.

Asymmetric Information

We have already mentioned that information is important in economics and, most often, we have assumed that the agents have perfect information. That is hardly a reasonable assumption. For instance, usually a seller knows more about a product than the buyer does, and a worker knows her skills better than the employer does. We will now look at some implications of the problem of asymmetric information.

There are two important subcategories:

- Adverse selection. Depending on the fact that one side in a contractual agreement, the buyers or the sellers, have information that the other part does not have, only some buyers or sellers will want to enter into the contract. Only the ones that will profit the most from the contract will do so. Moreover, those are, typically, the ones the other part wants to avoid.

- Moral hazard. Sometimes, one’s counterpart cannot check whether one fulfills one’s obligations after having agreed on a contract. One may them be tempted to exploit the other’s lack of knowledge. Note the difference between the two types: Adverse selection is about what happens before the agreement has been made. Moral hazard is about what happens after it has been made.

Adverse selection

We will give two classical examples of adverse selection: the insurance market and the market for used cars. Note, however, that the concept is possible to apply on many types of goods and services.

Insurance

The price of insurance largely depends on the probability that the insurance firm will have to pay, for instance, on the probability that your bike is stolen. If there is a high probability, the price of insurance will also be high.

Different people differ in how well they keep after their belongings, and the risk that a careless person will get her bike stolen is much higher than that a carful person will get hers stolen. However, the insurance firm cannot see a difference between careless and careful people, and therefore charges them the same price corresponding to an average of the risks.

This, however, makes the insurance a good deal for the careless people, but it might make it too expensive for the careful people. They will probably not lose their bikes anyway. Then only the careless people remain; the ones that constitute a high risk for the insurer. When the insurer realizes that all people buying insurance are high-risk people, they will have to increase the price even more. The high-risk people will then have pushed the low-risk people out of the market, even though the latter might be fully willing to pay for insurance.

Used Cars

Suppose there are 100 used cars in a market, and that they are of two different levels of quality: Half of them are of high quality (H-cars) and half are of low quality (L-cars). The sellers want at least 50,000 for an L-car and at least 100,000 for an H-car, whereas the buyers are prepared to pay at most 60,000 for an L-car and 110,000 for an H-car. There are consequently possibilities for trades that are beneficial for both sides. If there had been two submarkets, one for L-cars and one for H-cars, people could have negotiated prices between 50,000 and 60,000 for L-cars and between 100,000 and 110,000 for H-cars.

However, if they are sold in the same market, the buyers cannot tell them apart. Neither can she ask the sellers, as all sellers would say that their car is an Hcar. If the chance that she will get an L- or an H-car is 50% each, the buyer could think of this as a lottery. Suppose, for simplicity, that the buyer is risk neutral (so that she does not demand a risk premium for taking a risk). She would then be willing to pay the expected value of the car, i.e.

50%*(60.000)+ 50%*(110.000) = 85.000

She will then maximally offer 85,000. However, at that price no seller is prepared to sell an H-car. Their lowest price for an H-car is 100,000. Consequently, they withdraw the H-cars from the market and only sell L-cars.

Then, however, the probability of getting an L-car is no longer 50%, but instead 100%. Since the buyer realizes this, she is prepared to pay a maximum of 60,000 for a used car, and the L-cars have pushed the H-cars out of the market.

This outcome is not efficient, since there are cars that the buyers have a higher valuation for than the sellers do, but that are not traded.

Signaling and How to Reduce Problems with Adverse Selection

There are several ways to reduce problems with adverse selection:

- Legislation. For instance, one could demand that sellers have to reveal the ingredients of (food) products. Thereby, buyers gain more information and we get less asymmetric information.

- Demand more information. Insurers often demand, for instance, a medical examination before selling insurance.

- A firm could acquire a reputation for quality. The cost of selling an L-car as if it was an H-car, i.e. lying about the product, would then be too high, since that would damage the reputation. Therefore, the customers know that all the seller’s cars are H-cars.

- One could also offer a warranty for the cars. Since the probability that an L-car will break down is much higher than that an H-car will do that, a seller of L-cars cannot offer the guarantee. Thereby the sellers sort themselves into two groups, and for L-cars and one for H-cars.

The last two examples are variants of signaling. The idea with signaling is that the agents themselves signal to which group they belong. It is, of course, not enough that they say that they belong to a certain group. It must be a signal that the low-quality group cannot afford, so that truth telling is optimal.

Moral hazard

Moral hazard has to do with asymmetric information after an agreement has been made, for instance after a contract has been signed. We can continue the insurance example from above in the following way: Say that the careful person has managed to convince the insurance firm that she is, indeed, carful.

Therefore, she constitutes a low-risk person, and she only has to pay a small premium to get the insurance.

Say that she bought insurance for her bike, and that this guarantees her a new bike if the one she has is stolen. Before she bought insurance, she would have lost the full value of the bike if it had been stolen; now she will only lose the time it takes to get a new one. Consequently, there is much less reason for her to go through the trouble of taking good care of her bike. Therefore, the risk that the bike is stolen increases and she might now constitute a risk for the insurer that is as big as the careless people are.

Because she has insurance, her risk behavior has changed to the insurer’s disadvantage. She only had to pay a low price since she is careful, but after she got insurance, she is no longer careful and should have had to pay a high price. Since the insurer cannot check if her risk-behavior has changed, she can take advantage of the firm and offload a larger share of the risk on them than she has paid for.

How to Reduce Problems with Moral Hazard

The classical way to reduce problems with moral hazard in the insurance sector is to demand that the customer keeps a part of the risk. Usually, an insurer demands that the customer pays a certain amount herself, the so-called deductable. Thereby, the risk that she becomes overly careless is reduced.