Consumer price index

- Details

- Category: Economics

- Hits: 5,447

The Consumer Price Index (CPI) is one of the most critical economic indicators used worldwide to measure inflation, track price changes, and assess the cost of living. It is used by policymakers, businesses, and consumers to make informed economic decisions. Over the past 15 years, the CPI has experienced fluctuations influenced by economic crises, market disruptions, and policy shifts.

This article provides an in-depth understanding of the Consumer Price Index, how it is calculated, and a detailed analysis of its trends from 2010 to 2025.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is an economic metric that tracks the average change in prices paid by consumers for goods and services over time. It serves as a key gauge of inflation and is used by governments and businesses to adjust wages, benefits, and monetary policies.

CPI is expressed as an index number, with a base year set at 100. A rise in CPI indicates inflation, meaning prices are increasing, while a decline suggests deflation.

How is the Consumer Price Index Calculated?

The calculation of CPI involves several steps:

-

Selecting the Basket of Goods and Services:

-

The basket includes essential consumer items such as food, housing, transportation, healthcare, education, and entertainment.

-

The composition of the basket is periodically updated to reflect changes in consumer behavior.

-

-

Collecting Price Data:

-

Government agencies, like the U.S. Bureau of Labor Statistics (BLS), gather price data from thousands of retail stores, service providers, and online platforms.

-

-

Weighting Items in the Basket:

-

Each category is assigned a weight based on consumer spending patterns. For example, housing typically has a higher weight than entertainment.

-

-

Calculating the Index:

-

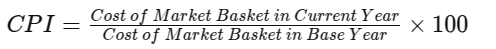

The formula used is:

-

-

Adjustments and Seasonal Variations:

-

CPI values are adjusted for seasonal changes and inflationary trends to provide an accurate reflection of price movement.

-

CPI Trends and Analysis Over the Last 15 Years (2010 - 2025)

The CPI trends from 2010 to 2025 have been shaped by several economic events, including financial crises, pandemics, and policy changes. Below is a detailed breakdown:

2010 - 2015: Post-Recession Recovery

-

The global economy was recovering from the 2008 financial crisis.

-

CPI growth remained moderate, with inflation rates averaging 1.5% - 2% annually.

-

Low interest rates encouraged economic growth, keeping consumer prices relatively stable.

2016 - 2019: Period of Economic Expansion

-

The economy showed steady growth, with GDP increasing and unemployment rates declining.

-

CPI inflation hovered around 2% - 2.5% due to strong consumer demand and stable energy prices.

-

Federal Reserve policies focused on maintaining stable inflation and economic expansion.

2020 - 2021: COVID-19 Pandemic and Economic Disruptions

-

The pandemic led to drastic price fluctuations, with initial deflation due to decreased demand.

-

Supply chain disruptions and government stimulus packages led to increased inflation by late 2020.

-

CPI surged beyond 4% in 2021 due to pent-up demand, supply shortages, and increased production costs.

2022 - 2023: Inflation Surge and Policy Interventions

-

Inflation peaked in mid-2022, with CPI increasing at an alarming rate of 7% - 8% year-over-year.

-

Energy prices, labor shortages, and supply chain constraints contributed to rapid price hikes.

-

Central banks responded with aggressive interest rate hikes to curb inflation.

-

By late 2023, inflationary pressures started to ease, bringing CPI growth down to 3.5%.

2024 - 2025: Stabilization and Economic Adjustment

-

As monetary policies took effect, inflation rates slowed, stabilizing at around 2.8% by early 2025.

-

Wage growth and cost-of-living adjustments helped balance purchasing power.

-

CPI data indicated a cooling trend in inflation, leading to economic normalization.

Impact of CPI Fluctuations

1. On Consumers

-

Higher CPI means increased costs for goods and services, reducing purchasing power.

-

Inflation-adjusted wages determine whether consumers can maintain their standard of living.

-

Social security benefits and pension plans adjust according to CPI changes.

2. On Businesses

-

Companies adjust prices, wages, and production costs based on CPI trends.

-

High inflation can lead to increased operating costs and reduced profit margins.

-

Business planning and investment strategies are influenced by CPI projections.

3. On Government and Monetary Policy

-

Central banks use CPI data to adjust interest rates and control inflation.

-

Fiscal policies, such as tax adjustments and subsidies, are based on CPI trends.

-

Government programs (e.g., food stamps, housing assistance) adjust to CPI changes to maintain support levels.

CPI vs. Other Inflation Indicators

While CPI is the most commonly used measure of inflation, other indicators provide additional insights:

-

Producer Price Index (PPI): Measures price changes at the wholesale level before reaching consumers.

-

Personal Consumption Expenditures (PCE) Index: Preferred by the Federal Reserve, it accounts for changes in consumer behavior more effectively than CPI.

-

GDP Deflator: Measures inflation based on the price changes of all goods and services produced domestically.

Future Trends and Expectations for CPI

Short-Term Forecast (2025 - 2027)

-

Inflation rates are expected to stabilize around 2% - 3%.

-

Continued government efforts to maintain economic balance through monetary policies.

-

Supply chain efficiency improvements may help control price volatility.

Long-Term Forecast (2028 - 2035)

-

Technological advancements and automation may reduce production costs, slowing inflation.

-

Climate change policies could impact energy prices and overall CPI trends.

-

Demographic shifts, such as an aging population, may influence demand for healthcare and housing, affecting CPI weights.

Frequently Asked Questions (FAQs)

1. How often is the CPI updated?

The CPI is updated monthly by government agencies such as the U.S. Bureau of Labor Statistics.

2. Why does CPI matter for everyday consumers?

CPI affects purchasing power, cost-of-living adjustments, and inflation rates, impacting wages and government benefits.

3. Does CPI measure the cost of living accurately?

CPI provides a general measure but may not fully capture individual experiences, as spending patterns vary across demographics.

4. How does CPI impact interest rates?

Central banks use CPI data to set interest rates, raising them to combat inflation and lowering them to stimulate economic growth.

5. Can CPI be used to predict future inflation?

While CPI trends provide insights into inflationary patterns, predictions also depend on economic policies, global events, and market conditions.

Conclusion

The Consumer Price Index (CPI) is a vital economic tool that reflects price trends and influences financial decisions at every level. Over the past 15 years, CPI has undergone significant changes due to economic crises, policy interventions, and market dynamics.

Understanding CPI trends helps consumers, businesses, and policymakers navigate inflationary pressures and plan for the future. As economies evolve, the importance of monitoring CPI will remain crucial in maintaining financial stability and economic growth.

Key Takeaways

- CPI measures the average price change of consumer goods and services.

- It is calculated based on a basket of goods, weighted by consumer spending.

- Over the last 15 years, CPI has been influenced by economic recovery, pandemics, and inflation control measures.

- CPI impacts consumers, businesses, and government policies.

- Future CPI trends will depend on economic policies, technological advancements, and global market conditions.

Stay informed about CPI trends to make better financial decisions and anticipate economic changes.