To Rent or to Buy a house

- Details

- Category: Economics

- Hits: 5,414

Deciding whether or not to buy a house is one of the most important financial decisions most people will make. Some people will save for years in order to buy a small house. Others take out huge mortgages to purchase large homes. Still others are content to rent a house, condo, or apartment most of their lives. In this section, you’ll learn about the advantages and disadvantages of both renting and buying.

Should You Rent or Buy?

There are advantages and disadvantages both to buying a home and renting a place to live.

Economics & You Have you ever thought about where you will live when you get out on your own? Read on to learn about the pros and cons of renting or buying a home.

The average American family spends about one-fourth to one-third of its income on housing. Therefore, deciding whether to rent or buy is one of the most important decisions a person can make.

When young adults first start out on their own, they will often rent an apartment or small house before they think about buying. There are many reasons why people often initially rent.

First, buying a house generally requires a substantial down payment of many thousands of dollars. Renting an apartment, on the other hand, usually requires only a security deposit and one or two months’ rent up front. Renters also do not have to pay maintenance costs or real estate taxes. Renting also allows people greater mobility; if renters want to find a different place to live, or if they want to move to another town or state, they don’t have to worry about trying to sell property first.

Eventually, though, many people will choose to buy a home. Again, financial benefits are a driving consideration. Ownership of a home provides significant income tax benefits to the owner. Also, houses build up equity, which is the market value of the property minus the mortgage amount still owed. Home ownership is often a good investment, as houses often appreciate, or go up, in value, although this can depend on the neighborhood and the housing market at the time.

Buying

In addition to the long-term financial benefits of home ownership, people who choose to buy also experience the pride of ownership, and they have the freedom to remodel or improve the property as they wish. In turn, they give up the freedom of easy mobility.

Renter Rights and Responsibilities

Renters should read their leases carefully to understand their rights and responsibilities.

Economics & You Do you know anyone who lives in an apartment, or have you ever experienced a conflict with a landlord? Read on to learn about the rights and responsibilities of renters and landlords.

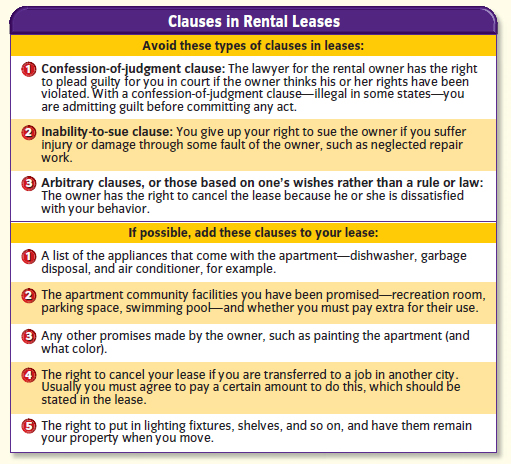

If you decide to rent, you will most likely be asked to sign a lease, or contract, that contains several clauses. As a prospective tenant, you should read the lease carefully. Most leases are for one to three years, although sometimes you may pay extra to get a six-month or nine-month lease. Often a lease will limit how an apartment can be used.

The lease may forbid pets, for example, or forbid anyone other than the person named on the lease from living there. In signing a lease, the tenant is usually required to give the owner a security deposit, or funds for the owner to hold in case the rent is not paid or the apartment is damaged.

The security deposit, usually equal to one month’s rent, is returned after the tenant has moved out. The amount returned depends on the condition of the apartment, as determined by the landlord.

Among the rights of tenants is the use of the property for the purpose stated in the lease. Tenants also have the right to a certain amount of privacy. A landlord usually needs the renter’s permission to enter an apartment.

In turn, the tenant’s responsibilities include paying the rent on time, taking reasonable care of the property, and notifying the landlord if repairs are needed.

The tenant is also required to give notice, or a formal warning, if he or she plans to move before the term of the lease is up. In this event, the landlord may ask for several months’ rent to pay for any time the apartment is empty before a new tenant moves in.

Restrictions May Apply

If you have pets and are trying to rent, be sure to ask the landlord about this issue. Some landlords do not allow pets at all, while others allow some animals but not others. You may have to put down an extra security deposit if you have pets.

Figure 5.4 Before You Sign

Follow these tips if you are planning on signing a lease on an apartment or other rental unit.

Landlords have responsibilities too. In many states, landlords must make sure that their apartments have certain minimum services, such as heat, and that they are fit to live in.

Landlords may also have to obey building safety laws. For example, fire escapes and smoke detectors may be required.

Leases usually call for the landlord to make repairs within a reasonable amount of time. In many states, a tenant has the right to pay for the repairs and withhold that amount of rent if the landlord does not make the repairs. Figure 5.4 above details more important information about leases.

Purchasing a House

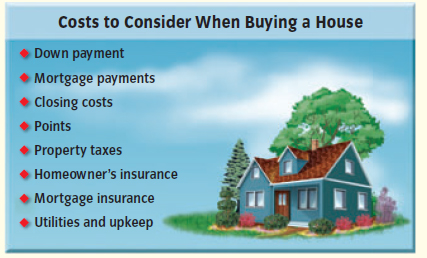

Potential home buyers need to consider many different costs before deciding to purchase a house.

Economics & You Do you plan to own a house someday? Why or why not? Read on to learn about the financial obligations of owning a home.

When you decide to buy a house, it is important that you do not take on financial obligations that are beyond your budget.

As a general rule, no more than a third of your total income should go toward your mortgage payment and other costs. (See Figure 5.5 below.)

One of the major challenges facing any home buyer is obtaining the mortgage. You will remember from Americans and Credit that a mortgage is the installment debt that you take on when you buy a house or other piece of property. If you buy a house for $200,000 and make a $40,000 down payment, you will need to obtain a mortgage for the remaining $160,000. The mortgage will then be repaid in monthly installments that include interest on the loan. Property taxes, homeowner’s insurance, and mortgage insurance are often included in your mortgage payment as well.

At the time of purchase, in addition to the down payment, you will need funds for closing costs. These are costs involved in arranging for the mortgage or in transferring ownership of the property. Closing costs can include fees for such items as the title search, legal costs, loan application, credit report, house inspections, and taxes. Although the person buying the house usually pays these fees, the seller may agree to pay part or all of them if this will make it easier to sell the house.

Figure 5.5 The Cost of Ownership

There are many expenses involved in owning a home apart from the mortgage payments. Remember, though, that owning a home builds equity and is often a good investment.

Freedom of Use

Owning a home provides the owner with the freedom to remodel, paint, or perform any other home improvements he or she wishes. Home owners should be careful, though, not to overextend their debt load on home-improvement projects.

When you are arranging for a mortgage, it is important to know about points, which are included in closing costs. Points are the fees paid to the lender and computed as a percentage of the loan.

Each point the lender charges equals 1 percent of the amount borrowed. Lenders charge points— usually one to four—when they believe that the current interest rate is not high enough to pay the expenses involved in handling the mortgage and still make a profit. When interest rates are up, on the other hand, lenders will sometimes waive points to attract home buyers. In any event, you should attempt to negotiate points with the lender. You also have the option of going to a different lender.

- lease: long-term agreement describing the terms under which property is rented

- security deposit: funds a renter lets an owner hold in case the rent is not paid or the apartment is damaged

- closing costs: fees involved in arranging for a mortgage or in transferring ownership of property

- points: fees paid to a lender and computed as a percentage of a loan