Special Savings Plans and Goals

- Details

- Category: Economics

- Hits: 6,386

One of the many reasons that people save is to send their children to college. Another is to make a down payment on a home. Yet another is for those years after people stop working. There are different methods of saving for retirement, each having different risks. As you read this section, you’ll learn about special savings plans and the amount of risk involved in these investments.

Investing for Retirement

Retirement is a major reason for saving and investing.

Economics & You Do you think much about retirement? Read on to learn ways to save for this time of life.

Although most people are eligible for Social Security when they retire, this plan does not provide enough income to live comfortably. It is important, therefore, for a person to save for and invest in his or her own retirement.

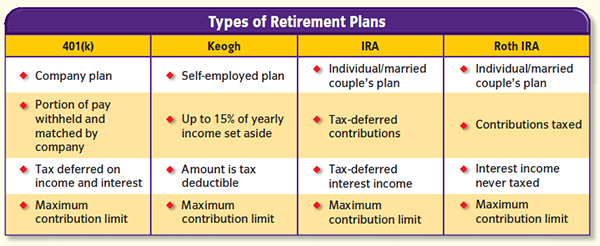

Many individuals have company-supported pension plans to save for retirement. One of the most common types is a 401(k) plan, in which a portion of your paycheck is withheld and the company matches the amount. A major benefit of such a plan is the tax savings. As long as your contribution does not exceed a certain amount, you do not have to pay federal income tax on the amount you put in—or on the amount the plan earns—until you withdraw funds from the plan at retirement.

Individual Pension Plans

The Keogh Act of 1962 was passed to help self-employed people set up their own pension plans. The Keogh plan allows those people who are self employed to set aside a maximum of 15 percent of their income up to a specified amount each year, and then deduct that amount from their yearly taxable income.

Figure 6.4 Retirement Plan Options

Today people have several choices in retirement plans.

Another form of retirement plan is the individual retirement account (IRA). A person earning less than $30,000 can contribute up to $4,000 a year and deduct those contributions from taxable income. The benefit of an IRA is that the income you contribute to the IRA is not taxed in the year it is contributed. In addition, the interest you earn on that income is not taxed either. You pay the tax only when you take out funds from your IRA account, usually after age 59½.

A relatively new form of IRA is called the Roth IRA. Again, you are allowed to put up to $4,000 a year in a Roth IRA. You do not get to deduct your contributions from your taxable income, however. The benefit is that all of the interest you earn on your contributions to a Roth IRA is tax-free forever. Thus, when you take out funds from your Roth IRA account while you are retired, you pay no additional taxes. See Figure 6.4 on the previous page for a summary of the major points of all of these retirement plans.

Real Estate as an Investment

Buying real estate, such as land and buildings, is another form of investing. For the past 50 years or so, buying a home, condominium, or co-op has proven to be a wise investment in many parts of the country.

Resale values have soared at times, especially during the late 1970s. Although the housing market fluctuates, buying a home is usually a good investment in the long run. Buying raw, or undeveloped, land is generally a much riskier investment. No one can guarantee that there will be a demand in the future for a particular piece of land.

Real estate, either as raw land or as developed land, is not very easy to turn into cash on short notice. Sometimes real property for sale stays on the market for long periods of time.

This difficulty in getting cash for your investment is one of the trade-offs involved when investing in real estate. You cannot get your funds as quickly as you could if you had invested in stocks, bonds, a bank CD, or some other savings plan.

How Much to Save and Invest?

How much to save and invest is determined by each individual’s income, risk tolerance, and values.

Economics & You If you have money saved, would you be willing to invest it even if it meant risking losing it? Read on to learn how to decide how much of your money you should save and invest.

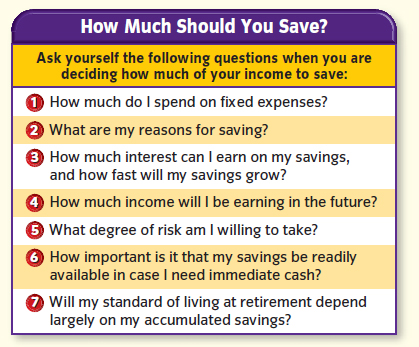

Saving involves a trade-off like every other activity. The more you save today, the more you can buy and consume a year from now, 10 years from now, or 30 years from now. You will, however, have less to spend today. Keep in mind that if you have debt, especially on a high-interest credit card, you may want to pay that off before diverting funds into savings. Also consider that if you expect to make a much higher income in the future than you do now, you have less reason to save a large percentage of today’s income. (See Figure 6.5 below.)

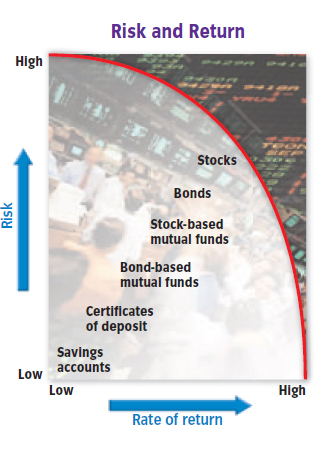

Amount of Risk

So, how much of your savings should you risk in investment? When making this decision, remember that if you put a lesser amount in the more risky types of investments, you will have some security with your savings, and you will have some funds readily available should you need cash in a hurry. You may also have a chance of making high returns, but the higher the promised return, the greater the risk. Indeed, it’s impossible to obtain higher returns without taking more risk.

Figure 6.5 Savings Considerations

Periodically, you should reevaluate how much of your income you are saving. If you are at a point where you have accumulated debt on a credit card, for example, you may want to pay off your debt before putting funds into savings. At another time, if interest rates rise, you may want to save more and earn more interest.

Spreading Out Your Investments

Investing your savings in several different types of accounts lowers the overall risk. If one investment turns sour, the others may do better. Financial planners call spreading out your investments diversification. Mutual funds, for example, help you diversify.

When you have very little income and cannot afford any investment losses, you should probably put your savings in insured accounts in a local bank or savings and loan association, or you should buy U.S. government savings bonds. The greater your income and the more savings you have, the more you can diversify into stocks, corporate bonds, and so on.

Values

Your values may also determine where you invest your savings. If you believe that your community needs more development, you might choose to put your savings in a local savings and loan that guarantees that a large percentage of its investments are made in community loans. You may also choose to invest in stocks issued by environmentally responsible companies or companies that have aggressive equal opportunity programs.

- pension plans: company plans that provide retirement income for their workers

- Keogh plan: retirement plan that allows self-employed individuals to save a maximum of 15 percent of their income up to a specified amount each year, and to deduct that amount from their yearly taxable income

- individual retirement account (IRA): private retirement plan that allows individuals or married couples

· to save a certain amount of untaxed earnings per year with the interest being tax deferred

- Roth IRA: private retirement plan that taxes income before it is saved, but which does not tax interest on that income when funds are used upon retirement

- diversification: spreading of investments among several different types to lower overall risk