Current Liabilities and Employer Obligations

- Details

- Category: Accounting

- Hits: 12,553

Current Liabilities

The current liabilities section of the balance sheet contains obligations that are due to be satisfied in the near term, and includes amounts relating to accounts payable, salaries, utilities, taxes, short-term loans, and so forth. This casual description is inadequate for all situations, so accountants have developed a very specific definition to deal with more issues.

Current liabilities are debts that are due to be paid within one year or the operating cycle, whichever is longer; further, such obligations will typically involve the use of current assets, the creation of another current liability, or the providing of some service. This enhanced definition is expansive enough to capture less obvious obligations pertaining to items like customer prepayments, amounts collected for and payable to third parties, the portion of long-term debt due within one year or the operating cycle (whichever is longer), accrued liabilities for expenses incurred but not yet paid, and contingent liabilities.

However, the definition is not meant to include amounts not yet “incurred.” For example, salary to be earned by employees next year is not a current liability (this year) because it has yet to be “incurred.”

The Operating Cycle

Remember that the operating cycle is the length of time it takes to turn cash back into cash. That is, a business starts with cash, buys inventory, sells goods, and eventually collects the sales proceeds in cash. The length of time it takes to do this is the operating cycle. Take careful note of how the perating cycle is included in the above definition of current liabilities:

“one year or the operating cycle, whichever is longer.”

For most businesses, the operating cycle is less than one year, but not always. A furniture manufacturer may have to buy and cure wood before it can be processed into a quality product. This could cause the operating cycle to go beyond one year. If that is the case, then current liabilities might include obligations due in more than one year.

Illustrations of Typical Current Obligations

Accounts Payable are the amounts due to suppliers relating to the purchase of goods and services. This is perhaps the simplest and most easily understood current liability. Although an account payable may be supported by a written agreement, it is more typically based on an informal working relation where credit has been received with the expectation of making payment in the very near term.

Notes Payable are formal short-term borrowings usually evidenced by a specific written promise to pay. Bank borrowings, equipment purchases, and some credit purchases from suppliers involve such instruments. The party who agrees to pay is termed the “maker” of the note. Properly constructed, a note payable becomes a negotiable instrument, enabling the holder of the note to transfer it to someone else. Notes payable typically involve interest, and their duration varies. When a note is due in less than one year (or the operating cycle, if longer), it is commonly reported as a current liability.

The Current Portion of Long-term Debt is another frequently encountered current obligation. When a note or other debt instrument is of long duration, it is reported as a long-term liability. However, the amount of principal which is to be paid within one year or the operating cycle, whichever is longer, should be separated and classified as a current liability. For example, a $100,000 long-term note may be paid in equal annual increments of $10,000, plus accrued interest. At the end of any given year, the $10,000 principal due during the following year should be reported as a current liability (along with any accrued interest), with the remaining balance shown as a long-term liability.

Accrued Liabilities (sometimes called accrued expenses) include items like accrued salaries and wages, taxes, interest, and so forth. These items relate to expenses that accumulate with the passage of time, but will be paid in one lump-sum amount. For example, the cost of employee service accrues gradually with the passage of time. The amount that employees have earned but not been paid is termed accrued salaries and should be reported as a current liability. Likewise, interest on a loan is based on the period of time the debt is outstanding; it is the passage of time that causes the interest payable to accrue. Accrued but unpaid interest is another example of an accrued current liability.

Prepayments by Customers arise from transactions such as selling magazine subscriptions in advance, selling gift-cards, selling tickets well before a scheduled event, and other similar items where the customer deposits money in advance of receiving the expected good or service.

These items represent an obligation on the part of the seller to either return the money or deliver a service in the future. As such, the prepayment is reported as “unearned revenue” within the current liability section of the balance sheet. Recall, from earlier chapters, that the unearned revenue is removed and revenue is recognized as the goods and services are provided. In some cases, customers may never redeem a gift-card. In this situation, it would generally be appropriate to derecognize the liability and record revenue once it is viewed as remote that the card will ever be redeemed and the company has no obligation to remit funds to some governmental jurisdiction (as is sometimes required by law).

Collections for Third Parties arise when the recipient of some payment is not the beneficiary of the payment. As such, the recipient has an obligation to turn the money over to another entity. At first, this may strike you as odd. But, consider sales taxes. The seller of merchandise must collect the sales tax on transactions, but then has a duty to pass those amounts along to the appropriate taxing entity. Such amounts are appropriately reflected as a current liability until the funds are remitted to the rightful owner.

Obligations to be Refinanced deserve special consideration. A long-term debt may have an upcoming maturity date within the next year. Ordinarily, this note would be moved to the current liability section. However, companies often simply renew such obligations, in essence, borrowing money to repay the maturing note. This poses an interesting question -- should currently maturing long-term debt be shown as a current or a long-term liability if it is going to be renewed by simply rolling the debt into a replacement long-term obligation? What financial statement is fair -- to show the debt as current even though it will not be a claim against current assets -- or to show the debt as long-term even though it is now due? To resolve this issue, accountants have very specific rules: a currently maturing long-term obligation is to be shown as a current liability unless (1) the company intends to renew the debt on a long-term basis, and (2) the company has the ability to do so (ordinarily evidenced by a firm agreement with a competent lender).

Notes Playable

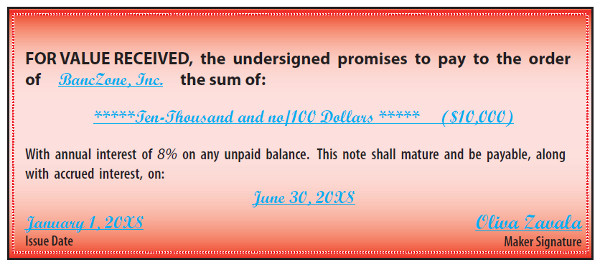

Long-term notes will be considered in the next chapter. For the moment, let’s focus on the appropriate accounting for a short-term note. A common scenario would entail the borrowing of money in exchange for the issuance of a promissory note payable. The note will look something like this:

Now, do not use my illustration above to construct a legal document for your own use; this is an abbreviated illustrative form to focus on the accounting issues. A correct legal form would typically be far more expansive and cover numerous things like what happens in the event of default, who pays legal fees if there is a dispute, requirements of demand and notice, and on and on. In the above note, Oliva has agreed to pay to Banc Zone $10,000 plus interest of $400 on June 30, 20X8. The interest represents 8% of $10,000 for half of a year.

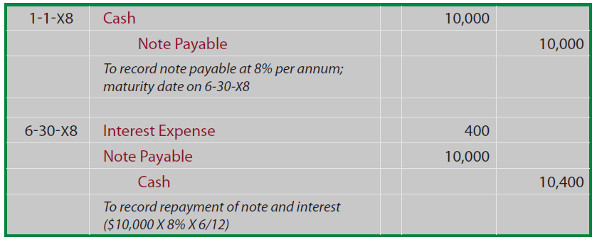

The amount borrowed is entered in the accounting records by increasing Cash (debit) and Notes Payable (credit). When the note is repaid, the difference between the carrying amount of the note and the cash necessary to repay that note is reported as interest expense. Representative journal entries for the above note follow:

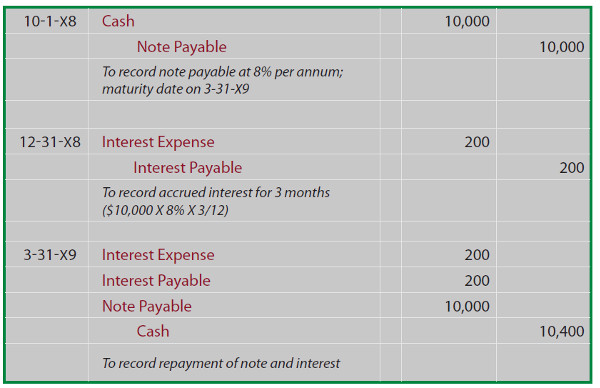

Had the above note been created on October 1, the entries would appear as follows:

In the above entries, notice that interest for three months was accrued at December 31, epresenting accumulated interest that must be paid at maturity on March 31, 20X9. On March 31, another three months of interest was charged to expense. The cash payment included $400 for interest, half relating to the amount previously accrued in 20X8 and half relating to 20X9.

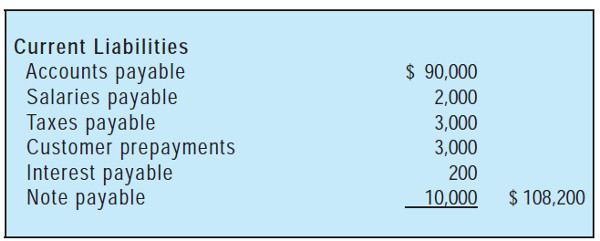

Next, let’s consider how the above amounts would appear in the current liability section of the December 31, 20X8 balance sheet. Observe the inclusion of two separate line items for the note and related interest:

In noting this illustration, you may wonder about the order for listing specific current obligations. One scheme is to list them according to their due dates, from the earliest to the latest. Another acceptable alternative is to list them by maturity value, from the largest to the smallest.

A Few Words About Interest Calculations that May Save YouSome Money

First, some short-term borrowing agreements may stipulate that a year is assumed to have 360 days, instead of the obvious 365 days. In the old days, before calculators, this could perhaps be justified to ease calculations. In modern days, the only explanation is that the lender is seeking to prey on unsuspecting borrowers. For example, interest on a $100,000, 8% loan for 180 days would be $4,000 assuming a 360-day year ($100,000 X .08 X 180/360), but only $3,945 based on the more correct 365-day year ($100,000 X .08 X 180/365). It is obvious that you should be alert to the stated assumptions intrinsic to a loan agreement.

Next, be aware of the “rule of 78s.” Some loan agreements stipulate that prepayments will be based on this tricky technique. A year has 12 months, and 12 + 11 + 10 + 9 + . . . + 1 = 78; somehow giving rise to the “rule of 78s.” Assume that $100,000 is borrowed for 12 months at 8% interest.

The annual interest is $8,000, but, if the interest attribution method is based on the “rule of 78s,” it is assumed that 12/78 of the total interest is attributable to the first month, 11/78 to the next, and so forth. If the borrower desired to prepay the loan after just two months, that borrower would be very disappointed to learn that 23/78 (12 + 11 = 23) of the total interest was due (23/78 X $8,000 = $2,359). If the interest had been based simply on 2 of 12 months, the amount of interest would come to only $1,333 (2/12 X $8,000 = $1,333).

Compounding is another concept that should be understood. So far in this text, I have assumed simple interest in the illustrated calculations. This merely means that Interest = Loan X Interest Rate X Time. But, at some point, it is fair to assume that the accumulated interest will also start to accrue interest -- some people call this “interest on the interest.” In the next chapter, this will be examined in much more detail. For the moment, just take note that a loan agreement will address this by stating the frequency of compounding -- annually, quarterly, monthly, daily, and even continuously (which requires a bit of calculus to deduce). The narrower the frequency, the greater the amount of total interest that will be calculated.

One last trick is for the lender to take their interest up front. That is, the note may be issued with interest included in the face value. For example, $9,000 may be borrowed, but a $10,000 note is established (interest is not separately stated). At maturity, $10,000 is repaid, representing a $9,000 repayment of borrowed amounts and $1,000 interest. Note that the lender may state that the interest rate is 10% ($1,000 out of $10,000), but the effective rate is much higher ($1,000 for $9,000 = 11.11% actual rate).

The journal entries for a note with interest included in face value (also known as a note issued at discount), are as follows:

As you examine the above journal entries, note that the $1,000 difference is initially recorded as a discount on notes payable (on a balance sheet, this would be reported as contra liability; i.e., a $10,000 notes payable minus a $1,000 discount, for a net liability equal to the $9,000 borrowed).

Discount amortization transfers the discount to interest expense over the life of the loan. This means that the $1,000 discount should be recorded as interest expense by debiting Interest Expense and crediting Discount on Notes Payable. In this way, the $10,000 paid at maturity (credit to Cash) can be offset with an $10,000 reduction in the Notes Payable account (debit).

Be aware that discount amortization occurs not only at the date of repayment, but also at the end of an accounting period (to record interest expense for the amount attributable to the period). If the preceding example had a maturity date at other than the December 31 year-end, the $1,000 of interest expense would need to be recorded partially in one period and partially in another.

Now, each of the above points about unique interest calculations is to alert you to devices that lenders can use to tilt the benefit of the bargain to their advantage. As a result, statutes have increasingly required fuller disclosure (“truth in lending”) and, in some cases, outright limited certain practices. The best I can tell you is to be careful, and understand the full economics of any borrowing you do. And, if you are lending, be sure to understand the laws that define fair practices and disclosures; a lender who overcharges interest or violates laws (applicable to the particular jurisdiction of the loan) can find themselves legally losing the right to collect amounts loaned. Both borrowers and lenders should be careful -- remember there is an old adage that goes “neither a borrower or lender be.” Of course, there are plenty of loans, and you will likely be a party to one someday, so be careful.

Contingent Liabilities

Some events may eventually give rise to a liability, but the timing and amount is not presently sure. Such uncertain or potential obligations are known as contingent liabilities. There are numerous examples of contingent liabilities. Legal disputes give rise to contingent liabilities, environmental contamination events give rise to contingent liabilities, product warranties give rise to contingent liabilities, and so forth. Do not confuse these “firm specific” contingent liabilities with general business risks. General business risks include the risk of war, storms, and the like which are presumed to be an unfortunate part of life for which no specific accounting can be made in advance.

Accounting for Contingent Liabilities

A subjective assessment of the probability of an unfavorable outcome is required to properly account for contingences. Rules specify that contingent liabilities should be recorded in the accounts when it is probable that the future event will occur and the amount of the liability can be reasonably estimated. This means that a loss would be recorded (debit) and a liability established (credit) in advance of the settlement. An example might be a hazardous waste spill that will require a large outlay to clean up – it is probable that funds will be spent and the amount can likely be estimated (or at least a range of the amount, in which case at least the lower end of the range is known).

On the other hand, if it is only reasonably possible that the contingent liability will become a real liability, then a note to the financial statements is all that is required. Likewise, a note is required when it is probable a loss has occurred but the amount simply cannot be estimated. There is an important lesson for you to learn from these rules: normally, accounting tends to be very conservative (when in doubt, book the liability), but this is not the case for contingent liabilities.

Therefore, you should carefully read the notes to the financial statements before you invest or loan money to a company. There are sometimes significant risks that are simply not on the liability section of the balance sheet, because the only recognized contingencies are those meeting the rather strict criteria of “probable” and “reasonably estimable.”

What about remote risks, like a frivolous lawsuit? Remote risks need not be disclosed; they are viewed as needless clutter. What about business decision risks, like deciding to reduce insurance coverage because of the high cost of the insurance premiums? GAAP is not very clear on this subject; such disclosures are not required, but are not discouraged. What about contingent assets/gains, like a company’s claim against another for patent infringement? GAAP does not permit the recognition of such amounts before settlement payments are actually received.

Timing of Events

If a customer was injured by a defective product in Year 1 (assume the company anticipates a large estimated loss from a related claim), but the company did not receive notice of the event until Year 2 (but before issuing Year 1’s financial statements), the event would nevertheless impact Year 1 financial statements. The reason is that the event (“the injury itself”) giving rise to the loss arose in Year 1. Conversely, if the injury occurred in Year 2, Year 1’s financial statements would not be adjusted no matter how bad the financial effect. However, a note to the financial statements may be needed to explain that a material adverse event arising subsequent to year end has occurred.

Warranty Costs

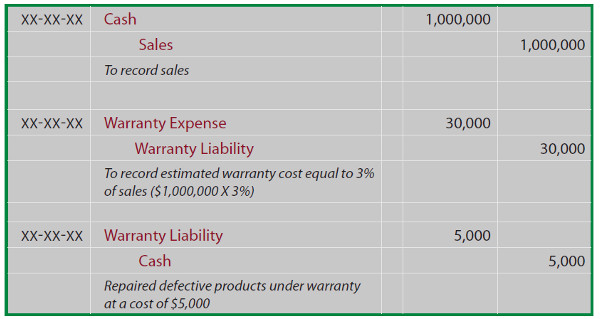

Product warranties are presumed to give rise to a probable liability that can be estimated. When goods are sold, an estimate of the amount of warranty costs to be incurred on the goods should be recorded as expense, with the offsetting credit to a Warranty Liability account. As warranty work is performed, the Warranty Liability is reduced and Cash (or other resources used) is credited. In this manner, the expense is recorded in the same period as the sale (matching principle). Following are illustrative entries for warranties. In reviewing these entries, carefully note the accompanying explanations:

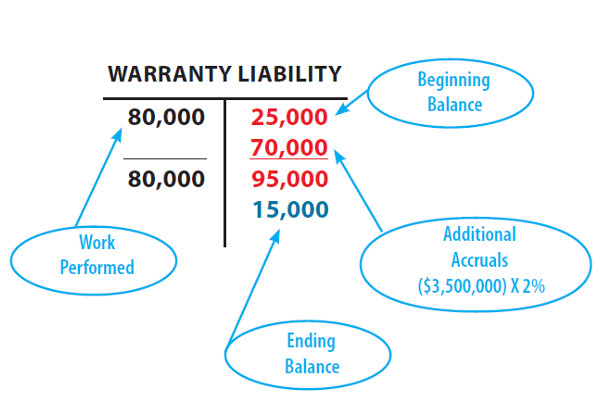

The analytics of warranty calculations require consideration of beginning balances, additional accruals, and warranty work performed. For example, assume Zeff Company had a beginning of year Warranty Liability account balance of $25,000. Zeff sells goods subject to a one-year warranty, expecting to incur warranty costs equal to 2% of sales. During the year, an additional $3,500,000 in product sales occurred and $80,000 was actually spent on warranty work. How much is the end of year Warranty Liability? The T-account reveals the logic that results in an ending warranty liability of $15,000.

Ask yourself what entries Zeff would make during the year based on these calculations. The entries will be just like those above, but for the revised amounts. The beginning warranty liability (credit balance of $25,000), plus the additional credit to Warranty Liability ($70,000), and minus the debit to Warranty Liability ($80,000) produces the ending Warranty Liability balance of $15,000.

Many other costs are similar to warranties. Companies may offer coupons, prizes, rebates, air-miles, free hotel stays, free rentals, and similar items associated with sales activity. Each of these gives rise to the need to provide an estimated liability. While the details may very, the basic procedures and outcomes are similar to those applied to warranties.

Payroll

For most businesses, payroll is perhaps the most significant cost of doing business. And, correctly planning for and managing these costs is enormously important to a business. Employees don’t tend to stay long if a payday is missed, so payroll is truly the life’s blood of the business.

Before looking at the special issues pertaining to payroll accounting, you should first understand who is an “employee.” Many services are provided to a business by other than employees. These services may include janitorial support, legal services, air conditioner repairs, audits, and so forth.

An employee is defined as a person who works for a specific business and whose activities are directed by that business -- the business controls what will be done and how it will be done. In contrast, an independent contractor is one who performs a designated task or service for a company – the company has the right to control or direct only the result of the work done by an independent contractor. The distinction is very important because the payroll tax and record keeping requirements differ for employees and independent contractors.

As a general rule, amounts paid to independent contractors do not involve any “tax withholdings” by the payer; however, the payer may need to report the amount paid to the Internal Revenue Service (IRS) on a Form 1099, with a copy to the independent contractor. But, the obligation for paying taxes rests with the independent contractor.

The employer’s handling of payroll to employees is another matter entirely. Let us begin by considering the specifics of a paycheck. You may have some work experience, and if you do, you know that the amount you receive is not the amount you have earned. Your check was likely reduced by a variety of taxes, possibly including federal income tax, state income tax, and FICA (social security taxes and medicare/medicaid). Additionally, your check might have been reduced for insurance costs, retirement savings, charitable contributions, special health and child care deferrals, and other similar items. Before you feel singled out, you also need to know that your employer paid additional FICA contributions on your behalf, unemployment taxes, and maybe insurance costs, workers compensation costs, matching contributions to retirement programs, and other items. A business must correctly account for all of this activity.

Gross Earnings

The total earnings of an employee is the “gross pay.” For hourly employees, it is the number of hours worked multiplied by the hourly rate. For salaried employees, it is the flat amount for the period, such as $3,000 per month. Gross pay might be increased for both hourly and salaried employees based on applicable overtime rules. Employers are well advised to monitor statutes relating to overtime; by law, certain employees must be paid for overtime.

Net Earnings

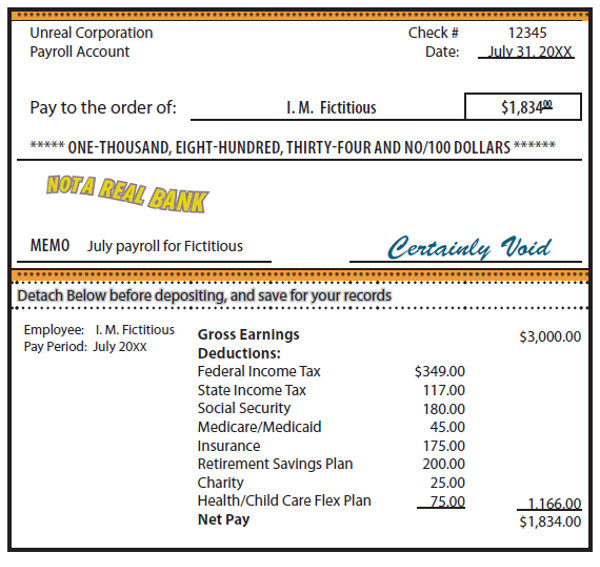

Gross earnings less all applicable deductions is the “net pay.” Let’s examine a representative paycheck, and the attached stub, as shown on the next page:

You will notice that I. M. Fictitious earned $3,000 during the month, but “took home” only $1,834. The difference was withheld by Unreal Corporation. The withholdings pertained to:

Income taxes -- Employers are required to withhold federal, state (when applicable), and city (when applicable) income taxes from an employee’s pay. The withheld amounts must be remitted periodically to the government by the employer. In essence, the employer becomes an agent of the government, serving to collect amounts for the government.

Withheld amounts that have yet to be remitted to the government are carried as a current liability on the employer’s books (recall the earlier mention of amounts collected for third parties). The level of withholdings are based on the employee’s level of income, the frequency of pay, marital status, and the number of withholding allowances claimed (based on the number of dependents). Employees claim withholding allowances by filing a form W-4 with their employer.

It is very important for you to know that the employer’s obligation to protect withheld taxes and make certain they are timely remitted to the government is taken very seriously. Employers who fail to do so are subject to harsh penalties for the obvious reason that the funds do not belong to the employer. Likewise, employees who participate in, or are aware of misapplication of such funds can expect serious legal repercussions.

You should never be a part of such an activity. The government has made it very simple for employers to remit withheld amounts, as most commercial banks are approved to accept such amounts from employers. Further, there are online systems that allow easy funds transfer. The frequency of the required remittance is dependent upon the size of the employer and the total payroll. Social Security/Medicare Taxes are also known as “FICA.” FICA stands for Federal Insurance Contributions Act.

This Act establishes a tax that transfers money from workers to aged retirees (and certain other persons who are in the unfortunate position of not being able to fully provide for themselves due to disability, loss of a parent, or other serious problem). The social purpose of the tax is to provide a modest income stream to the beneficiaries. This component is the social security tax. Another component of the Act is the medicare/medicaid tax, which provides support for health care costs incurred by retirees (and designated others). You are perhaps aware that these taxes present an actuarial problem, as the aged population is growing relative to the number of workers. And, the tax is a transfer of money from one group to another, rather than being based upon an established insurance-like fund.

The social security tax is presently a designated percentage of income, up to a certain maximum level of annual income per employee. After the maximum is reached, no further amounts are due for that year for that employee. The history of both the rate and maximum level is one of consistent increases over time. For illustrative purposes, I am assuming a 6% social security tax, on an annual income of $100,000.

In the above pay stub, you will note that I. M. Fictitious paid $180 in social security tax for the month (6% X $3,000). Since Fictitious has not yet exceeded $100,000 in gross income for the year-to-date, the annual maximum has not been reached. Once Fictitious exceeds the annual limit (for most employees that never occurs), the tax would cease to be withheld -- only to resume anew in January of the following year. If this tax seems high, you need to know that the employee’s amount must be matched by the employer.

Thus, the burden associated with this tax is actually twice what is apparent to most employees. The medicare/medicaid tax is also a designated percentage of income. Unlike the social security tax, there is no annual maximum. This tax is levied on every dollar of gross income, without regard to the employees total earnings. I have assumed a 1.5% rate in the above illustration (1.5% X $3,000 = $45). This is another tax the employer must match dollar-for-dollar.

Other Employee Deductions typically occur for employee cost sharing in health care insurance programs, employee contributions to various retirement or other savings plans, charitable contributions, contributions to tax-advantaged health and child care savings programs (“flex accounts”), and so forth. In each case, the employer is acting to collect amounts from the employee, with a resultant fiduciary duty to turn the monies over to another entity.

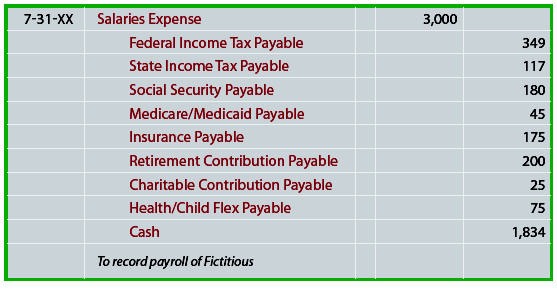

The Journal Entry for Payroll

I.M. Fictitious’ pay would be recorded as follows:

Although not illustrated, as the company remits the withheld amounts to the appropriate entities (i.e., turns the taxes over to the government, retirement contributions to an investment trust, etc.), it would debit the related payable and credit cash.

Employer Payroll Taxes and Contributions

Recall from above, that social security and medicare/medicaid tax amounts must be matched by employers.In addition, the employer must pay federal and state unemployment taxes. These taxes are levied to provide funds that are paid to workers who are temporarily unable to find employment. The bulk of unemployment tax is usually levied at the state level since most states choose to administer their own unemployment programs (which is encouraged by the federal government via a system of credits to the federal tax rate).

The specific rates will depend on the particular state of employment, and each individual employer’s history. Employers who rarely release employees get a favorable rate (since they don’t contribute to unemployment problems), but those who do not maintain a stable labor pool will find their rates going higher. Like social security, the unemployment tax stops each year once a certain maximum income level is reached. In this text, I will assume the federal rate is one-half of one percent (0.5%), and the state rate is three percent (3%), on a maximum income of $10,000. Thus, I assume the federal unemployment tax (FUTA) is capped at $50 per employee and the state unemployment tax (SUTA) is capped at $300.

Many employers will carry workers’ compensation insurance. The rules about this type of insurance vary from state to state. Generally, this type of insurance provides for payments to workers who sustain on-the-job injuries, and shields the employer from additional claims. But, for companies that do not carry such insurance, the employer has an unlimited exposure to claims related to work place injuries. Nevertheless, the cost of this insurance can be very high (for risky work, like construction), and some employers don’t carry such policies. Please be advised that these are very general statements; if you have specific questions about the rules in your state, you should consult appropriate counsel and not rely on this generalization.

Many employers will provide health care insurance and retirement plan contributions. These amounts can often be substantial, perhaps even exceeding the amounts contributed by employees on their own behalf.

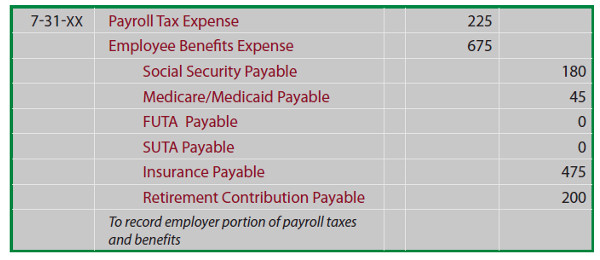

As you can see, the employer’s cost of an employee goes well beyond the amount reported on the pay check. For many companies, the total cost of an employee can be 125% to 150% of the gross earnings. Of course, these added costs also need to be entered in the accounting records. Below is the entry for I. M. Fictitious:

In preparing this entry it was assumed that (a) FUTA and SUTA bases had already been exceeded earlier in 20XX (hence the related amounts are zero), (b) the employer exactly matched employee contributions to insurance and retirement programs, and (c) the employer incurred workers’ compensation insurance of $300 (bringing total insurance to $475 ($175 + $300)). Note that additional accounts could be used to separate employee benefits expense into more specific sub components (like insurance expense, retirement plan expense, etc.).

Annual Reports

Each employee and the Internal Revenue Service is to receive an annual statement regarding compensation. Shortly after the conclusion of a calendar year, an employer must review their employee records and prepare a summary wage and tax statement (commonly called a W-2). This information helps employees accurately prepare their own annual federal and state income tax returns, and allows the government to verify amounts reported by those individual taxpayers.

Accurate Payroll Systems

As you can tell, accuracy is vital in payroll accounting. Oftentimes, a business may hire an outside firm that specializes in payroll management and accounting. The business then need only provide the outside firm with information about time worked by each employee (and of course the money to cover the gross payroll). The outside firm manages the rest -- providing individual paychecks/deposits, payroll recordkeeping, government compliance reporting, timely processing of tax deposits, and the like. For many businesses, being relieved of the burden of payroll processing is a great relief and allows them to focus on their product and customer.

But, when a business manages its own payroll, very accurate data must be maintained. Most firms will set up a separate payroll journal or data base that tracks information about each employee, as well as in the aggregate. In addition, it is quite common to open a separate payroll bank account into which the gross pay is transferred and from which paychecks and tax payments are disbursed. This system provides an added control to make sure that employee funds are properly maintained, processed, and reconciled.

Other Components of Employee Compensation

Paid vacations are another element of compensation that many employees receive. In addition to paid vacations, employers may provide for other periods of “compensated absences.” Examples include paid sick leave, holidays, family emergency time, “comp time” (payback for working overtime), birthdays, jury duty time, military reserve time, and so forth. Sometimes, these benefits accumulate with the passage of time, so that the benefit is a function of tenure with the company. To illustrate, a company may stipulate that one half-day of sick leave and one day of vacation time is accrued for each month of employment.

Because the cost of periods of compensated absence can become quite significant, it is imperative that such amounts be correctly measured and reported. Accounting rules provide that companies expense (debit) and provide a liability (credit) for such accumulated costs when specified conditions are present. Those conditions are that the accumulated benefit (1) relates to services already rendered, (2) is a right that vests or accumulates, (3) is probable to be paid to the employee, and (4) can be reasonably estimated (note that the last two conditions -- probable and reasonably estimable – are purloined from the contingency rules discussed earlier).

Vacation pay typically meets these conditions for accrual, while other costs may or may not depending upon the individual company’s policies and history. The bottom line here, is that a company will expense the cost of periods of compensated absence as those benefits are earned by the employee (another example of the matching principle); when the employee receives their pay during their time off, the attendant liability will then be reduced.

Pension Plans

It is common for a company to offer some form of retirement plan for its employees. These were touched upon in the above illustrated entries. But, more needs to be said about such plans. First, I must point out that this is a very complex area of accounting. Most intermediate textbooks will devote a full chapter to this subject alone, and reducing the discussion to a few paragraphs is a daunting challenge for any author. Let me begin by noting that there are two broad types of pensions -- defined contribution plans and defined benefit plans.

With a defined contribution plan, an employer promises to make a periodic contribution (usually a set percentage of the employee’s salary with some matching portion also put up by the employee) into a separate pension fund account. After a minimum vesting period, the funds become the property of the employee for their benefit once they enter retirement. Prior to withdrawal, the funds might be invested in stocks, bonds, or other approved investments. The employee will receive the full benefit of the funds and the investment returns, usually withdrawing them gradually after retirement. With defined contribution type plans, there will be winners and losers. If such funds are invested well for long periods, they can grow to substantial sums and employees can enjoy great retirement benefits. On the other hand, some persons will be disappointed when the investment performance of their fund fails to meet target performance standards.

For the employer, defined contribution plans offer an important desirable feature: the employer’s obligation is known and fixed. Risk is transferred to the employee. Further, the employer ordinarily gets a tax deduction for its contribution, even though the employee does not recognize that contribution as taxable income until amounts are withdrawn from the pension many years later. Another aspect of defined benefit plans is that the accounting is straight-forward. The company merely expenses the required periodic contribution as incurred. Thus the company expenses the retirement plan payment (like in the journal entries above), and no further accounting on the corporate books is necessitated. The pension assets and obligations are effectively transferred to a separate pension trust, greatly simplifying the recordkeeping of the employer.

In stark contrast are the defined benefit plans. With these plans the employer’s promise becomes more elaborate, and its cost far more uncertain. For example, the company may agree to make annual pension payments equal to 2% (for each year of service) times the average annual salary during the last three years of employment. So, a person who works 30 years and then retires, may be eligible for continuing pay at 60% of their average salary during the last years of employment. Obviously, these plans are fraught with uncertainty. How long will retirees live and draw benefits, how many years will employees work, how much will their salary be, and so on?

Accountants typically rely on actuaries (persons trained and skilled to make assessments about life expectancy and related work force trends) to come up with certain core estimates. Then, those estimates are leveraged into an elaborate accounting model that attempts to produce an estimated annual expense for the eventual pension cost. Some or all of that estimate is funded each year by a transfer of money into a pension trust fund. Those funds are invested and eventually disbursed to retirees, but the company remains obligated for any shortfalls in the pension trust.

On the corporate books, you will find the amount of expense attributed to each year (remember, this amount is only an estimate of actual cost since the true cost will not be known for many years to come). Beyond that, if a company has failed to fund all the amounts expensed to date, or if the pension fund is “underfunded” relative to outstanding pension promises made, a pension liability is reported on its balance sheet. But, the bulk of the pension assets and obligations are carried on the books of the separate pension trust fund.

There has been a clear trend in recent years away from defined benefit plans and toward defined contribution plans. Contributing factors have been to reduce corporate risk, simplify corporate accounting, provide benefits more suitable for transitory work forces, and satisfy workers who perceive that their own investment returns generated via defined contribution plans will produce a better retirement.

Other Post Retirement Benefits

Some companies provide items like health care coverage, prescriptions, and life insurance. It is not uncommon for an employee to continue to enjoy such benefits after retirement. However, because the employee is no longer working for the company, it is imperative that corporate cost of such benefits be expensed during the period of time during which the employee is actively working for the company and helping it to produce revenues.

Again, the matching idea comes into play, where we must expense costs to match the revenue they help to produce. As a result, companies will expense the estimated cost of post retirement benefits over many years, creating an offsetting liability. In later years, as the cost of post retirement benefits is paid out, the liability is accordingly reduced.

(Note: as with pensions, portions of the liability may appear in the current liability section of the balance sheet, and portions in the long-term section).