The Four Sectors of the Economy

- Details

- Category: Economics

- Hits: 59,448

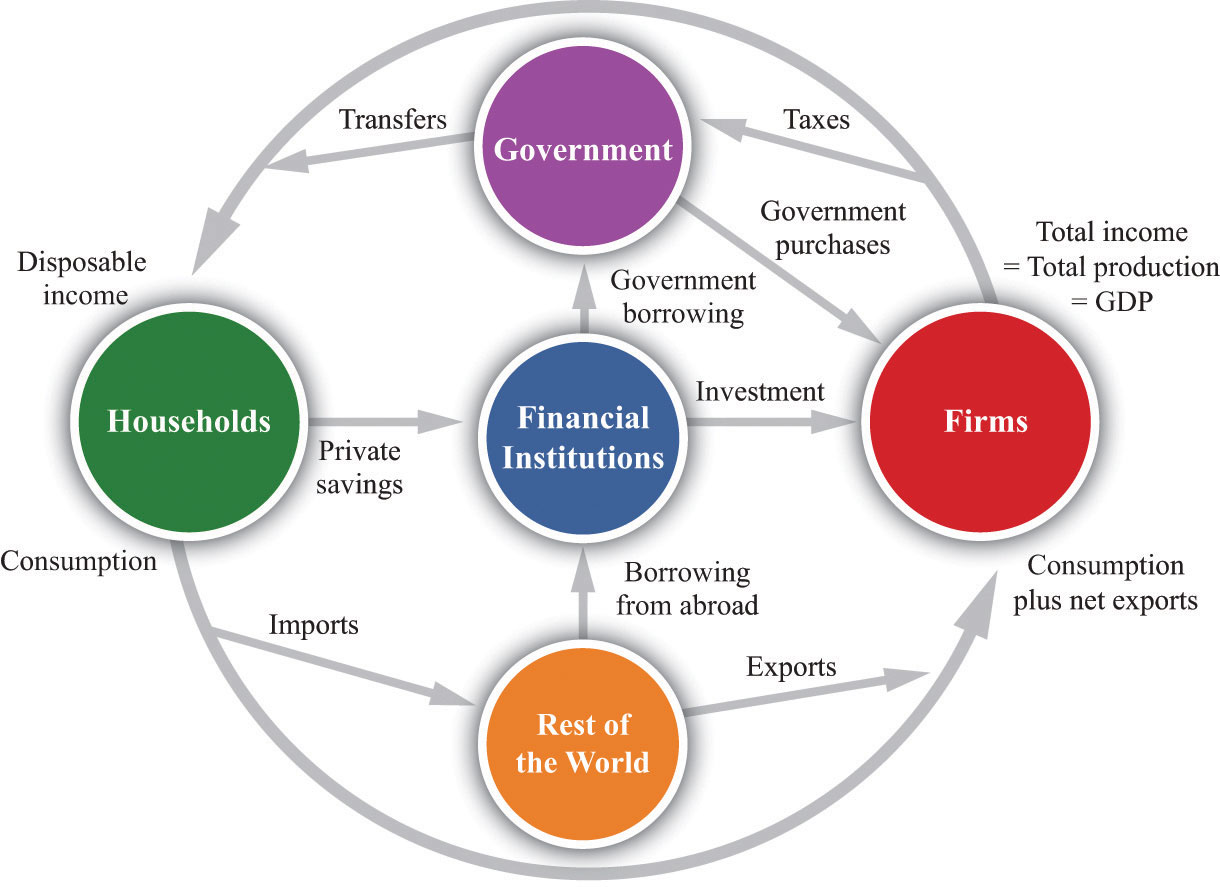

Modern complex economies involve the interactions of large numbers of people and organizations. These economic agents fall into one of three categories: business, households, government, and the rest-of-the-world. Economists find it useful to think of these groupings as sectors of the economy. Let's look at each of these sectors in turn:

Business

The business sector is where production takes place in the economy. The individual agents making up the business sector are called firms. These are the organizations within which entrepreneurship brings together land, labor and capital for the production of goods or services.

Economies in which firms are generally owned by private individuals rather than by governments are called capitalist or private enterprise economies. These include almost all the countries in the world today. A firm may be as small as one individual. An example is a plumber with a truck and tools whose income is whatever is left over from sales after paying expenses. These one-owner firms are called individual proprietorships.

A large firm is typically a corporation which is a legal entity in itself, having many of the same rights and privileges under law as does a person. The corporation purchases factors of production and receives payment from buyers of its output. The difference between its sales revenue and its costs of production is its profit or earnings. A corporation purchases capital goods, plant and equipment, from earning profits, borrowing from lenders, and selling shares in the ownership of the corporation. The latter is called stock.

The owners of a corporation are called shareholders. A large firm typically has many shareholders, some of which are other firms. Firms which primarily invest in other firms are called financial intermediaries. Shareholders play no direct role in the running of the firm, rather they are represented by a board of directors who are elected by shareholders on a one vote per share basis. Shareholders are not liable, in general, for the debts of the corporation. The term "Ltd." used in the names of corporations in Britain refers to the limited liability of the shareholders.

The entrepreneurial input to the corporation is often provided by salaried managers who may not even be shareholders. These managers are appointed by the directors as officers of the corporation who is then legally empowered to conduct its business. A primary responsibility of the directors of a corporation is the hiring and oversight of the officers.

Households

Those are us, the family units that makeup society. We consume the goods and services produced by the economy. It is for our benefit that the economy exists.

The household sector provides the labor used in production, receiving payment of wages and salaries in return. Households also provide financial capital to the business sector which includes loans to firms, direct ownership, or the purchase of shares. Households may invest directly in firms by purchasing their stock or bonds, but more typically households invest indirectly through financial intermediaries such as pension funds, insurance companies, banks, and mutual funds.

Households own the firms and have a claim to all the income produced by the business sector, including wages, interest, and profits.

Government

We can think of government as having four basic economic functions:

1) First, it establishes the legal framework within which the economy operates. Economists sometimes refer to this framework as the rules of the game. A complex body of commercial law clarifies relations between buyers and sellers, employers and employees, and parties involved in private contracts.

The corporation, an essential building block of modern economies, is a creation of the law. It was the development of the limited liability corporation in Britain during the industrial revolution that made possible the formation of very large firms co-owned by many individuals. Such enterprises could not exist without the assurance that individual shareholders are not personally liable for the actions of the corporation.

Property rights are not unconditional but rather are defined by laws which establish the privileges, obligations, and limitations of ownership.

For example, city government decides what the owner of a city lot can and cannot do with it. The owner of a residence is entitled to live in it, rent it to someone else to live in, or sell it, but usually is prevented by zoning laws from tearing down the house and putting in a fast-food restaurant or a rifle range. Regulations control entry into certain economic activities such as banking or medicine, restrict what firms can say in their ads, and even prohibit sale of goods deemed not in the public interest.

2) Second, taxes are collected by the government from households and firms. The U.S. federal government collects most of its revenue from individual income taxes. It also taxes corporate profits and estates, levies excise taxes on the value of certain goods and tariffs on imports from abroad, and it collects payroll taxes. State governments collect sales taxes on retail purchases and/or income taxes on both individuals and corporations. County and municipal governments levy a tax on the value of real estate property, and often also participate in sales tax or income tax revenues.

What activities are taxed, and how heavily, gives government many levers with which to encourage or discourage specific economic activities. The tax on gasoline is cents per gallon in the U.S. and dollars per gallon in Europe. The high cost of fuel creates an incentive that results in cars in Europe being much smaller and less powerful than in the U.S. and less driving. This has far reaching effects on the environment and the greater use of public transportation.

3) Third, the government spends some of these tax revenues to provide goods and services through agencies that operate much like firms, for example the National Park Service which produces recreation and the U.S. Navy which produces national defense. These firms are engaged in the production of public goods, ones we consume as a society rather than as individuals.

The prime example is national defense which cannot be provided to one individual without providing it to others. Some goods have both private and public dimensions. For example, education benefits not only the individual who is educated but society as a whole, so it is not surprising that government plays a large but not exclusive role in education.

In socialist economies, the government operates a wider range of firms. In the former Soviet Union, all firms were under government ownership. Advocates of socialism contended that government ownership would lead to greater welfare, claiming that government is more responsive to the needs of society, and kinder to employees, than the market.

These ideas were very popular in Europe following World War II, and large sectors of those economies were "nationalized" under government ownership or control. The wave of "privatization" of industry in Europe after the failure of the Soviet Union reflected the realization that socialism failed to deliver on those rosy promises. The influence of socialist ideas is evident today in the major role of the governments in most industrialized countries in basic health care and a “safety net” of income support programs.

The allocation of government spending among alternatives also influences how firms and households allocate their private resources. For example, police protection is thought of as a public good, but the level of police protection will affect whether the Jones family installs a burglar alarm. And whether government builds freeways or subways affects private choices among alternative forms of transportation.

4) Fourth, the government also makes transfer payments to those who are entitled to receive them under the law. For example, people qualify to receive Social Security benefits on the basis of age or disability. Farm subsidies are paid by the U.S. government to firms which qualify by engaging in certain farming activities.

Transfer payments redistribute income among groups in society, and are a larger part of the total expenditures of the federal government than is the purchase of goods and services including defense. The distribution of income between the young and the old in the U.S. has been substantially altered by the growth in Social Security benefits received primarily by the elderly and the corresponding increase in Social Security taxes paid primarily by the young.

Transfer payments also affect private decisions. For example, the increase in the number of people choosing earlier retirement is surely related to the increase in the level of Social Security benefits as well as the penalties which the rules put on continued work by those qualifying for old age benefits.

We tend to focus on the federal government in thinking about the role of government in the economy, but state and local governments also play important roles in all four functions of government. Economists refer to governments at all levels as the public sector.

The Rest-of-the-World

We naturally focus on the economy of our nation because the government plays an important role in economic life and because economic interactions are usually concentrated within political borders. However, the movement of goods and services as well as factors of productions across national borders is also an important aspect of economic activity.

U.S. households consume stereos made in Asia and US firms purchase machine tools produced in Europe. Foreign airlines fly airplanes made in the U.S. and serve their passengers food exported from the U.S.

International trade now comprises about 10% of our national economy and is growing rapidly. Growth in trade has been accelerated by the removal of barriers under the North American Free Trade Agreement (NAFTA), and the 1994 round of the General Agreement on Trade and Tariffs (GATT) lowered barriers to trade around the world.

Think of the Rest-of-the-World, or ROW, as a fourth sector of the economy. In addition to trading with the ROW, American firms, government, and households also borrow from the ROW and lend to it.

Japanese, Chinese, and European investors are major lenders to both firms and government in the U.S., while American firms and households also have made large investments in Europe and Asia.

Exercises 1.2

A. Indicate which of the four factors of production each of the following is an example of:

- 1) a MacintoshTM computer

- 2) an electronics engineer

- 3) a Boeing 767TM

- 4) crude petroleum

- 5) the Empire State Building

- 6) the lot it sits on

- 7) Bill Gates

- 8) college graduates.

B. Name one or more prominent entrepreneur of today and explain briefly what this person has done.

C. Categorize the following by economic sector:

- 1) the Hernandez family,

- 2) the Ford Motor Company

- 3) the State of California

- 4) the University of California

- 5) the Durn-Good Grocery

- 6) Toyota Motors, Ltd.

D. Which of the functions of government in the economy is represented by the following:

- 1) Aid to Families of Dependent Children

- 2) the Federal Aviation Administration

- 3) truth-in-advertising laws

- 4) state sales tax

- 5) the Washington State Ferry System

- 6) Small Claims Court

E. Russia attempted to convert from a centrally planned economy under Soviet Communism to a largely private enterprise economy. What basic function of government in a private enterprise economy was lacking in Soviet Russia and was needed before a private enterprise economy could function? Has the conversion succeeded? Why?