Sources of Loans and Credit

- Detalii

- Categorie: Economics

- Accesări: 9,621

There are two major types of credit—using credit cards and borrowing directly from a financial institution. Although they differ in their services, they all charge interest on the funds they lend. In this section, you’ll learn about financial institutions, charge accounts, and credit cards—and why you should be aware of the high interest rates they sometimes charge.

Types of Financial Institutions

Financial institutions borrow funds at one interest rate and lend it at a higher rate.

Economics & You Chances are, you will have to take out a loan in the future, whether to pay for college, buy a car, or purchase a home. From whom should you borrow? Read on to learn about the different types of financial institutions available to consumers.

Once you have decided to take out a loan, you should first comparison shop. To gather information about borrower requirements, interest rates, and payment schedules, check various lending agencies in person, over the phone, or at their Web sites.

Commercial Banks

The first place you might think to go for a loan is a commercial bank. Commercial banks today control the largest amount of funds and offer the widest range of services. These services include offering checking and savings accounts and loans to individuals. They also transfer funds among banks, individuals, and businesses.

Savings and Loan Associations

A savings and loan association (S&L), like a commercial bank, accepts deposits and lends funds. S&Ls make many mortgage loans to families. They also finance commercial mortgages and auto loans. Their interest rates for loans are often slightly less than those for commercial banks.

Savings Banks

Savings banks were first set up to serve the small savers who were overlooked by the large commercial banks. Most savings banks, like S&Ls, lend funds for home mortgages, along with personal and auto loans. Since 1980, savings banks, like commercial banks, have also been able to offer services similar to checking accounts.

Commercial Banking

At some point, you have probably been inside a commercial bank, one of the most popular of the common financial institutions for consumers.

Credit Unions

Union members and employees of many companies often have a credit union. A credit union is owned and operated by its members to provide savings accounts and low-interest loans only to its members. Credit unions primarily make personal, auto, and home improvement loans, although larger credit unions offer home mortgages as well. In general, credit unions offer higher interest rates on savings and charge lower interest rates on loans than other financial institutions.

Finance Companies

A finance company takes over contracts for installment debts from stores and adds a fee for collecting the debt. The consumer pays the fee in the form of slightly higher interest than he or she would pay to the retailer. Retailers use this method to avoid the risks involved in lending money to consumers. A consumer finance company makes loans directly to consumers at relatively high rates of interest—often as much as 15 percent a year or more. The people who use consumer finance companies are usually unable to borrow from other sources with lower rates because they have not repaid loans in the past or have an uneven employment record.

Borrower Beware

One type of consumer finance company specializes in “payroll advances.” In a payroll advance, almost anyone who can prove he or she has a steady job can get a small loan, with the understanding that the loan will be paid back on the next payday. The catch, however, is that these institutions charge very high fees for such advances—sometimes as much as 30% of the paycheck itself. People can get into trouble using such a system, as they may get trapped in a spiral of debt, borrowing again and again and paying out more and more in fees each time. Eventually, they might wind up owing an entire paycheck in fees alone!

Charge Accounts and Credit Cards

Charge accounts and credit cards extend credit directly to an individual or business.

Economics & You Do you own a credit card? Does having such a card affect your spending habits? Read on to learn more about this type of direct credit.

A second major type of credit is extended directly to an individual or business, without that person or business having first to borrow any funds. This credit may be in the form of a charge account or a credit card.

Charge Accounts

A charge account allows a customer to buy goods or services from a particular company and pay for them later. Department stores generally offer three main types of charge accounts. A regular charge account, also known as a 30-day charge, has a credit limit, or a maximum amount of goods or services a person or business can buy on the promise to pay in the future. At the end of every 30-day period, the store sends a bill for the entire amount. No interest is charged if the entire bill is paid at that time. If it is not, interest is charged on the unpaid amount, often at a high interest rate.

A revolving charge account allows you to make additional purchases from the same store even if you have not paid the previous month’s bill in full. Usually you must pay a certain portion of your balance each month. Interest is charged on the amount you do not pay. Of course, if you pay everything you owe each month, no interest is charged. This type of account also has a credit limit.

Major items such as sofas, televisions, and refrigerators are often purchased through an installment charge account. The items are purchased and paid for through equal payments spread over a period of time. Part of the amount paid each month is applied to the interest, and part is applied to the principal. This continues until the item is paid in full.

Other Charge Options

Sometimes you will hear stores offering special deals, such as “90 Days Same as Cash.” This means that the store will give you longer than the usual 30-day period to pay off a bill—in this case, 90 days—without charging interest. Often, though, if a person fails to pay the balance within the extended time period, the store will charge a higher interest rate than usual.

Credit Cards

A credit card, like a charge account, allows a person to make purchases without paying cash. The difference is that credit cards can be used at many kinds of stores, restaurants, hotels, and other businesses throughout the United States and even foreign countries. Visa, MasterCard, and others issue cards through banks. These cards can be used to purchase items in stores that accept them, or they may be used to borrow funds up to a certain limit. This gives consumers access to loans at all times without having to apply for them. There is another method of payment known as a debit card.

Although debit cards look like credit cards, they do not provide a loan or extend credit. See Exhibit 4.4 below for more information on debit cards.

Exhibit 4.4 Debit Cards

Debit cards make cashless purchases easier by letting customers transfer funds electronically from their bank accounts directly to stores, restaurants, gas stations—almost anywhere transactions take place. Debit cards were first available in the 1970s, but they did not catch on with the public until the 1990s. By 2006, debit cards had become a more popular payment method than checks. Remember when using a debit card that it is not the same as a credit card. The funds will be taken directly from your checking account, usually within 72 hours. Debit cards do not provide loans or credit.

- Using a Debit Card When you use a debit card in a store, the card reader will usually ask you to select “debit” or “credit.”

- Selecting “Debit” If you select “debit,” you will need to type in a PIN number. You will not have to provide a signature, and from many stores, you can get cash back from your account when you use this payment method.

- Selecting “Credit” Remember that if you select “credit,” the money will still come directly out of your account. By selecting credit, you usually do not need to type in a personal identification number (PIN). Instead, you will sign a receipt.

Finance Charges and Annual Percentage Rates

The cost of credit can be expressed as a finance charge or as an annual percentage rate.

Economics & You Do you think that lenders should be allowed to charge fees to customers who use credit, in addition to what the customer originally paid for the item? Why or why not? Read on to learn about the cost of credit.

The terms finance charge and annual percentage rate tell the consumer the same thing—the cost of credit. Each, however, is expressed in a different way.

Finance Charges

The finance charge is the cost of credit expressed in dollars and cents. It must take into account interest costs plus any other charges connected with credit. For example, yearly membership fees for the use of a credit card are included in the finance charge.

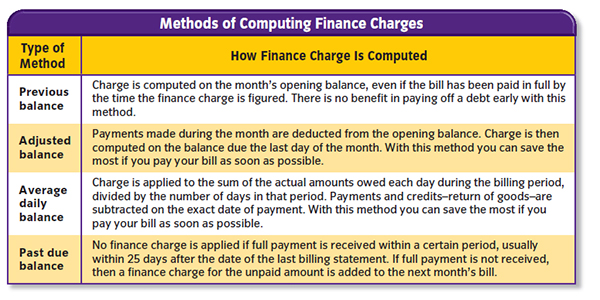

The way finance charges are computed is an important factor in determining the cost of credit. Store charge accounts and credit cards use one of four methods to determine how much people will pay for credit: previous balance, average daily balance, adjusted balance, or past due balance. Each method applies the interest rate to an account’s balance at a different point during the month. The different methods can result in widely varying finance charges. In order to determine which method is used, you may have to call or write to the credit issuer.

Annual Percentage Rates

The annual percentage rate (APR) is the cost of credit expressed as a yearly percentage. Like the finance charge, the APR must take into account any non interest costs of credit, such as a membership fee.

Knowing which creditor is charging the most for credit would be very difficult without some guide for comparison. The APR provides that guide by allowing consumers to compare costs regardless of the dollar amount of those costs or the length of the credit agreement. Suppose creditor A is charging an APR of 16 percent, while creditor B is charging 17 percent, and creditor C is charging 18½ percent. On a yearly basis, creditor C is charging the most for credit and creditor A the least.

Credit Card Trade-Off

Using credit cards is convenient but costly. Stores must pay a percentage of credit purchases to the company that issued the card. This cost is then included in the prices stores charge customers.

- commercial bank: bank whose main functions are to accept deposits, lend funds, and transfer funds among banks, individuals, and businesses

- savings and loan association (S&L): depository institution that accepts deposits and lends funds

- savings bank: depository institution originally set up to serve small savers overlooked by commercial banks

- credit union: depository institution owned and operated by its members to provide savings accounts and

low-interest loans only to its members

- finance company: company that takes over contracts for installment debts from stores and adds a fee for collecting the debt; a consumer finance company makes loans directly to consumers at high rates of interest

- charge account: credit extended to a consumer allowing the consumer to buy goods or services from a particular company and to pay for them later

- credit card: credit device that allows a person to make purchases at many kinds of stores, restaurants, and other businesses without paying cash

- finance charge: cost of credit expressed monthly in dollars and cents

- annual percentage rate (APR): cost of credit expressed as a yearly percentage