Income Measurement

- Details

- Category: Accounting

- Hits: 16,760

Measurement Triggering Transactions and Events

Economists often refer to income as a measure of better-offenses. In other words, economic income represents an increase in the command over goods and services. Such notions of income capture a business’s operating successes, as well as a good fortune from holding assets that may increase in value.

The Meaning of Accounting Income

Accounting does not attempt to measure all value changes (e.g., the land is recorded at its purchase price and that historical cost amount is maintained in the balance sheet, even though the market value may increase over time -- this is called the historical cost principle). Whether and when accounting should measure changes in value has long been a source of debate among accountants. Many justify historical cost measurements because they are objective and verifiable.

Others submit that market values, however imprecise, may be more relevant for decision-making purposes. Suffice it to say that this is a long-running debate, and specific accounting rules are mixed. For example, although the land is measured at historical cost, investment securities are apt to be reported at market value. There are literally hundreds of specific accounting rules that establish measurement principles; the more you study accounting, the more you will learn about these rules and their underlying rationale.

For introductory purposes, it is necessary to simplify and generalize: thus, accounting (a) measurements tend to be based on historical cost determined by reference to an exchange transaction with another party (such as a purchase or sale) and (b) income represents revenues minus expenses as determined by reference to those transactions or events.

More Income Terminology

At the risk of introducing too much too soon, the following definitions may prove helpful:

- Revenues - Inflows and enhancements from delivery of goods and services that constitute central ongoing operations

- Expenses - Outflows and obligations arising from the production of goods and services that constitute central ongoing operations

- Gains - Like revenues, but arising from peripheral transactions and events

- Losses - Like expenses, but arising from peripheral transactions and events

Thus, it may be more precisely said that income is equal to Revenues + Gains - Expenses - Losses.

You should not worry too much about these details for now, but do take note that revenue is not synonymous with income. And, there is a subtle distinction between revenues and gains (and expenses and losses).

An Emphasis on Transactions and Events

Although accounting income will typically focus on recording transactions and events that are exchange based, you should note that some items must be recorded even though there is not an identifiable exchange between the company and some external party. Can you think of any nonexchange events that logically should be recorded to prepare correct financial statements? How about the loss of an uninsured building from fire or storm? Clearly, the asset is gone, so it logically should be removed from the accounting records.

This would be recorded as an immediate loss. Even more challenging for you may be to consider the journal entry: debit a loss (losses are increased with debits since they are like expenses), and credit the asset account (the asset is gone and is reduced with a credit).

The Periodicity Assumption

Business activity is fluid. Revenue and expense generating activities are in constant motion. Just because it is time to turn a page on a calendar does not mean that all business activity ceases. But, for purposes of measuring performance, it is necessary to draw a line in the sand of time. A periodicity assumption is made that business activity can be divided into measurement intervals, such as months, quarters, and years.

Accounting Implications

Accounting must divide the continuous business process, and produce periodic reports. An annual reporting period may follow the calendar year by running from January 1 through December 31.

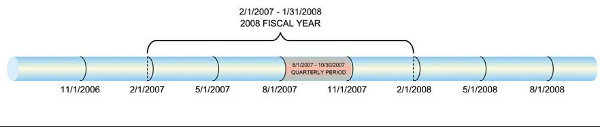

Annual periods are usually further divided into quarterly periods containing activity for three months. In the alternative, a fiscal year may be adopted, running from any point of beginning to one year later. Fiscal years often attempt to follow natural business year cycles, such as in the retail business where a fiscal year may end on January 31 (allowing all of the Christmas rushes, and corresponding returns, to cycle through). Note in the following illustration that the 2008 Fiscal Year is so named because it ends in 2008:

You should also consider that internal reports may be prepared on even more frequent monthly intervals. As a general rule, the more narrowly defined a reporting period, the more challenging it becomes to capture and measure business activity. This results because continuous business activity must be divided and apportioned among periods; the more periods, the more likely that ongoing transactions must be allocated to more than one reporting period.

Once a measurement period is adopted, the accountant’s task is to apply the various rules and procedures of generally accepted accounting principles (GAAP) to assign revenues and expenses to the reporting period. This process is called accrual basis accounting – accrue means to come about as a natural growth or increase -- thus, accrual basis accounting is reflective of measuring revenues as earned and expenses as incurred.

The importance of correctly assigning revenues and expenses to time periods is pivotal in the determination of income. It probably goes without saying that reported income is of great concern to investors and creditors, and its proper determination is crucial. These measurement issues can become highly complex. For example, if a software company sells a product for $25,000 (in year 20X1), and agrees to provide updates at no cost to the customer for 20X2 and 20X3, then how much revenue is earned in 20X1, 20X2, and 20X3? Such questions are vexing, and they make accounting far more challenging than most realize.

At this point, suffice it to say that we would need more information about the software company to answer their specific question. But, there are several basic rules about revenue and expense recognition that you should understand, and they will be introduced in the following sections.

Before moving away from the periodicity assumption, and its accounting implications, there is one important factor for you to note. If accounting did not require periodic measurement, and instead, took the view that we could report only at the end of a process, the measurement would be easy. For example, if the software company were to report income for the three-year period 20X1 through 20X3, then revenue of $25,000 would be easy to measure. It is the periodicity assumption that muddies the water.

Why not just wait? Two reasons: first, you might wait a long time for activities to close and become measurable with certainty, and second, investors cannot wait long periods of time before learning how a business is doing. Timeliness of data is critical to its relevance for decision making. Therefore, procedures and assumptions are needed to produce timely data, and that is why the periodicity assumption is put in play.

Basic Elements of Revenue Recognition

To recognize an item is to record it into the accounting records. Revenue recognition normally occurs at the time services are rendered or when goods are sold and delivered to a customer. The basic conditions of revenue recognition are to look for both (a) an exchange transaction, and (b) the earnings process is complete.

For a manufactured product, should revenue be recognized when the item rolls off of the assembly line? The answer is no! Although production may be complete, the product has not been sold in an exchange transaction. Both conditions must be met. In the alternative, if a customer ordered a product that was to be produced, would the revenue be recognized at the time of the order? Again, the answer is no! For revenue to be recognized, the product must be manufactured and delivered.

Modern business transactions frequently involve complex terms, bundled items (e.g., a cell phone with a service contract), intangibles (e.g. a software user license), order routing (e.g., an online retailer may route an order to the manufacturer for direct shipment), and so forth. It is no wonder that many accounting failures involve the misapplication of revenue recognition concepts. The USA Securities and Exchange Commission has additional guidance, noting that revenue recognition would normally be appropriate only when there is persuasive evidence of an arrangement, the delivery has occurred (or services rendered), the seller’s price is fixed or determinable, and collectability is reasonably assured.

Payment and Revenue Recognition

It is important to note that receiving payment is not a criterion for initial revenue recognition. Revenues are recognized at the point of sale, whether that sale is for cash or a receivable. Recall the earlier definition of revenue (inflows and enhancements from delivery of goods and services), noting that it contemplates something more than simply reflecting cash receipts. Also, recall the study of journal entries from The accounting Journal; specifically, you learned to record revenues on the account.

Much business activity is conducted on credit, and severe misrepresentations of income could result if the focus was simply on cash receipts. To be sure, if the collection of a sale was in doubt, allowances would be made in the accounting records. When you study the chapter on accounts receivable you will see how to deal with these issues.

Basic Elements of Expense Recognition

Expense recognition will typically follow one of three approaches, depending on the nature of the cost:

- Associating cause and effect: Many costs can be directly linked to the revenue they help produce. For example, a sales commission owed to an employee is directly based on the amount of a sale. Therefore, the commission expense should be recorded in the same accounting period as the sale. Likewise, the cost of inventory delivered to a customer should be expensed when the sale is recognized. This is what is meant by associating cause and effect, and is most often referred to as the matching principle.

- Systematic and rational allocation: In the absence of a clear link between a cost and revenue item, other expense recognition schemes must be employed. Some costs benefit many periods. Stated differently, these costs expire over time. For example, a truck may last many years; determining how much cost is attributable to a particular year is difficult. In such cases, accountants may use a systematic and rational allocation scheme to spread a portion of the total cost to each period of use (in the case of a truck, through a process known as depreciation).

- Immediate recognition: Last, some costs cannot be linked to any production of revenue, and do not benefit future periods either. These costs are recognized immediately. An example would be severance pay to a fired employee, which would be expensed when the employee is terminated.

Payment and Expense Recognition

It is important to note that making payment is not a criterion for initial expense recognition. Expenses are based on one of the three approaches just described, no matter when payment of the cost occurs. Recall the earlier definition of expense (outflows and obligations arising from the production of goods and services), noting that it contemplates something more than simply making a cash payment.

The Adjusting Process and Related Entries

In the previous chapter, you saw how tentative financial statements could be prepared directly from a trial balance. However, you were also cautioned about adjustments that may be needed to prepare a truly correct and up-to-date set of financial statements. This occurs because:

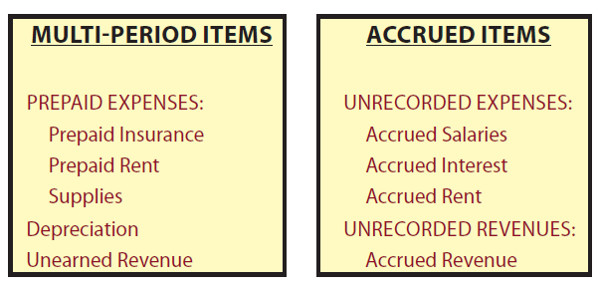

- MULTI-PERIOD ITEMS: Some revenue and expense items may relate to more than one accounting period, or

- ACCRUED ITEMS: Some revenue and expense items have been earned or incurred in a given period, but not yet entered into the accounts (commonly called accruals).

In other words, the ongoing business activity brings about changes in economic circumstances that have not been captured by a journal entry. In essence, time brings about change, and an adjusting process is needed to cause the accounts to appropriately reflect those changes. These adjustments typically occur at the end of each accounting period and are akin to temporarily cutting off the flow through the business pipeline to take a measurement of what is in the pipeline -- consistent with the revenue and expense recognition rules described in the preceding portion of this chapter.

There is simply no way to catalog every potential adjustment that a business may need to make. What is required is a firm understanding of a particular business’s operations, along with a good handle on accounting measurement principles. The following discussion will describe typical adjustments that one would likely encounter. You should strive to develop a conceptual understanding based on these examples. Your critical thinking skills will then allow you to extend these basic principles to most any situation you are apt to encounter. Specifically, the examples will relate to:

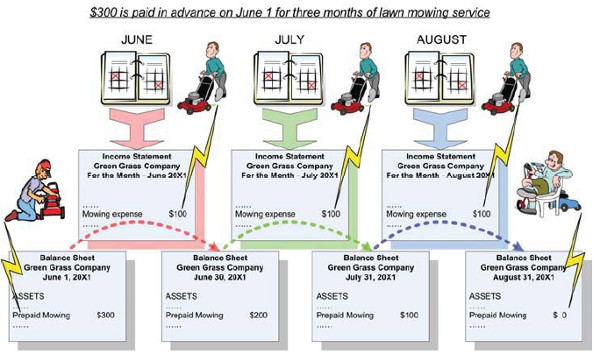

It is quite common to pay for goods and services in advance. You have probably purchased insurance this way, perhaps prepaying for an annual or semi-annual policy. Or, rent on a building may be paid ahead of its intended use (e.g., most landlords require monthly rent to be paid at the beginning of each month). Another example of prepaid expense relates to supplies that are purchased and stored in advance of actually needing them.

At the time of purchase, such prepaid amounts represent future economic benefits that are acquired in exchange for cash payments. As such, the initial expenditure gives rise to an asset. As time passes, the asset is diminished. This means that adjustments are needed to reduce the asset account and transfer the consumption of the asset’s cost to an appropriate expense account.

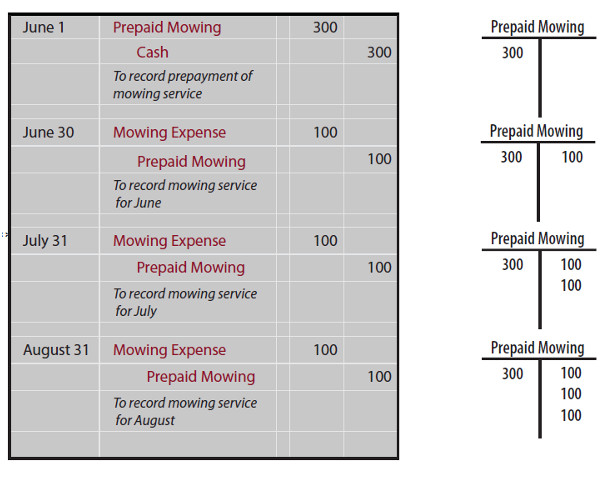

As a general representation of this process, assume that you prepay $300 on June 1 for three months of lawn mowing service. As shown in the following illustration, this transaction initially gives rise to a $300 asset on the June 1 balance sheet. As each month passes, $100 is removed from the balance sheet account and transferred to expense (think: an asset is reduced and expense is increased, giving rise to lower-income and equity -- and leaving the balance sheet in balance):

Examine the journal entries for this cutting-edge illustration, and take note of the impact on the balance sheet account for Prepaid Mowing (as shown by the T-accounts at right):

Now that you have a general sense of the process of accounting for prepaid items, let’s take a closer look at some specific illustrations.

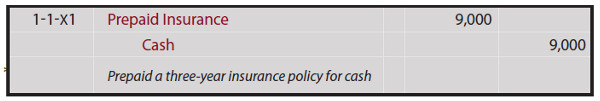

Illustration of Prepaid Insurance

Insurance policies are usually purchased in advance. You probably know this from your experience with automobile coverage. Cash is paid upfront to cover a future period of protection. Assume a three-year insurance policy was purchased on January 1, 20X1, for $9,000. The following entry would be needed to record the transaction on January 1:

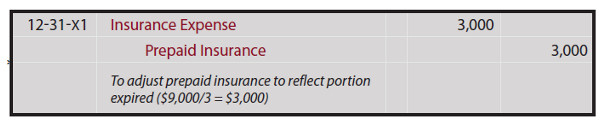

By December 31, 20X1, $3,000 of insurance coverage would have expired (one of three years, or 1/3 of the $9,000). Therefore, an adjusting entry to record expenses and reduce prepaid insurance would be needed by the end of the year:

As a result of the above entry and adjusting entry, the income statement for 20X1 would report insurance expense of $3,000, and the balance sheet at the end of 20X1 would report prepaid insurance of $6,000 ($9,000 debit less $3,000 credit). The remaining $6,000 amount would be transferred to expense over the next two years by preparing similar adjusting entries at the end of 20X2 and 20X3.

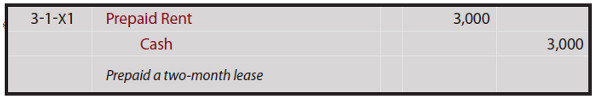

Illustration of Prepaid Rent

Assume a two-month lease is entered and rent paid in advance on March 1, 20X1, for $3,000. The following entry would be needed to record the transaction on March 1:

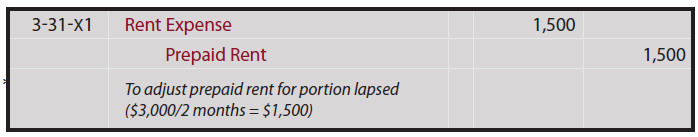

By March 31, 20X1, half of the rental period has lapsed. If financial statements were to be prepared at the end of March, an adjusting entry to record rent expense and reduce prepaid rent would be needed on that financial statement date:

As a result of the preceding entries, the income statement for March would report rent expense of $1,500, and the balance sheet at March 31, would report prepaid rent of $1,500 ($3,000 debit less $1,500 credit). The remaining $1,500 prepaid amount would be expensed in April.

I’m a Bit Confused – Exactly When do I Adjust?

In the illustration for insurance, the adjustment was applied at the end of December, but the rent adjustment occurred at the end of March. What’s the difference? What has not stated in the first illustration was the assumption that financial statements were only being prepared at the end of the year, in which case the adjustments were only needed at that time. In the second illustration, it was explicitly stated that financial statements were to be prepared at the end of March, and that

necessitated an end of March adjustment. There is a moral to this: adjustments should be made every time financial statements are prepared, and the goal of the adjustments is to correctly assign the appropriate amount of expense to the time period in question (leaving the remainder in a balance sheet account to carry over to the next time period(s)). Every situation will be somewhat unique, and careful analysis and thoughtful consideration must be brought to bear to determine the correct amount of adjustment.

To extend your understanding of this concept, return to the facts of the insurance illustration, but assume monthly financial statements were prepared. What adjusting entry would be needed each month? The answer is that every month would require an adjusting entry to remove (credit) an additional $250 from prepaid insurance ($9,000/36 months during the 3-year period = $250 per month), and charge (i.e., debit) insurance expense. This would be done in lieu of the annual entry.

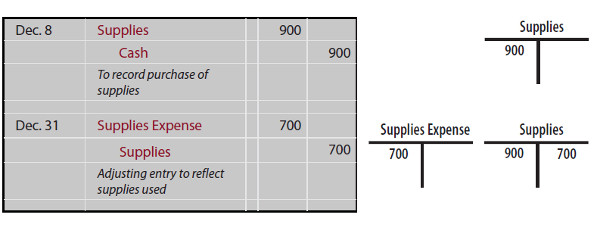

Illustration of Supplies

The initial purchase of supplies is recorded by debiting Supplies and crediting Cash. Supplies Expense should subsequently be debited and Supplies should be credited for the amount used. This results in supplies expense on the income statement being equal to the amount of supplies used, while the remaining balance of supplies on hand is reported as an asset on the balance sheet. The following illustrates the purchase of $900 of supplies. Subsequently, $700 of this amount is used, leaving $200 of supplies on hand in the Supplies account:

The above example is probably not too difficult for you. So, let’s dig a little deeper, and think about how these numbers would be produced. Obviously, the $900 purchase of supplies would be traced to a specific transaction. In all likelihood, the supplies were placed in a designated supply room (like cabinet, closet, or chest). Perhaps the storage room has a person in charge to make sure that supplies are only issued for legitimate purposes to authorized personnel (a logbook may be maintained).

Each time someone withdraws supplies, journal entry to record expense could be initiated; but, of course, this would be time-consuming and costly (you might say that the record-keeping cost would exceed the benefit). Instead, it is more likely that supplies accounting records will only be updated at the end of an accounting period.

To determine the amount of adjustment, one might back in to the calculation: Supplies in the storage room are physically counted at the end of the period (assumed to be $200); since the account has a $900 balance from the December 8 entry, one backs in to the $700 adjustment on December 31. In other words, since $900 of supplies was purchased, but only $200 was leftover, then $700 must have been used.

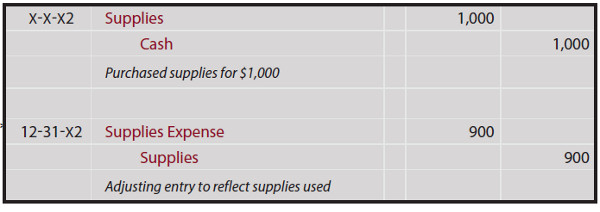

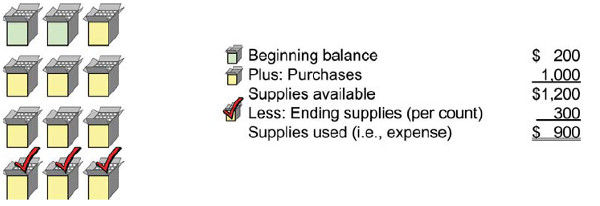

The following year becomes slightly more challenging. If an additional $1,000 of supplies is purchased during 20X2, and the ending balance at December 31, 20X2, is physically counted at $300, then these entries would be needed:

The $1,000 amount is clear enough, but what about the $900 of expense? You must take into account that you started 20X2 with a $200 beginning balance (last year’s leftovers), purchased an additional $1,000 (giving you total available for the period at $1,200), and ended with only $300 of supplies. Thus, $900 was used up during the period:

Depreciation

Many assets have a very long life. Examples include buildings and equipment. These assets will provide productive benefits to a number of accounting periods. Accounting does not attempt to measure the change value of these assets each period. Instead, a portion of their cost is simply allocated to each accounting period. This process is called depreciation.

A subsequent chapter will cover depreciation methods in great detail. However, one simple approach is called the straight-line method. Under this method, an equal amount of asset cost is assigned to each year of service life. In other words, the cost of the asset is divided by the years of useful life, resulting in annual depreciation expense.

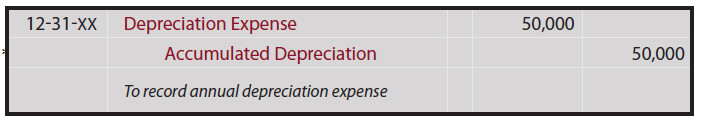

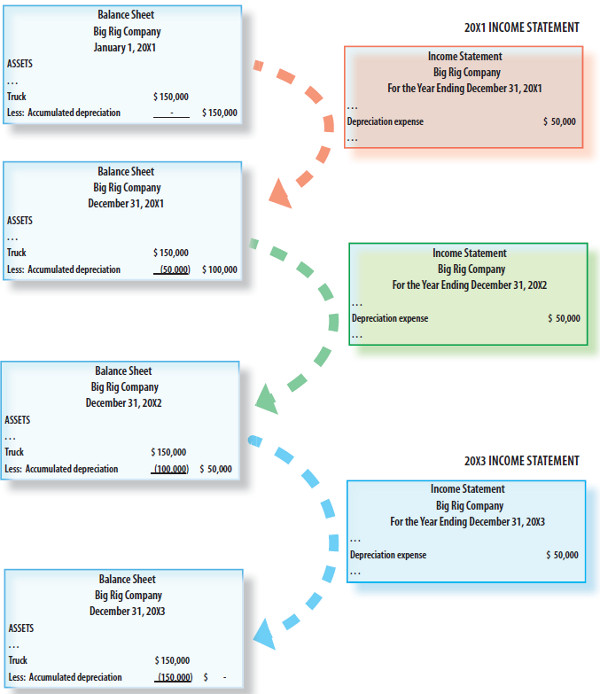

By way of example, if a $150,000 truck with a 3-year life was purchased on January 1 of Year 1, depreciation expense would be $50,000 ($150,000/3 = $50,000) per year. $50,000 of expense would be reported on the income statement each year for three years. Each year’s journal entry to record depreciation involves a debit to Depreciation Expense and a credit to Accumulated Depreciation (rather than crediting the asset account directly):

Accumulated depreciation is a very unique account. It is reported on the balance sheet as a contra asset. A contra account is an account that is subtracted from a related account. As a result, contra accounts have opposite debit/credit rules from those of the associated accounts. In other words, accumulated deprecation is increased with a credit, because the associated asset normally has a debit balance. This topic usually requires additional clarification. Let’s see how this truck, the related accumulated depreciation, and depreciation expense would appear on the balance sheet and income statement for each year:

As you can see on each year’s balance sheet, the asset continues to be reported at its $150,000 cost. However, it is also reduced each year by the ever-growing accumulated depreciation. The asset cost minus accumulated depreciation is known as the netbook value of the asset. For example, on December 31, 20X2, the net book value of the truck is $50,000, consisting of $150,000 cost less than $100,000 of accumulated depreciation. By the end of the asset’s life, its cost has been fully depreciated and its net book value has been reduced to zero. Customarily the asset could then be removed from the accounts, presuming it is then fully used up and retired.

Unearned Revenues

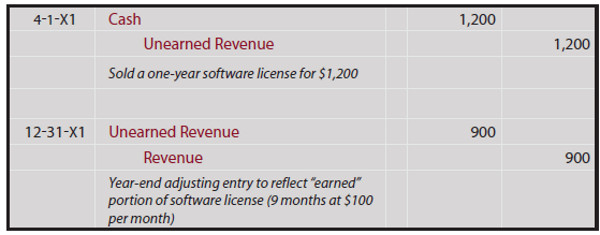

Often, a business will collect money in advance of providing goods or services. For example, a magazine publisher may sell a multi-year subscription and collect the full payment at or near the beginning of the subscription period. Such payments received in advance are initially recorded as a debit to Cash and a credit to Unearned Revenue. Unearned revenue is reported as a liability, reflecting the company’s obligation to deliver the product in the future.

Remember, revenue cannot be recognized in the income statement until the earnings process is complete. As goods and services are delivered (e.g., the magazines are delivered), the Unearned Revenue is reduced (debited) and Revenue is increased (credited). The balance sheet at the end of an accounting period would include the remaining unearned revenue for those goods and services not yet delivered. The rationale for this approach is important to grasp; a liability exists to deliver goods and services in the future and should be reflected in the balance sheet.

Equally important, revenue (on the income statement) should only be reflected as goods and services are actually delivered (in contrast to recognizing them solely at the time of payment). Unearned Revenue accounts may be found in the balance sheets of many businesses, including software companies (that license software use for multiple periods), funeral homes (that sell preneed funeral agreements), internet service providers (that sell multi-period access agreements), advertising agencies (that sell advertising services in advance), law firms (that require advance retainer payments), airlines (that sell tickets in advance), and so on. Following are illustrative entries for the accounting for unearned revenues:

Accruals

Another type of adjusting journal entry pertains to the accrual of unrecorded expenses and revenues. Accruals are expenses and revenues that gradually accumulate throughout an accounting period. Accrued expenses relate to such things as salaries, interest, rent, utilities, and so forth. Accrued revenues might relate to such events as client services that are based on hours worked. Because of their importance, several examples follow.

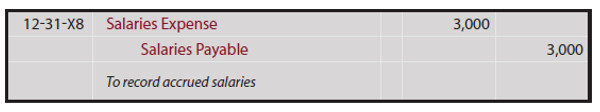

Accrued Salaries

Few, if any, businesses have daily payroll. Typically, businesses will pay employees once or twice per month. Suppose a business has employees that collectively earn $1,000 per day. The last payday occurred on December 26, as shown in the 20X8 calendar at right below. Employees worked three days the following week, but would not be paid for this time until January 9, 20X9. As of the end of the accounting period, the company owes employees $3,000 (pertaining to December 29, 30, and 31). As a result, the adjusting entry to record the accrued payroll would appear as follows:

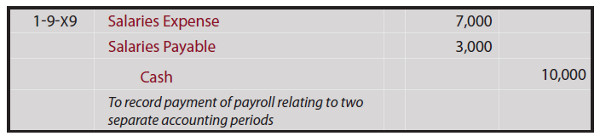

The above entry records the $3,000 of expense for services rendered by the employees to the company during year 20X8, and establishes the liability for amounts that have accumulated and will be included in the next round of paychecks. Before moving on to the next topic, you should also consider the entry that will be needed on the next payday (January 9, 20X9). Suppose the total payroll on that date is $10,000 ($3,000 relating to the prior year (20X8) and another $7,000 for an additional seven days in 20X9). The journal entry on the actual payday needs to reflect that the $10,000 is partially for the expense and partially to extinguish a previously established liability:

You should carefully note that the above process assigns the correct amount of expense to each of the affected accounting years (regardless of the moment of payment). In other words, $3,000 is expensed in 20X8 and $7,000 is expensed in 20X9.

Accrued Interest

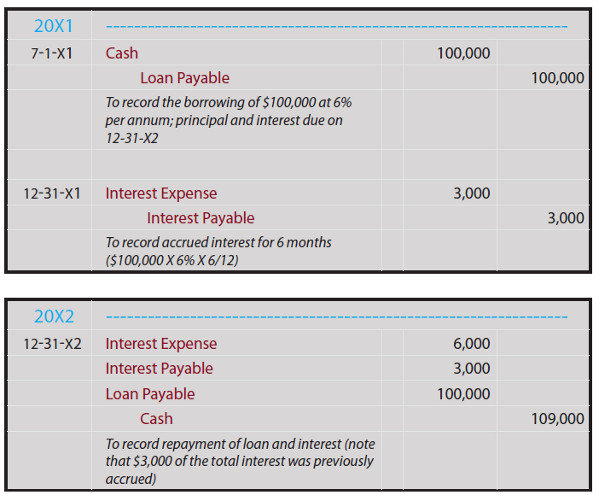

Most loans include charges for interest. Interest charges are usually based on agreed rates, such as 6% per year. The amount of interest therefore depends on the amount of the borrowing (principal), the interest rate (“rate”), and the length of the borrowing period (time). The total amount of interest on a loan is calculated as Principal X Rate X Time. For example, if $100,000 is borrowed at 6% per year for 18 months, the total interest will amount to $9,000 ($100,000 X 6% X 1.5 years). However, even if the interest is not payable until the end of the loan, it is still logical and appropriate to “accrue” the interest as time passes. This is necessary to assign the correct interest cost to each accounting period. Assume that our 18-month loan was taken out on July 1, 20X1, and was due on December 31, 20X2.

The accounting for the loan on the various dates (assume a December year-end, with an appropriate year-end adjusting entry for the accrued interest) would be as follows:

In reviewing the above entries, it is important to note that the loan benefited 20X1 for six months, hence $3,000 of the total interest was expensed in 20X1. The loan benefited 20X2 for twelve months, and twice as much interest expense was recorded in 20X2.

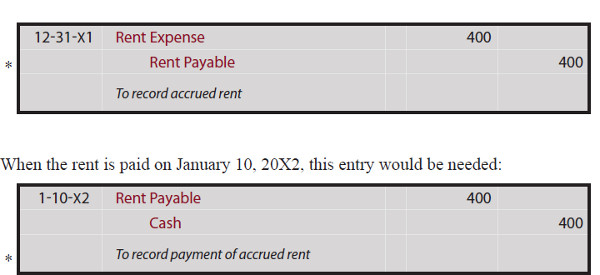

Accrued Rent

Accrued rent is the opposite of the prepaid rent discussed earlier. Recall that prepaid rent accounting related to rent that was paid in advance. In contrast, accrued rent relates to rent that has not yet been paid – but the utilization of the asset has already occurred. For example, assume that office space is leased, and the terms of the agreement stipulate that rent will be paid within 10 days after the end of each month at the rate of $400 per month. During December of 20X1, Cabul Company occupied the lease space, and the appropriate adjusting entry for December follows:

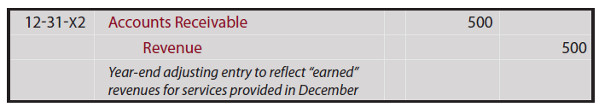

Accrued Revenue

Many businesses provide services to clients under an understanding that they will be periodically billed for the hours (or other units) of service provided. For example, an accounting firm may track hours worked on various projects for their clients. These hours are likely accumulated and billed each month, with the periodic billing occurring in the month following the month in which the service is provided. As a result, money has been earned during a month, even though it won’t be billed until the following month. Accrual accounting concepts dictate that such revenues be recorded when earned. The following entry would be needed at the end of December to accrue revenue for services rendered to date (even though the physical billing of the client may not occur until January):

Recap of Adjustments

The preceding discussion of adjustments has been presented in great detail because it is imperative to grasp the underlying income measurement principles. Perhaps the single most important element of accounting judgment is to develop an appreciation for the correct measurement of revenues and

expenses. These processes can be fairly straight-forward, as in the above illustrations. At other times, the measurements can grow very complex. A business process rarely starts and stops at the beginning and end of a month, quarter or year – yet the accounting process necessarily divides that flowing business process into measurement periods. And, the adjusting process is all about getting it right; to assign costs and revenues to each period in a proper fashion.

The Adjusted Trial Balance

Keep in mind that the trial balance introduced in the previous chapter was prepared before considering adjusting entries. Subsequent to the adjustment process, another trial balance can be prepared. This adjusted trial balance demonstrates the equality of debits and credits after recording adjusting entries. The adjusted trial balance would look the same as the trial balance, except that all accounts would be updated for the impact of each of the adjusting entries. Therefore, correct financial statements can be prepared directly from the adjusted trial balance. The next chapter looks at the adjusted trial balance in detail.

Alternative Procedures for Certain Adjustments

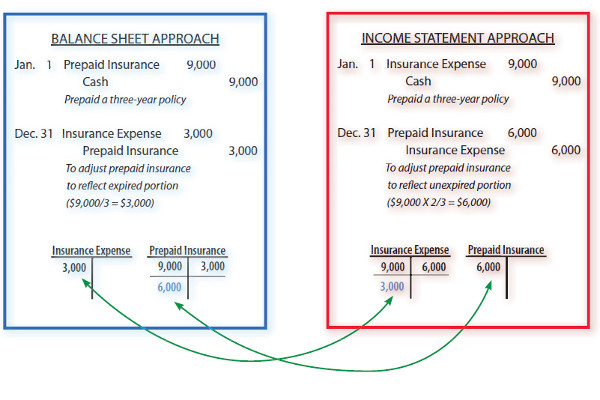

In accounting, as in life, there is often more than one approach to the same end result. The mechanics of accounting for prepaid expenses and unearned revenues can be carried out in several ways. No matter which method is employed, the resulting financial statements should be identical. As an example, recall the illustration of accounting for prepaid insurance - Prepaid Insurance was debited and Cash was credited at the time of purchase. This is referred to as a balance sheet approach because the expenditure was initially recorded into a prepaid account on the balance sheet. However, an alternative approach is the income statement approach.

With this approach, the Expense account is debited at the time of purchase. The appropriate end-of-period adjusting entry establishes the Prepaid Expense account with a debit for the amount relating to future periods. The offsetting credit reduces the expense account to an amount equal to the amount consumed during the period. Review the following comparison, noting in particular that Insurance Expense and Prepaid Insurance accounts have identical balances at December 31 under either approach:

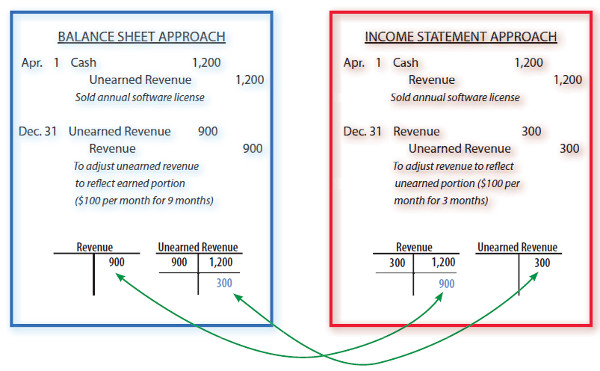

Accounting for unearned revenue can also follow a balance sheet or income statement approach. The balance sheet approach for unearned revenue was presented earlier in this article and is represented at left below. At right is the income statement approach for the same facts. Under the income statement approach, the initial receipt is recorded entirely to a Revenue account. Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase unearned revenue. As you can see, both approaches produce the same financial statements.

The balance sheet and income statement methods result in identical financial statements. Notice that the income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting period. No adjusting entry is needed because the expense or revenue was fully recorded at the date of the original transaction.

Accrual- Versus Cash- Basis Accounting

Generally accepted accounting principles (GAAP) require that a business use the accrual basis.

Under this method, revenues and expenses are recognized as earned or incurred, utilizing the various principles introduced throughout this chapter. An alternative method in use by some small businesses is the cash basis. The cash basis is not compliant with GAAP, but a small business that does not have a broad base of shareholders or creditors does not necessarily need to comply with GAAP. The cash basis is much simpler, but its financial statement results can be very misleading in the short run. Under this easy approach, revenue is recorded when cash is received (no matter when it is earned), and expenses are recognized when paid (no matter when incurred).

Modified Approaches

The cash and accrual techniques may be merged together to form a modified cash basis system. The modified cash basis results in revenue and expense recognition as cash is received and disbursed, with the exception of large cash outflows for long-lived assets (which are recorded as assets and depreciated over time). However, to repeat, proper income measurement and strict compliance with GAAP dictates use of the accrual basis; virtually all large companies use the accrual basis.

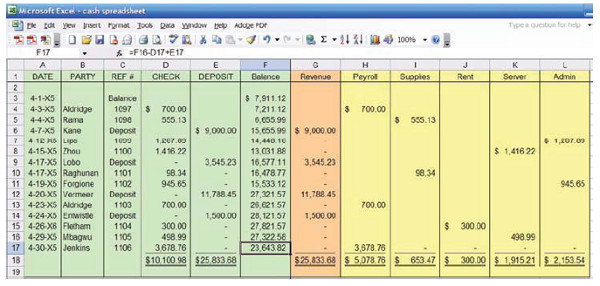

Illustration of Cash- Versus Accrual Basis of Accounting

Let’s look at an example for Ortiz Company. Ortiz provides web design services to a number of clients and has been using the cash basis of accounting. The following spreadsheet is used by Ortiz to keep up with the business’s cash receipts and payments. This type of spreadsheet is very common for a small business. The checkbook is in green, noting the date, party, check number, check amount, deposit amount, and resulting cash balance. The deposits are spread to the revenue column (shaded in tan) and the checks are spread to the appropriate expense columns (shaded in yellow). Note that total cash on hand increased by $15,732.70 (from $7,911.12 to $23,643.82) during the month.

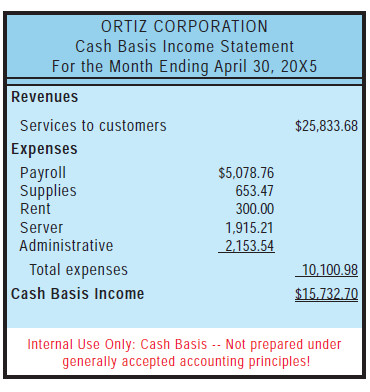

The information from this spreadsheet was used to prepare the following “cash basis” income statement for April, 20X5. The increase in cash that is evident in the spreadsheet is mirrored as the cash basis income:

Ortiz has been approached by Mega Impressions, a much larger web-hosting and design firm. Mega has offered to buy Ortiz’s business for a price equal to “100 times” the business’s monthly net

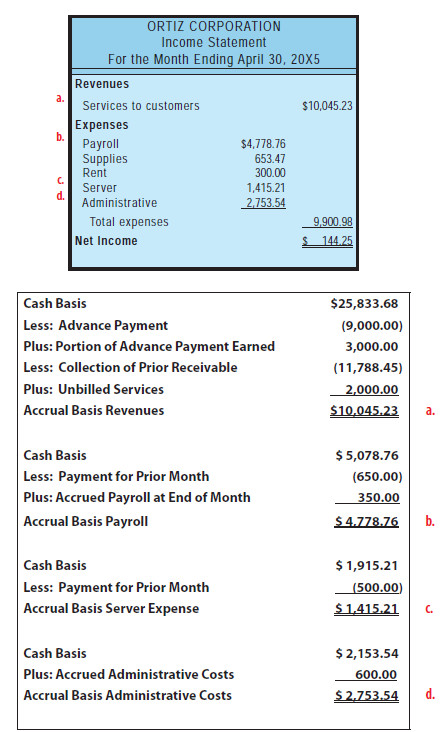

income, as determined under generally accepted accounting principles. An accounting firm has been retained to prepare Ortiz’s April income statement under the accrual basis. The following additional information is gathered in the process of preparing the GAAP-based income statement:

Revenues:

- The $9,000 deposit on April 7 was an advance payment for work to be performed equally during April, May, and June.

- The $11,788.45 deposit on April 20 was a collection of an account for which the work was performed during January and February.

- During April, services valued at $2,000 were performed and billed, but not yet collected.

Expenses:

- Payroll -- The $700 payment on April 3 related $650 to the prior month. An additional $350 is accrued by the end of April, but not paid.

- Supplies -- The amount paid corresponded to the amount used.

- Rent -- The amount paid corresponded to the amount used.

- Server -- The $1,416.22 payment on April 15 related $500 to prior month’s usage.

- Admin -- An additional $600 is accrued by the end of April, but not paid.

The accounting firm prepared the following accrual basis income statement and corresponding calculations in support of amounts found in the statement:

Although Ortiz was initially very interested in Mega’s offer, he was very disappointed with the resulting accrual-basis net income and decided to reject the deal. This illustration highlights the important differences between cash- and accrual-basis accounting. Cash basis statements are significantly influenced by the timing of receipts and payments, and can produce periodic statements that are not reflective of the actual economic activity of the business for the specific period in question.

The accrual basis does a much better job of portraying the results of operations during each time period. This is why it is very important to grasp the revenue and expense recognition concepts discussed in this chapter, along with the related adjusting entries that may be needed at the end of each accounting period.