Forecasting the 2007 recession

- Details

- Category: Economics

- Hits: 4,542

After the introduction to economic indicators in section : macroeconomic forecasting through economic indicators, this section will look at the possibilities of predicting the recession starting in December 2007 using these indicators. Again it is important to remember that as this paper is written ex. post with revised data and a broad understanding of what went wrong1, it could easily be pointed at numerous of relatively detailed and complicated indications that something was fundamentally wrong with the US economy ahead of the recession.

But instead this section will show how investors and corporation could have kept track of the business cycle and forecasted the 2007 recession using a broad, but still simple, analyzing approach towards the US economy. This means that many vital factors and details on why the US economy entered a recession will not be discussed.

The analysis will include all indicators from section macroeconomic forecasting through economic indicators and follow a relatively chronological order from the time the different indicators in the different sectors show signs of weakness, and use the three D’s as tools when looking at the signs in conjunction. The analysis will start with a look at the developments in the CI to get an understanding of where in the business cycle the economy stood in the period before the recession.

It will then analyze the rate of inflation together with the yield curve, before analyzing the housing market. Next are the indicators towards the corporate developments and finally the very important consumers.

The stage of the business cycle

In March 2004 the CI index again reached the record values from the peak of the business cycle which ended in the 2001 recession. From this, and the cycle theory in section 4, we can expect that the business cycle is close to the trend line at point B in figure 2. If we are above or below point B is not of major importance, but from the historical perspective which created Zarnowitz’ cycle theory, the forecaster should acknowledge the likelihood that the economy might keep growing towards new record levels at point C, above the trend line.

Knowing that the CI has reached point B and is moving towards point C, the forecaster should expect the next stage to be a slowdown. This means that even though the economy is at that point still expected to grow, forecasters should keep their eyes open for where the slowdown is likely to enter first. Looking at the indicators discussed in section 6, the housing market should have seemed as a clear candidate for a future slowdown as early as in 2004.

The housing market had at that point experienced successive years with record price levels which from the indicators discussed, especially the Case-Shiller index, arguably seemed to be heading towards a bubble. Indications like these towards a single market could suggest the need to seek more detailed information towards this sector through more indicators, to see whether the price growth could be correctly driven by fundamentals like it was in the boom after World War 2.

Throughout the boom explanations for the price growth was many. One theory was that land is scarce and the population is growing, and as a result we have an unbalance between increasing demand and decreasing supply. A different plausible explanation could be that the costs of construction had increased, and hence pushed prices upward. In his book Irrational Exuberance from 2005, Robert J. Shiller explains why neither of these are good explanations as the price of houses have increased at a much higher rate than both population and income growth. He also argues that while land is indeed scarce, this is not a problem big enough to explain the price growth.

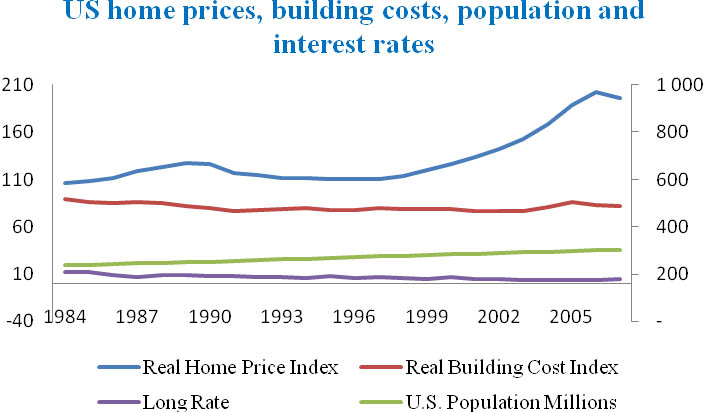

Figure 18 -The left scale: Real Home Price Index for the US, real building costs index and the long term interest rate. On the right scale: US population in millions. 2

Figure 18 show that building costs have actually fallen since it’s top in the late 1970’s, and it also pictures that neither population nor the long interest rate hold the explanation behind the growth in prices. In other words it is difficult to explain the price increase on the basis of underlying fundamentals, and it should hence have been hard to justify the developments.

Higher inflation and an inverting yield curve

Critiques argue that the long period of low short term interest rates during the Great Moderation 3, created a credit boom which finally resulted in the credit crunch of 2007 (Mizen 2008). The reasoning is that these years of stable and broad economic growth created an incentive to increase both the supply and demand for credit in a goal to add to future yield4.

From the indicators discussed in section 6, the savings ratio gives a good indication that risk taking and consumption was at very high levels. With negative savings ratios in 2005, and reports of increasing debt-to-disposable income ratios from 75% to 120% 5 during the years of the Great Moderation, there was a story of high economic activity and low reserves for a rainy day. As housing prices increased at a higher rate than income, lenders who wanted to add to their yield increased their multiples on mortgages which reinforced a bubble both within housing and credit markets (Mizen 2008).

Acknowledging these high levels of debt and the fact that house prices increased at a higher rate than income, it should have been obvious that the magnitude of a possible downturn with a burst of a housing and credit- bubble, could result in a deep and dispersed recession.

As the short term interest rates at that point were increasing and housing prices were at record high levels, the potential danger signs should have been evident even at this early stage. As the debt-to-disposable income ratios were operating at very high levels, and inflation increased to the highest levels since the early 1990s in 2006, the interest rates were very likely to stay at a higher level in the coming year.

Knowing that interest rates carry an important and negative influence on housing prices and that much of the consumer-debt was invested in real-estate, it was clear that the downturn was getting more imminent and that a fall in the housing market was a potential trigger of a recession.

An inversion of the yield curve has arguably been the most powerful forecasting tool in the US economy over the years covered in this paper, and in Q1 2006 the yield curve inverted for the first quarter since before the 2001 recession. This came as a result of a monetary contraction with increasing short term interest rates which created the expectations of a peak in economy activity. From reasons explained in section 6.4 the monetary contraction were believed to be followed by a slower economic growth and possibly end in a downturn in the business cycle.

The expected downturn in housing

At the end of 2006 the fall in the housing market was no longer potential. The prices from the Case-Shiller index was negative for all quarters since the peak in Q2 20066, and the number of new housing startups was also experiencing a falling trend during the whole year of 2006. This was in other words a downturn in the real-estate market which already seemed to be relatively deep and dispersed, and with a duration of over 6 months. Taking into account that the yield curve was inversed for three out of four quarters in 2006 7, the probability of a broader stagnation and recession in 2007 grew stronger.

I argued in the introduction that forecasters with specialized knowledge about important sectors should use this knowledge to get a broader understanding of the economy. The approach used in this paper however is very general, but it is still not possible to write an analysis about the 2007 recession without mentioning the subprime loans8. The increase in subprime mortgage defaults during 2007 was arguably one of the main triggers of the recession. Still the average forecaster without specialized knowledge about the subprime loans would probably not have detected in advance that this would be an issue of such magnitude.

But as we at this point already had poor expectations about the housing and credit markets, the news about the subprime problems generated much attention. During the spring and summer of 2007 the subprime problems resulted in large scale bankruptcies and rescue packages by the Fed. Even though some of the banks tried to talk down the problems, there were strong indications that the economy was stagnating and that there was a significant downturn in the loom.

More dispersion with signs of negative corporate developments

As the subprime defaults resulted in some significant bankruptcies and instability in the credit markets, on top of the struggling housing market, also corporate profits seemed to become more volatile. Both Q4 2006 and Q1 2007 were negative, suggesting that a negative trend in profits had already started. But as the profits are only updated at a quarterly basis and Q2 was positive, it was neither possible to be sure about the depth nor duration of the negative trend before the announcements of the Q3 2007 profits, which was also negative.

This was important indications influencing falling expectations of future profits in the stock markets as well. Investors were worried about a potential future downturn and started selling to reduce risk and secure some of the profits earned during the great moderation. This was one of the reasons behind the increased volatility of the S&P500 composite index during the year of 2007, especially after the magnitude of the subprime problems became more and more obvious.

During 2007 the NAPM index also experienced volatility, but most of the time held values just above 50. This was signs that the manufacturing sector was indeed struggling, but the volatility made it difficult to create any clear expectations about the future.

Looking at all the indicators of corporate developments they all, except the number of new orders for durable goods which was only stagnating at this time, experienced negative growth. The fact that the number of new orders remained at a relatively high level throughout 2007 indicated that the depth and duration of the downturn could be short, but the dispersion and duration of negative trends over the year of 2007 gave strong signals that the corporate downturn had started.

The employment situation held strong

While the housing market was struggling and the signs of negative corporate developments became stronger, the rate of unemployment remained relatively low ahead of the recession. The rate of unemployment reached its latest low of 4,4% in March 2007, and while it increased to 4,9% in December the same year, the developments were not of any significant magnitude ahead of the recession.

As neither the number of initial claims for unemployment insurance made any noteworthy increase, the employment situation seemed stable. Even though the rate of unemployment normally is coincident with the business cycle, this suggested that the depth of the downturn could of a lower magnitude than feared.

While the employment situation remained relatively strong, the consumer sentiment started falling in 2007. But even though the index fell with a total of 22% during the year, it did not fall to any historically low levels before the start of the recession. From section 6.7 we would expect consumer sentiment to lead the economy, but even though one could see signs of a falling trend, the fact that the indicator remained at relatively high levels in historical terms, it was difficult to get any clear pointers to how imminent the recession was.

The rate of unemployment is, as explained earlier, normally coincident to the business cycle, so even though it too was stable at a low level this was not necessarily a sign that the recession was not coming, but simply implied that the economy had still not reached its peak.

Initial claims of unemployment insurance on the other hand is expected to lead the unemployment rate, but as there was no sign of a trend it could have be argued that a recession was still not of any immediate danger.

The current account

The current account did show some signs of improvements during 2007 as the US dollar lost value against both the Euro and a basket of major currencies. This was found as the understanding of the improvements resulted in a need to implement indicators towards the trade balance and the value of the dollar. The improvements seem to be a result of positive developments in the trade balance 9 as a result of the falling dollar which decreased the purchasing power of imports for US consumers.

While positive growth in the current account was in itself a positive development, the fact that one of the reasons behind this was the falling purchasing power of US consumers, it was likely that these necessary developments could also be a problem in regards to short term growth. One can also argue that an economic slowdown in the US could have provoked lower demand for imports, and hence increased the current account.

While the current account gained much negative attention at the time it was also understood that improving the deficit could prove costly in terms of short term local growth, and this also seemed to be the case as the deficit started falling. The falling and more expensive imports could arguably have positive long term implications on the current account, but was at the same time likely have a negative effect on short term total economic activity.

Peak in the CLI

The Conference-Board’s leading index experienced stagnation and a peak during 2006. The index was increasingly volatile and suffered twice from two consecutive months with negative growth. This resulted in a total negative growth both for Q2 and Q3 of 2006. In 2007 the index was still very volatile with more negative months than positive, resulting in a negative trend at the end of the year.

From this broad index the stagnation in economic activity was obvious, and by the start of 2007 the signs of recession became even clearer. But with this said, the Conference Board states as a rule of thumb that the indicator should experience three consecutive months of negative growth before you can call the developments a sign of a future recession, and not simply the sign of a smaller market correction (Conference Board, 2001). This did not happen before October, November and December of 2007.

| Indicator | Development | Time ahead |

| GDP and CI | The business cycle grows above its trend line | 31 months |

| Current Account | Positive developments in the current account | 12 months |

| Inflation | Reached highest levels since early 90s | 18 months |

| Yield curve | Inversion | 18 months |

| Corporate profits | Peak | 12 months |

| Stock market | Increased volatility and peak | 10 months |

| New Orders | Stagnation | 12 months |

| NAPM | Peak, followed by levels around 50 | 12 months |

| Unemployment | Reached lowest level in March 2007 | |

| Initial claims | No sign | |

| Consumer sentiment | No significant sign | |

| Personal savings | Negative savings | 24 months |

| S&P Case-Shiller national home price index | Peak followed by streak of negative growth | 18 months |

| New housing starts | Only values below 1,5 mill. during 2007 | 11 months |

| Leading index | Peak followed by negative trend | 12 months |

Table 3 - Summary of developments in relevant economic indicators ahead of the business cycle peak in December 2007

Table 3 holds a summary of the developments in the discussed indicators during 2006 and 2007. As can be seen, the increased inflation followed by a yield curve inversion and a fall in the housing market during the spring of 2006, was the first signs that the total economic activity was heading towards a recession.

At this point the probability of a business cycle stagnation followed by a recession during the next 6 to 18 months was increasing by the day. Nevertheless, it was still difficult to predict whether the Fed would be able to stop the economy from entering a recession through monetary expansion.

But as the downturn in the indicators towards housing grew deeper and gained longer duration every month, and recognizing that much of the very high levels of consumer debt were generated from speculative financial investments in real-estate 10, the likelihood that this would result in a dispersed recession recognized through all the three D’s grew significantly.

In 2007 the indicators towards the wealth of the US corporations also started showing weaknesses, and the housing market seemed to grow even more depressed. With the burst of the subprime bubble leaving the economy in a credit squeeze, the downturn in the indicators became deeper and more and more dispersed. The dispersion towards US corporations was expected as so many sectors of the economy are vitally dependent on both these respective markets.

It was somewhat surprising that the consumer sentiment kept relatively high values up until the start of the recession. This is probably a result of the low rate of unemployment, which started increasing but still remained at low levels in historically terms throughout the year. Neither the initial claims for unemployment insurance, which was such an important indicator for the 2001 recession, experienced any significant increase.

This could suggest that the Fed might be able to save the economy from a deep recession, but recognizing that the problems indicated from the other sectors seemed to grow deeper, a recession seemed inevitable11.

After the peaks in housing in the spring of 2006, that is 1,5 years before the dated start of the recession in December 2007, it should have become clear that the economy was entering a stage of slowdown and stagnation. In 2007 the likelihood of a future fall in economic activity increased substantially as time passed. In other words the indicators produced both deep and dispersed negative developments which only grew in duration during the months ahead of the recession.

As we passed December the weakening health of the US corporations and housing- and credit markets proved that the stagnation was a fact, and during the first quarter of 2008 all indicators agreed that the economy indeed was in a recession. Because NBER published the date of the business cycle peak in December 2008, a year after the actual peak, this was an important understanding as the forecaster could acknowledge that the business cycle had turned and that the economy in fact was in a recession before it was official (NBER 2008).

1 As already stated in section 2.2, this approach should not be directly compared to ”real -time-forecasting” as long as the data used is revised. It is also a possibility that the forecaster is biased from detailed information about what caused the recession.

2 The figure is based on the data behind figure 2.1 in Irrational Exuberance by Robert J. Shiller (2005). T

3 Especially in the period after the 2001 recession and the 9/11 attacks.

4 A situation where investors often take on investments with higher risks as they seek to increase profits.

5 Paul Mizen - The credit crunch of 2007-2008: A discussion of the background, market reactions and policy responses. PP 534.

6 It is again important to remember that the data for the Case-Shiller index is not very timely. But two consecutive negative quarters had not been seen since the mid 1990s.

7 The yield curve was positive in Q2 2006.

8 Subprime normally represents mortgages to individuals with poor credit history (Mizen 2008)

9 By positive developments I refer to decreasing imports compared to exports.

10 21% of all home purchases in 2007 were made as pure investments.

11 Remember the theories of Shiller and Akerlof (2009) from section 6.6 that employment should not be expected to lead the economy.