The Reporting Cycle

- Detalii

- Categorie: Accounting

- Accesări: 13,499

Preparing Financial Statements

In the previous chapter, you learned all about adjustments that might be needed at the end of each accounting period. These adjustments were necessary to bring a company’s books and records currently in anticipation of calculating and reporting its income and financial position.

However, Information Processing did not illustrate how those adjustments would be used to actually prepare the financial statements. This chapter will begin with that task.

An Illustration

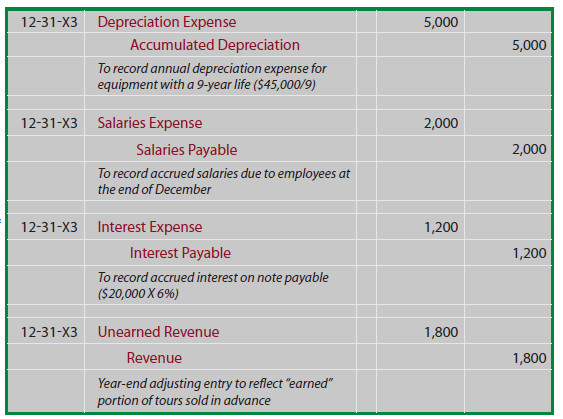

To illustrate the process for preparing financial statements, let’s look at some facts for England Tours Company. England began operation early in 20X3. In the process of preparing its financial statements for the year ending December 31, 20X3, England determined that the following adjusting entries were needed. The numbers are all “assumed” and you should not be concerned about that. But, if you are unclear as to why anyone of these entries might be needed, you should definitely review the detailed discussion of adjusting entries from the previous post: Income Measurement.

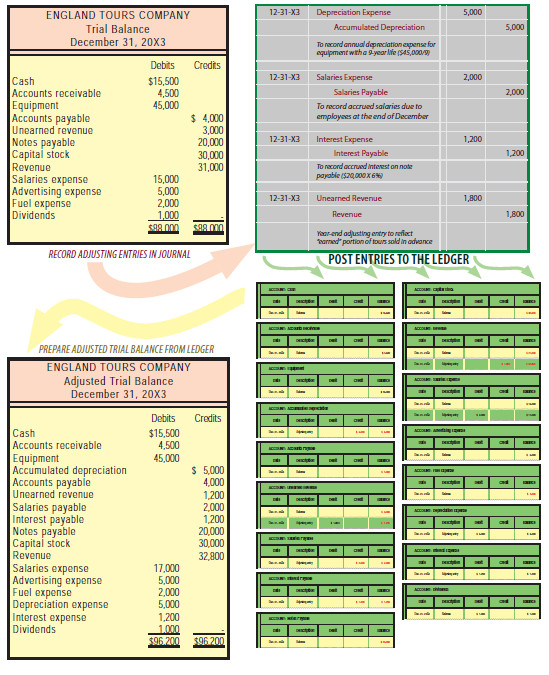

Below is a graphic showing England’s trial balance before the above-adjusting entries, and after the adjusting entries. If England had prepared its financial statements based only on the unadjusted trial balance, the reported information would be incomplete and incorrect. Instead, it is necessary to utilize the adjusted trial balance because it has been updated to reflect the year-end adjusting entries.

Considering the Actual Process for Adjustments

Most of the time, a company will prepare its trial balance, analyze the trial balance for potential adjustments, and develop a list of necessary adjusting entries. Knowing what to adjust is not necessarily intuitive. It usually requires hands-on review by someone who is very knowledgeable about the business and accounting. As a practical matter, a company should not allow anyone and everyone to have access to the accounting system for purposes of entering year-end adjustments; too many errors and rogue entries will appear.

Instead, a company will usually have a defined process where proposed entries are documented on a form (sometimes called a journal voucher). These forms are submitted to a chief accountant/controller who reviews and approves such proposed entries. The approved journal vouchers then serve as supporting documents to authorize data entry into the accounting system. The adjusting entries are entered in the journal, posted to the appropriate ledger accounts, and then the adjusted trial balance can be prepared from the up-to-date ledger.

Financial Statements

The adjusted trial balance is ordinarily sufficient to facilitate the preparation of financial statements. You should take time to trace the amounts from England’s adjusted trial balance to the financial statements that follow:

Computerization

The financial statement preparation process is mostly mechanical and easily automated. Once the adjusting entries have been prepared and entered, every accounting software package will race through the steps of processing the data to produce the financial statements. As such, you may be inclined to discount your need to understand how to move amounts from an adjusted trial balance into a set of financial statements.

In some respects that is true, just as it is true that you do not need to know how to add and subtract if you own a calculator. Of course, you probably see the value of understanding addiction and subtraction even if you use a calculator. In the same light, please consider that understanding the flow of transactions into financial statements is an essential foundation for furthering your knowledge of accounting.

A Worksheet Approach

Occasionally, one may desire to prepare financial statements that take into account necessary adjustments, but without actually updating journals and ledgers. Why? A manager may desire monthly financial reports even though the business may not formally prepare and book adjusting entries every month. A worksheet approach can be used for this purpose. Or, an auditor may use a worksheet to prepare financial statements that take into account recommended adjustments, before proposing that the actual journal/ledger be updated.

The accounting department could be requested to prepare financial statements at any point in time; rather than break routine and book entries outside of the normal cycle, they might instead simply prepare financial statements via an informal worksheet.

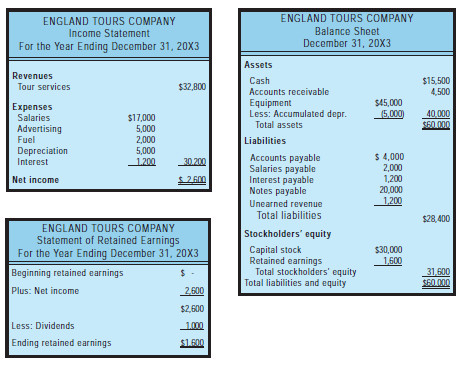

The following illustrates a typical worksheet. The data and adjustments correspond to information previously presented for England. The first set of columns is the unadjusted trial balance. The next set of columns reveals the end-of-period adjustments. The information in the first two sets of columns is combined to generate the adjusted trial balance columns.

The last three pairs of columns in the worksheet are the appropriate financial statement extensions of amounts from the adjusted trial balance columns. For example, Cash is an asset account with a debit balance and is “appropriately” extended to the debit column of the balance sheet pair of columns. Likewise, Service Revenue is an income statement account with a credit balance; notice that it is extended to the income statement credit column.

This extension of accounts should occur for every item in the adjusted trial balance. Look at the worksheet, and then consider the additional comments that follow. After all adjusted trial balance amounts have been extended to the appropriate financial statement columns; the income statement columns are subtotaled. If credits exceed debits, the company has more revenues than expenses (e.g., $32,800 vs. $30,200 = $2,600 net income)). On the other hand, an excess of debits over credits would represent a net loss.

To complete the worksheet, the amount of net income or loss is entered in the lower portion of the income statement columns in a manner which causes total debits to equal total credits. England Tours had a $2,600 net income, and a debit is needed to balance the income statement pair. An offsetting credit is entered in the lower portion of the retained earnings columns.

This credit represents income for the year that must be added to retained earnings to complete the preparation of a formal statement of retained earnings. Within the retained earnings columns, the subtotal indicates that ending retained earnings is $1,600 (noted by the excess of credits ($2,600) over debits ($1,000)); this amount is debited in the retained earnings columns and credited in the balance sheet columns – thereby bringing both sets of columns into final balance.

An Additional Illustration

The illustration shown assumed England Tours was formed early in 20X3. As such, there was no beginning retained earnings balance. You may wonder how the worksheet would be influenced by a beginning retained earnings balance. If you were to look at England’s 20X4 worksheet, the $1,600 ending retained earnings from 20X3 would carry over to become the beginning balance for 20X4.

The Accounting Cycle and Closing Process

Reflecting on the accounting processes thus far described reveals the following typical steps:

- transactions are recorded in the journal

- journal entries are posted to appropriate ledger accounts

- a trial balance is constructed

- adjusting entries are prepared and posted

- an adjusted trial balance is prepared

- formal financial statements are produced (perhaps with the assistance of a worksheet)

It appears that we have completed the accounting cycle - capturing transaction and event data and moving it through an orderly process that results in the production of useful financial statements. And, importantly, we are left with substantial records that document each transaction (the journal) and each account’s activity (the ledger). It is no wonder that the basic elements of this accounting methodology have endured for hundreds of years.

The Closing Process

There remains one final step. It is known as the closing process. The purpose of the closing process is two-fold:

- Closing is a mechanism to update the retained earnings account in the ledger to equal the end of-period balance. Keep in mind the recording of each item of revenue, expense, or dividend does not automatically produce an updating debit or credit to retained earnings. As such, the beginning-of-period retained earnings amount remains in the ledger until the closing process “updates” the retained earnings account for the impact of the period’s operations.

- Revenue, expense, and dividend accounts represent amounts for a period of time; one must “zero out” these accounts at the end of each period (as a result, revenue, expense, and dividend accounts are called temporary or nominal accounts). In essence, by zeroing out these accounts, one has reset them to begin the next accounting period. In contrast, asset, liability, and equity accounts are called real accounts, as their balances are carried forward from period to period. For example, one does not “start over” each period accumulating assets like cash and so on -- their balances carry forward.

Closing involves a four-step process:

- close revenue accounts (to a unique account called Income Summary -- a non-financial statement account used only to facilitate the closing process),

- close expense accounts to Income Summary,

- close the Income Summary account to Retained Earnings,

- close the Dividend account to Retained Earnings.

By doing this, all revenues and expenses are “corralled” in Income Summary (the net of which represents the income or loss for the period). In turn, the income or loss is then swept to Retained Earnings along with the dividends. Recall that beginning retained earnings, plus income, less dividends, equals ending retained earnings; likewise, the closing process updates the beginning retained earnings to move forward to the end-of-period balance.

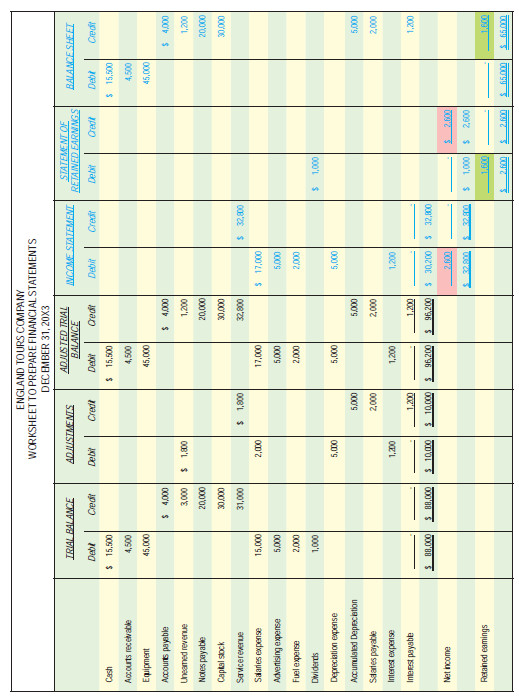

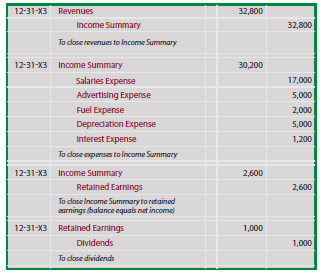

Below are the closing entries for England Tours. You may find it helpful to compare the accounts and amounts below to those that appeared in the previous adjusted trial balance:

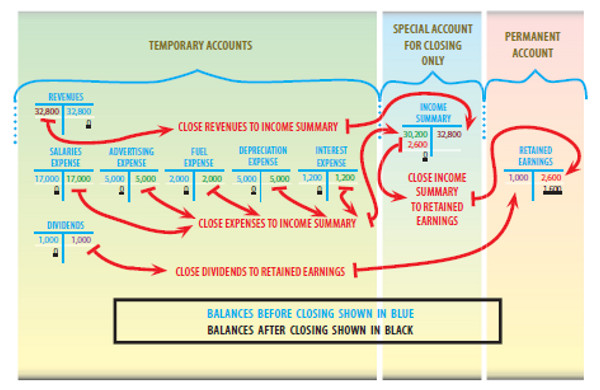

Be certain to note the effect of the above entries is to (1) update the retained earnings account and (2) cause a zero balance to occur in the temporary (revenue, expense, and dividends) accounts. The Income Summary account is also left “zeroed” out ($32,800 (cr.) = $30,200 (dr.) + $2,600 (dr.)). The following T-accounts reveal the effects of the closing entries on the various accounts:

Post Closing Trial Balance

The post-closing trial balance reveals the balance of accounts after the closing process and consists of a balance sheet account only. The post-closing trial balance is a tool to demonstrate that accounts are in balance; it is not a formal financial statement. All of the revenue, expense, and dividend accounts were zeroed away via closing, and do not appear in the post-closing trial balance.

Revisiting Computerization

Many accounting software programs are based on database logic. These powerful tools allow the user to query with few restrictions. As such, one could request financial results for almost any period of time (e.g., the 45 days ending October 15, 20XX), even if it related to a period several years ago. In these cases, the notion of closing the accounts becomes far less relevant. Very simply, the computer can mine all transaction data and pull out the accounts and amounts that relate to virtually any requested interval of time.

Reversing Entries

Reversing entries are an optional accounting procedure which may prove useful in simplifying record-keeping. A reversing entry is a journal entry to “undo” an adjusting entry. You will soon see how reversing entries can simplify the overall process.

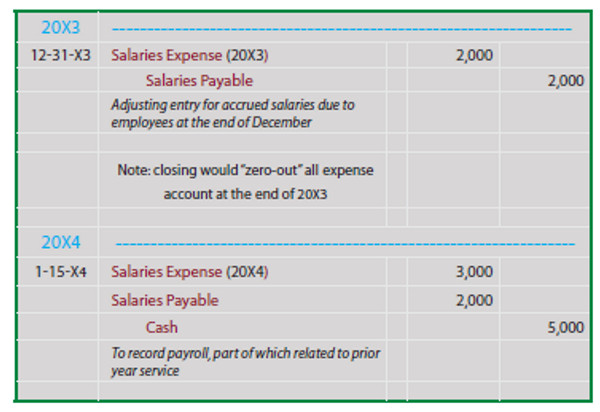

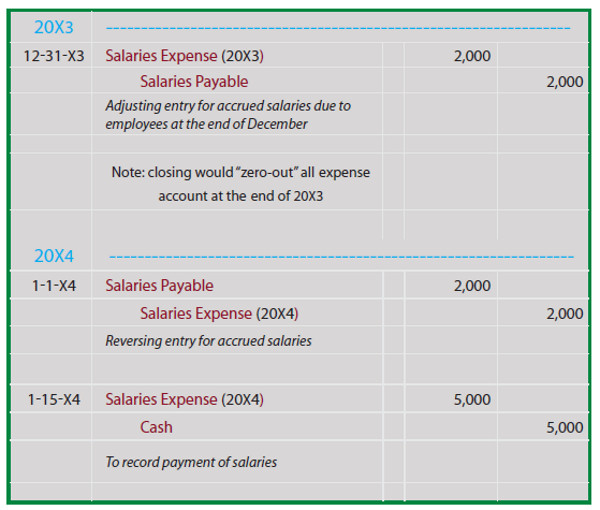

First, consider this example, which does not utilize reversing entries. An adjusting entry was made to record $2,000 of accrued salaries at the end of 20X3. The next payday occurred on January 15, 20X4, when $5,000 was paid to employees. The entry on that date required a debit to Salaries Payable (for the $2,000 accrued at the end of 20X3) and Salaries Expense (for $3,000 earned by employees during 20X4):

Illustration without Reversing Entries

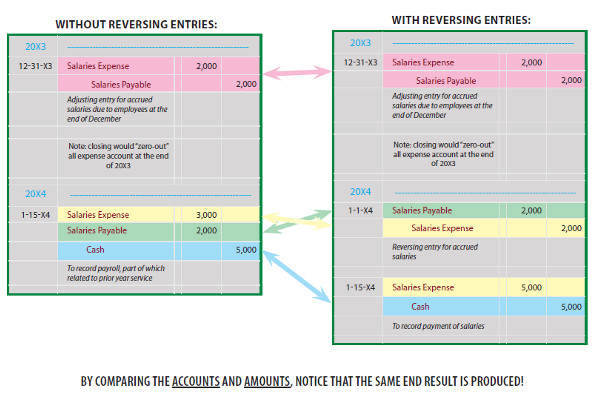

Let’s revisit these facts using reversing entries. The adjusting entry in 20X3 to record $2,000 of accrued salaries is the same as above. However, the first journal entry of 20X4 simply reverses the adjusting entry. On the following payday, January 15, 20X5, the entire payment of $5,000 is recorded as an expense:

Illustration with Reversing Entries

The net impact of these procedures is to record the correct amount of salary expense for 20X4 ($2,000 credit and $5,000 debit, produces the correct $3,000 net debit to salaries expense). You may find it odd to credit an expense account on January 1, because, by itself, it makes no sense. The credit only makes sense when coupled with the subsequent debit on January 15. Notice from the following diagram that both approaches produce the same final results:

In practice, reversing entries will simplify the accounting process. For example, on the first payday following the reversing entry, a “normal” journal entry can be made to record the full amount of salaries paid as an expense - without having to give special consideration to the impact of any prior adjusting entry. Reversing entries would ordinarily be appropriate for those adjusting entries that involve the recording of accrued revenues and expenses; specifically, those that involve future cash flows. Importantly, whether reversing entries are used or not, the same result is achieved!

Classified Balance Sheets

The balance sheet reveals the assets, liabilities, and equity of a company. In examining a balance sheet, you should always be mindful that the components listed in a balance sheet are not necessarily at fair value. Many assets are carried at historical cost, and other assets are not reported at all (such as the value of a company’s brand name, patents, and other internally developed resources).

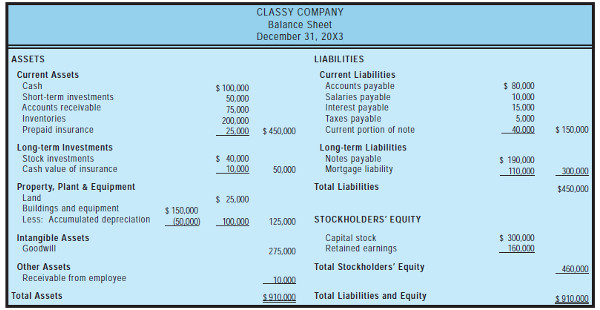

Nevertheless, careful examination of the balance sheet is essential to the analysis of a company’s overall financial condition. To facilitate proper analysis, accountants will often divide the balance sheet into categories or classifications. The result is that important groups of accounts can be identified and subtotaled. Such balance sheets are called “classified balance sheets.”

Assets

The asset side of the balance sheet may be divided into as many as five separate sections (when applicable), in the following order:

- Current Assets are those assets that will be converted into cash or consumed in a relatively short period of time; specifically, those assets that will be converted into cash or consumed within one year or the operating cycle, whichever is longer. The operating cycle for a particular company is the period of time it takes to convert cash back into cash (i.e., purchase inventory, sell the inventory on account, and collect the receivable); this is usually less than one year. In listing assets within the current section, the most liquid assets should be listed first (i.e., cash, short-term investments, and receivables). These are followed by inventories and prepaid expenses.

- Long-term Investments include land purchased for speculation, funds set aside for a plant expansion program, funds redeemable from insurance policies (e.g., cash surrender value of life insurance), and investments in other entities.

- Property, Plant, and Equipment include the land, buildings, and equipment productively in use by the company.

- Intangible Assets lack physical existence and include items like purchased patents and copyrights, “goodwill” (the amount by which the price paid to buy another entity exceeds that entity’s identifiable assets), and similar items.

- Other Assets is the section used to report asset accounts that just don’t seem to fit elsewhere, such as a special long-term receivable.

Liabilities

Just as the asset side of the balance sheet may be divided, so too for the liability section. The liability section is customarily divided into:

- Current Liabilities are those obligations that will be liquidated within one year or the operating cycle, whichever is longer. Normally, current liabilities are paid with current assets.

- Long-term Liabilities relate to any obligation that is not current and includes bank loans, mortgage notes, and the like. Importantly, some long-term notes may be classified partially as a current liability and partially as a long-term liability. The portion classified as the current would be the principal amount to be repaid within the next year (or an operating cycle, if longer). Any amounts due after that period of time would be shown as a long-term liability.

Equity

The appropriate financial statement presentation for equity depends on the nature of the business organization for which it is prepared. The illustrations in this book generally assume that the business is incorporated. Therefore, the equity section consists of:

Capital Stock includes the amounts received from investors for the stock of the company. The investors become the owners of the company, and that ownership interest is represented by shares that can be transferred to others (without further involvement by the company). In actuality, the legalese of stock issues can become quite involved, and you are apt to encounter expanded capital stock related accounts (such as preferred stock, common stock, paid-in capital in excess of par, and so on). Those advanced issues are covered in subsequent chapters.

Retained Earnings are familiar to you, representing the accumulated income less the dividends. In essence, it is the profit that has been retained and plowed back (reinvested) into the expansion of the business.

Other Entity Forms

Other Entity Forms

There is nothing that requires that a business activity be conducted through a corporation. A sole proprietorship is an enterprise owned by one person. If the illustration above was instead being prepared for a sole proprietorship, it would look the same except that the equity section would consist of a single owner’s capital account (instead of capital stock and retained earnings).

If several persons are involved in a business that is not incorporated, it is likely a partnership. Again, the balance sheet would be unchanged except for the equity section; the equity section would be divided into separate accounts -- one for each partner (representing each partner’s residual interest in the business).

Recent years have seen a spate of legislation creating variants of these entity forms (limited liability companies/LLC, limited liability partnerships/LLP, etc.), but the overall balance sheet structure is relatively unaffected. The terminology used to describe entity forms and equity capital structure also vary considerably around the world, but there is very little substantive difference in the underlying characteristics or the general appearance and content of the balance sheet.

Notes to the Financial Statements

Financial statements, by themselves, may not tell the whole story. Many important details about a company cannot be described in money on the balance sheet. Notes are used to describe accounting policies, major business events, pending lawsuits, and other facets of the operation. The principle of full disclosure means that financial statements result in a fair presentation and that all facts which would influence investors’ and creditors’ judgments about the company are disclosed in the financial statements or related notes.

Business Liquidity and the Operating Cycle

As was noted above, careful examination of the balance sheet is essential to the analysis of a company’s financial health, and the classified balance sheet helps in that analysis. Investors and creditors must be mindful of a company’s liquidity. Liquidity is the ability of a firm to meet its near-term obligations as they come due. Inadequate liquidity can spell doom, even for a company with bright long-term prospects and significant noncash assets.

Working Capital

Working capital is the difference between current assets and current liabilities. The illustration for Classy Company revealed current assets of $450,000 and current liabilities of $150,000. Thus, working capital is $300,000 ($450,000 - $150,000). For obvious reasons, one would hope to find a positive amount of working capital. If not, it may be an indication of financial stress.

Of course, care should be taken in drawing blanket conclusions about a firm’s condition based solely upon an examination of a single number. Could a firm have negative working capital, and still be in great shape? Yes! For instance, the firm may have a standby letter of credit at a bank that enables it to borrow money as needed to meet near-term obligations.

Or, some companies are in great shape even though they have negative working capital. Consider a fast food restaurant that has virtually no receivables (most sales are for cash) and a very low inventory (you know bread and milk don’t store well). The only current assets may consist of cash, nominal inventories, and some prepaid items.

Nevertheless, they may have current liabilities in the form of significant accounts payable and short term debt. How do they survive? The velocity of their cash flow may be very fast, as they hopefully turn large volumes of business at high-profit margins. This enables the spinning of enough free cash flow to pay obligations as they come due and have money left over to reinvest in growing other business locations. So, you see that working capital is important to monitor. Just be careful about blanket conclusions based on any single measure.

Current Ratio

Is $1,000,000 of working capital a lot? Maybe, maybe not. $1,000,000 is but a drop in the bucket to a corporate giant, and that amount of working capital could signal the end. On the other hand, a “mom and pop” business could be doing grand with far less than $1,000,000. So, it really depends on the ratio of current assets to current liabilities. The current ratio is used to express the relative amount of working capital. It is calculated by dividing current assets by current liabilities:

Current Ratio = Current Assets/Current Liabilities

Classy Company has a current ratio of 3:1 ($450,000/$150,000). Be advised that ratios can be manipulated. If Classy wished to increase their current ratio, they could just pay off a little debt. For instance, if they paid off $50,000 of accounts payable with cash, then-current assets and current liabilities would each decline by $50,000, and the revised current ratio would “improve” to 4:1 (($450,000 -$50,000)/($150,000 - $50,000)).

Quick Ratio

A company could possess a large amount of inventory that is not easily sold. Thus, the current ratio (which includes inventory) could signal no problem, all the while the company is struggling to pay its bills. A tougher ratio is the quick ratio. This ratio provides a more stringent test of debt-paying ability by dividing only a firm’s quick assets (cash, short-term investments, and accounts receivable) by current liabilities:

Quick Ratio = (Cash + Short-term Investments + Accounts Receivable)/Current Liabilities

Classy Company has a quick ratio of 1.5:1 (($100,000 + $50,000 + $75,000)/$150,000).