Why Save?

- Details

- Category: Economics

- Hits: 8,557

If you have a part-time job, you may already be saving some of your income for a future use, such as buying the latest gaming system or continuing your education. Don’t be discouraged if you can save only a small amount, as saving something is better than saving nothing.

IAs you read this section, you’ll learn why saving is important to you and the economy as a whole.

Deciding to Save

Savings consist of income set aside for future use.

Economics & You Think of a time you wanted something that you couldn’t afford. Did you save to buy it? Read on to learn about the benefits of saving.

Economists define saving as the setting aside of income for a period of time so that it can be used later. Any saving that you do now may be only for purchases that require more funds than you have at one time. When you are self-supporting and have more responsibilities, you will probably save for other reasons.

When an individual saves, the economy as a whole benefits.

Saving provides funds for others to invest or spend. Saving also allows businesses to expand, which provides increased income for consumers and raises the standard of living.

Generally, when people think of saving, they think of putting their funds in a savings bank or other financial institution where it will earn interest. Interest is the payment people receive when they lend funds, or allow someone else to use their funds. A person receives interest on a savings plan for as long as funds are in the account.

You have many options regarding places in which to put your savings. As you learned in Chapter 4, the most common places are commercial banks, savings and loan associations, savings banks, and credit unions. In shopping for the best savings plan, you need to consider the trade-offs. Some savings plans allow immediate access to your funds but pay a low rate of interest. Others pay higher interest and allow immediate use of your funds, but require a large minimum balance.

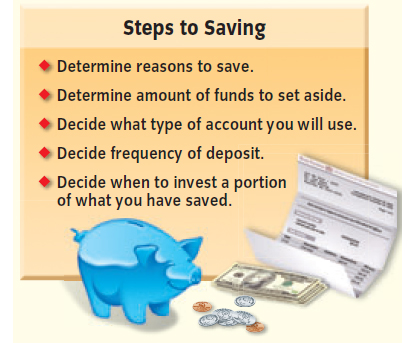

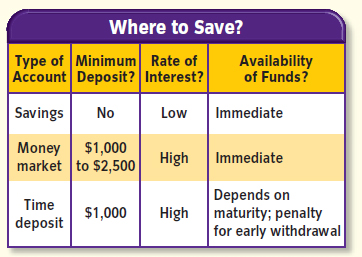

Figure 6.1 Savings Basics

Saving money can be difficult, but if you come up with a plan and stick with it, your overall financial situation will improve.

- How to Save Following the steps listed here will start you on the road to saving.

- Where to Save You have several choices about the type of savings account to open first.

Savings Accounts and Time Deposits

Savings accounts and time deposits offer a variety of maturities and are insured by agencies of the federal government.

Economics & You Where do you keep what you save? At home, or in a bank? Read on to learn about the different types of saving plans available to you.

Figure 6.1 above outlines several options for saving. A basic savings account is an interest-earning account that has no set maturity. Funds from such accounts can be withdrawn at any time without penalty to the account owner.

A money market deposit account (MMDA) is another type of account that pays relatively high rates of interest and allows immediate access to one’s funds through checks. The trade-off is that these accounts have a $1,000 to $2,500 minimum balance requirement. Customers can usually make withdrawals from a money market account in person at any time, but they are allowed to write only a few checks a month against the account.

Time Deposits

The term time deposits refers to a wide variety of savings plans that require a saver to deposit his or her funds for a certain period of time. The period of time is called the maturity, and it may vary from seven days to eight years or more. Time deposits are often called certificates of deposit (CDs), or savings certificates. CDs state the amount of the deposit, the length of time until maturity is reached, and the rate of interest being paid.

Time deposits offer higher interest rates than regular savings accounts. (See Figure 6.2 below.) The longer the maturity, the higher the interest rate that is paid. For example, a CD with a short-term maturity of 90 days pays less interest than a CD with a 2-year maturity. Savers who cash a time deposit before maturity pay a penalty.

Insuring Deposits

When the stock market collapsed in 1929, the resulting financial crisis wiped out many people’s entire savings. Congress passed, and President Franklin Roosevelt signed, legislation to protect many types of deposits.

This legislation created the Federal Deposit Insurance Corporation (FDIC). In addition to savings accounts, money market deposit accounts, and CDs, the FDIC also protects funds in regular checking accounts.

Figure 6.2 Savings Choices

While a regular savings account allows you ready access to your funds, a time deposit, such as a CD, earns more interest income. If you have funds that you will not need for a while, you should choose a time deposit, as it will pay you more in the long run.

Today there are several federal agencies that insure most banks and savings institutions. The major one besides the FDIC is the National Credit Union Association (NCUA). Through these federal agencies, each depositor’s funds in a particular savings institution are insured up to $100,000. If an insured institution fails, each depositor will be paid the full amount of his or her savings up to $100,000 for each legally separate account.

Federal deposit insurance has started to change with the times. Beginning on January 1, 2011, the $100,000 deposit insurance limit will be adjusted by the amount of inflation that occurred over the previous five years. Also, some special retirement accounts now have a limit of $250,000.

Savings Convenience

Although regular savings accounts have a relatively low interest rate, they also provide easy and convenient access to your funds.

- saving: setting aside income for a period of time so that it can be used later

- savings account: the account that pays interest, has no maturity date, and from which funds can be withdrawn at any time without penalty

- money market deposit account: the account that pays relatively high rates of interest, requires a minimum balance, and allows immediate access to funds

- time deposits: savings plans that require savers to leave their funds on deposit for certain periods of time

- maturity: period of time at the end of which time deposits will pay a stated rate of interest

- certificates of deposit: time deposits that state the amount of the deposit, maturity, and rate of interest being paid