Relationship and Integration

- Details

- Category: Supply Chain Management

- Hits: 11,600

Supply Relationship Defined

Supply relationship can be defined as the cross organisational interaction and exchange between the participating members of the supply chain. This means that the relationship is between organisations not individual people within the same supply chain where the material flows defines the boundary. However for the inter-organisational interaction that falls outside of the main streams of the material flows, then it may not be called collaborative relationship or partnership relation, but may not be the supply relationship.

Supply relationship can be either on the upstream side with the suppliers or on the downstream side with the buyers. If the relationship is solely observed between one supply and one buyer, it is also called dyadic relationship.

Supply relationship can be defined as the cross organisational interaction and exchange between the participating members of thesupply chain.

One of the most common organisational relationships is what’s called the partnership relation. A partnership is defined as a specific relationship arrangement where parties agree to cooperate to advance their mutual interests. Since humans are social beings partnerships between individuals, businesses, organisations, and varied combinations thereof, have always been commonplace. In the most frequent instance, a partnership is formed between two or more businesses in which partners cooperated to achieve and share business advancement and profits or losses.

In supply chain management, relationship between the participating members is in fact more a dimension rather than an element. This means that supply relationship cannot be understood as something that you either have it or you don’t; instead it is a dimension from which various different relationship postures can be identified, such as arm’s length relation; shortterm contractual relationship, long-term partnership relation and so on.

It is almost like a variable that may take different values under different circumstances. Then the question is how, in practice, one might measure the ‘value’ of relationship? This is a difficult question. Amongst many known attempts, a relatively more convincing one is that if a relationship is a form of interaction and exchange, then a specific relationship can be measured by the contents of the exchange.

As relationship is a form of interaction and exchange, a specific

relationship is measured by the contents of the exchange.

Since relationship is ultimately about exchange, and hence, so long as we know what has been exchanged in between we should be able to pigeonhole it to a specific type. For example, if the buyer and supplier have only exchanged on the price and volume of the goods, we can very safely assess that they are having an arm’s length relationship; on the other hand if the two companies have been exchange their vision, mission and value, have joint design and product development and coordinated production and so on, one can safely assess that the relationship between them is close and highly engaging.

Close Partnership

The traditional supplier-buyer relationship has been limited to almost single point contact of purchasing officer on the buyer side and the sales person on the supplier side. The purchasing decision is largely based on the unit price. Information sharing is very limited if not at all in existence. The relationship tends to be antagonistic and adversarial.

The close partnership relation with suppliers was first practiced in the Toyota led Japanese automotive industry. It had profound influence on Western assemblers and is now a dominant school of thought in supply relationships. The basic practices of the Japanese close partnership with suppliers involve many aspects of supply chain management.

First they reduced their supplier basis and form tiered supply network structure. As a result, the buyer can then focus much smaller number of 1 st-tier suppliers; more time and other resources can be focused on them to develop much closer relationships.

They use long term contract with their suppliers. Not only the long-term contract stabilises the contractual relationship, but also psychologically it is a statement of trust and good-will intention which seldom fail to entice a higher level of commitment.

Single sourcing is preferred to dual sourcing or multiple sourcing, taking advantage of volume consolidation, coupled with greater subcontracting to suppliers. This shift has seen the vertical disintegration of the industry.

They get the suppliers involved earlier in the new product introduction process. Suppliers can then contributing their expertise to design and engineering of the new products, adding substantial value to the supply chain. Some of the suppliers’ designers and engineers may reside in the premises of the assembler, creating much closer relationship.

They move away from price based purchasing towards quality-driven purchasing. Putting tremendous amount of effort in working with the suppliers closely to achieve the ‘zero-defect’ target as part of their TQM campaign.

They developed the JIT production system, which require close integration of suppliers and buyers production system. Supplier’s capacity is synchronised with the buyer’s; and the production scheduling is coordinated to ensure smooth flow of materials and low or no inventories along the processes.

The current emphasis on the close relational exchange represents a departure from the former transactional focus widely practiced in the Western industries, which is characterised by the short-term gains and limited communications and no collaboration. The close relationship is concerned with long-term partnerships and long-term gains for the whole supply chain.

It is a shared destiny relationship with suppliers. It is often developed incrementally between the buyer and supper over time. Research suggests that the concept of trust and commitment are pivotal to the relationship’s success. Trust is defined as ‘the willingness to rely on anexchange partner in whom one has confidence. It is thought to be the binding force in most productive buyer-supplier relationships.

Lamming (1993) proposed a nine factors model to summarise the key success factors of the close partnership between supplier and buyer, which could be helpful as a benchmark for supply relationship development.

The nature of competition

- Global operation and local presence

- Based upon contributions to product technology

- Combination of Organic growth, merger and acquisition

- Dependent upon alliance/collaboration

Basis of sourcing decision

- Small supply base

- Supplier selection not just on bid price

- Single and dual sourcing

- Re-sourcing as a last resort

- Earlier involvement of established suppliers

Role of information exchange

- True transparency: cost etc.

- Two-ways: discussion of cost and volumes

- Technical and commercial information exchange

- Kanban system for production deliveries

Management of capacity

- Synchronised capacity

- Flexibility to operate with fluctuations

Delivery practice

- Just-in-time delivery

- Local, distance and international JIT

Dealing with price changes

- Price reductions based on cost reductions

- Joint efforts form a key part of information exchange in lean supply

- There is a combination of working pressure and co-operation, coupled with transparency in costing

Attitude to quality

- Supplier vetting system become redundant

- Mutual agreement on quality targets

- Continual interaction and Kaizen

- Perfect quality as a goal (such as 6o, and zero-defects)

Role of R&D

- Integrated assembler and supplier

- Long-term development of components system

Level of pressure

- Very high for both customer and supplier

- Self-imposed

- Not culturally specific

Strategic Alliance

Strategic alliance is defined as an informal or formal arrangement between two or more companies with a common business objective. They are seen as a manifestation of inter-organisational cooperative strategies that entails pooling of skills and resources by the alliance partners in order to achieve one or more goals linked to the strategic objectives of the cooperating firms. They usually will take one of the three structural types:

- Horizontal alliance: that is between companies on the same level of different supply chains, which is also referred to as inter-channel alliances.

- Vertical alliance: that is between the firms on the different levels of the same supply chain, which also referred to as the intra-channel alliances.

- Lateral alliance: that is developed between the client company and logistics service provider firms. Those logistics providers usually will serve many different supply chains and thus they are often seen from any supply chain as the ‘lateral’ rather than internal.

Companies embarked on the business of strategic alliances do so for many reasons:

- Sharing complementary resources

- Sharing market risks

- Achieve economy of scale and economy of scope

- Joint development and collaboration

- Create value through synergy as the partners achieve mutually benefit gains that neither would be able to achieve individually

- Cost saving and customer value adding

Strategic alliances between businesses usually do not start by the ‘love at the first sight’. They must be contemplated and planned dispassionately, and they call for a continuous process of initiation and development. Statistics show that 70% of newly created strategic alliances decease within one year of operation. This may not be as alarming as it sounds. Alliances, perhaps, are supposed to be so.

Strategic alliance is fundamentally informal to start with and will certainly enjoy a cosy but flexible relationship. It is perfectly alright for the parties to decease the alliance without costing them an arm or leg if the experience is not what was expected.

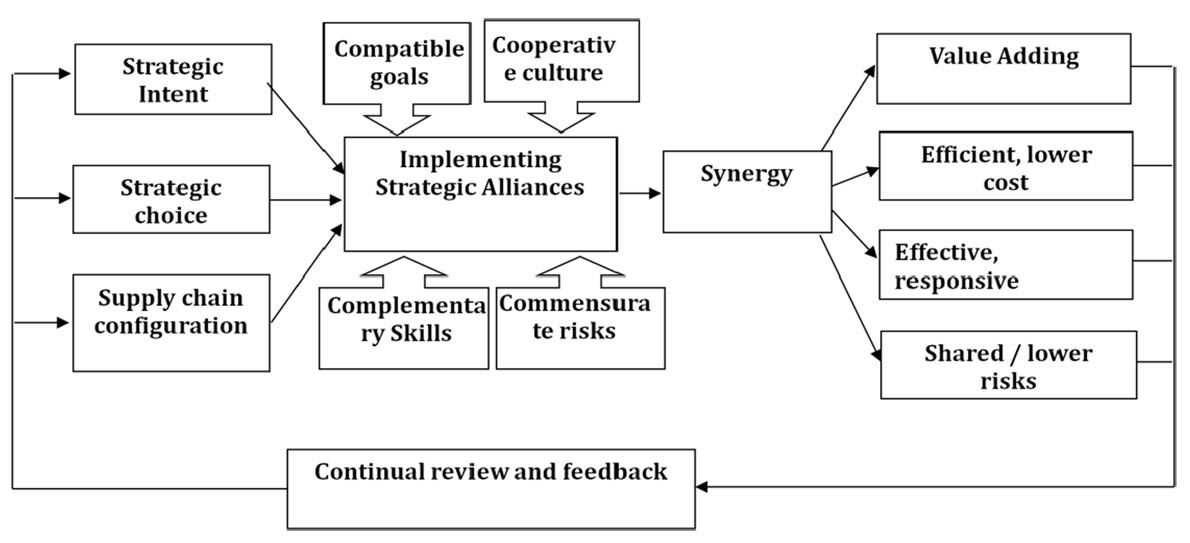

Figure 35. Continuous processes of alliance development

As illustrated in the diagram, the starting point is the matching of the strategic intent of both parties, which is based on their careful analysis and decisions in respect to the strategic choice and supply chain configuration at a high level. The strategic intention of alliance can only become the reality when the agreed alliance is implemented and put to practice. But the implementation is usually facilitated, affected, or constrained by many factors (the 4 Cs, in the model) including the whether the two parties have compatible goals, cooperative culture, complementary skills and commensurate risks.

If all goes well the alliance is expected to produce some positive result through synergy; and they are usually evaluated on the value-adding, efficiency and effectiveness, cost, and shred risks. The evaluated results of the alliance will then be reviewed to see if they have met both parties’ strategic intentions. That completes the cycle of alliance development model. It is anticipated that continuing success of the alliance will rely on the continuing process of those described steps.

Relationship Dilemma

Why close partnership is so great? We ask this question because the validity of the close partnership appears to have not been challenged, and most of the times it has been pursued as a best practice almost religiously. Most of supply chain relationship literatures appear to be in the same vein; practitioner world zealously follow the close partnership as the principal developed from the lean supply chain model.

The resultant phenomenon is that we all choose to practice the close partnership without questioning its merit in all circumstances, and that could be dangerous. Here, we are going to investigate the three relationship dilemmas in order to have more thorough understanding of the issue.

Dilemma No.1

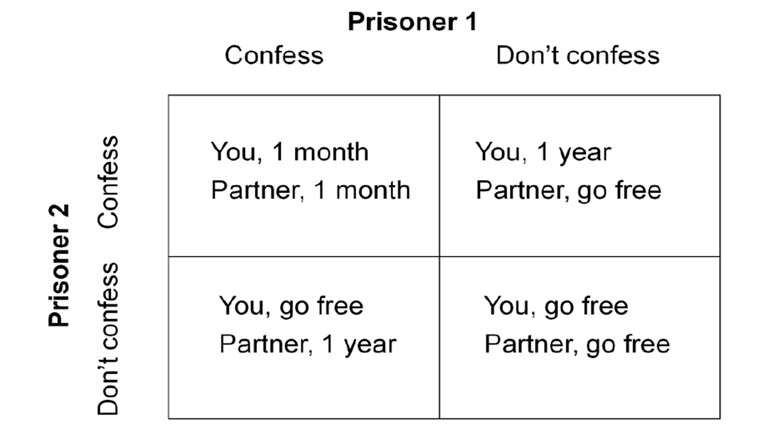

Relationship could often run into a dilemma between cooperation of and non-cooperation. The well known prisoner’s dilemma game (figure x)vividly illustrates this phenomenon. Two suspects are arrested by the police. The police have insufficient evidence for a conviction, and, having separated the prisoners, visit each of them to offer the same deal. If one testifies for the prosecution against the other (defects) and the other remains silent (cooperates), the defector goes free and the silent accomplice receives the full one-year sentence.

If both remain silent, both prisoners are sentenced to only one month in jail for a minor charge. If each betrays the other, each receives a three-month sentence. Each prisoner must choose to betray the other or to remain silent. Each one is assured that the other would not know about the betrayal before the end of the investigation. How should the prisoners act?

Figure 36. Prisoner's dilemma

The prisoner’s dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so. In this game, as in most game theory, the only concern of each individual player (prisoner) is maximizing his or her own payoff, without any concern for the other player’s payoff.

The unique equilibrium for this game is that the rational choice leads the two players to both play defect, even though each player’s individual reward would be greater if they both played cooperatively. This scenario of dilemma does sound very familiar in supplier buyer relationship. The trust may leave the business vulnerable to the onslaught of betrayal; but the betrayal will surely destroy the collaboration, that’s the dilemma.

Dilemma No.2

Relationship-based supply chain collaboration and integration often run into the dilemma between positive gains and negative constraint from the same loyalty and closeness of the relationship. A well-developed, high-involvement supplier buyer relationship is at the heart of a supply chain’s survival and is the basis of its growth and development. This is because the close relationship cultivates a culture of trust, creates synergy in collaboration and ensures operational efficiency.

But the high-involvement relationship also ties the company into its current ways of operating and restricts its capacity to change. The close partnerships are designed to be got rid of very easily. Trusted commitment is for the long-term. Cut short of close relationship unilaterally could be seen as a moral betrayal, and losing face is even harder to accept. Supplier buyer close relationship is, therefore for a company, both a powerful driver for development and the cage that imprisons it. The existing close relationship with the buyer, and the psychological commitment to it, could be a major constraint for the supply chain to engage with better suppliers when opportunities arise.

Dilemma No.3

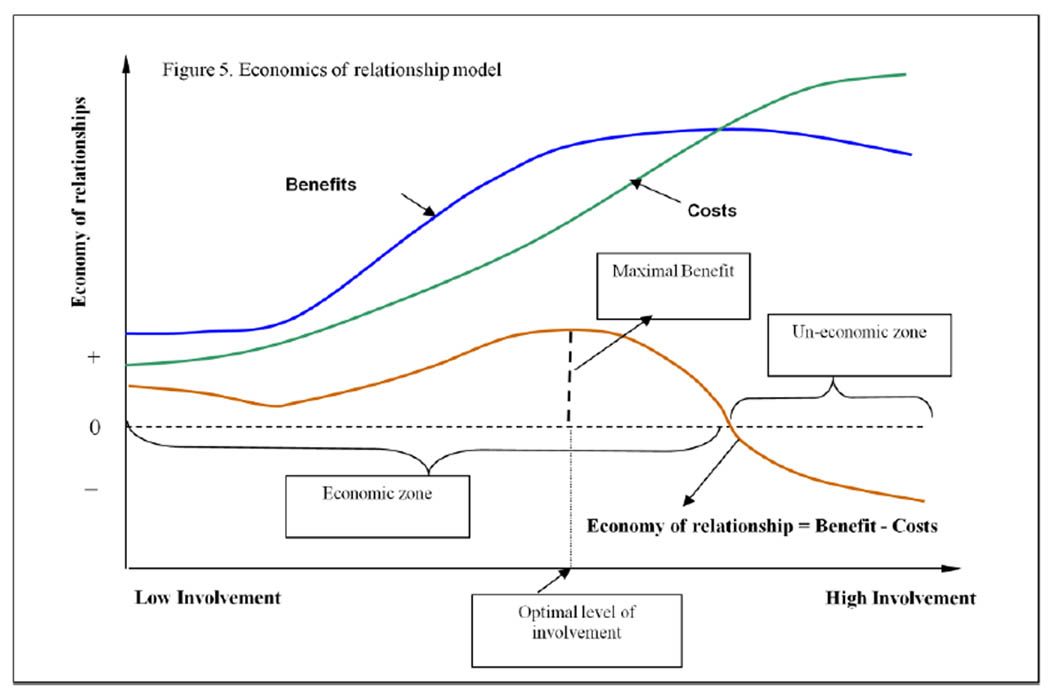

Relationship development will always have the dilemma between the level of commitment or cost on relationship and the level of benefit gained from the close partnership. The commitment and cost is the investment the company has to make in order to get closer with its supplier, which include all the activities and expenditures associated with it; and the benefit is everything and anything that contribute to the stakeholders’ interests.

Shown in figure 37, the benefit-gain (indicated by the blue line) from the supplier buyer relationship increases when the relationship gets closer, this is proven by numerous business cases. However, when the relationship gets too close, the gain of benefits may not continue to rise proportionally (the blue line dips a little at the end).

Nevertheless, the cost including all the invested commitment, time and money increase all the way when the relationship gets closer. The high level of engagement in all sorts of activities incurs costs (as shown by the green line). Combining the benefit curve and cost curve together, i.e. take the costs away from the benefit we arrive at a economics model for relationships. This model shown by the orange line depicted the cost and benefit dilemma in determining the level of engagement or the closeness of supplier and buyer relationship.

Three key rules can be derived from the model:

- The closer the more cost; are you prepare to pay or commit to the relationship?

- Over certain level of closeness the cost will surpass the benefit, and become uneconomical; never over-kill; enthusiasm must be tamed by reason.

- There always be an optimum level of closeness in the economic zone, where the effectiveness (benefit over cost) is at its highest.

Figure 37. Relationship dilemma on cost and benefit

Supply Chain Integration

Close relationship between the members of the supply chain is an indispensible part of the supply chain integration, and supply chain integration is an indispensible part of business success. I firm needs to develop effective coordination within and beyond its boundaries in order to maximise the potential for converting competitive advantage into profitability. That basically is what supply chain integration is all about. Conceptually, supply chain integration means that the legally independent participating firms coordinate seamlessly together as if they one company in order to achieve the common goal.

An integrated supply chain will coordinate the order fulfilment to match actual consumption at the end of the supply chain, and synchronise the suppliers’ production to ensure the timely delivery of the products to the right place at the right time and with the right price. Wal-Mart, for instance, shares point-of-sales data including sales and stocking data with its key suppliers. Tracking daily sales enables the suppliers to differentiate popular from slow-moving items and to respond quickly either to replenish or to discontinue the items in retail stores. Tight coordination between Wal-Mart and its key suppliers dramatically increases product availability and reduces inventory costs.

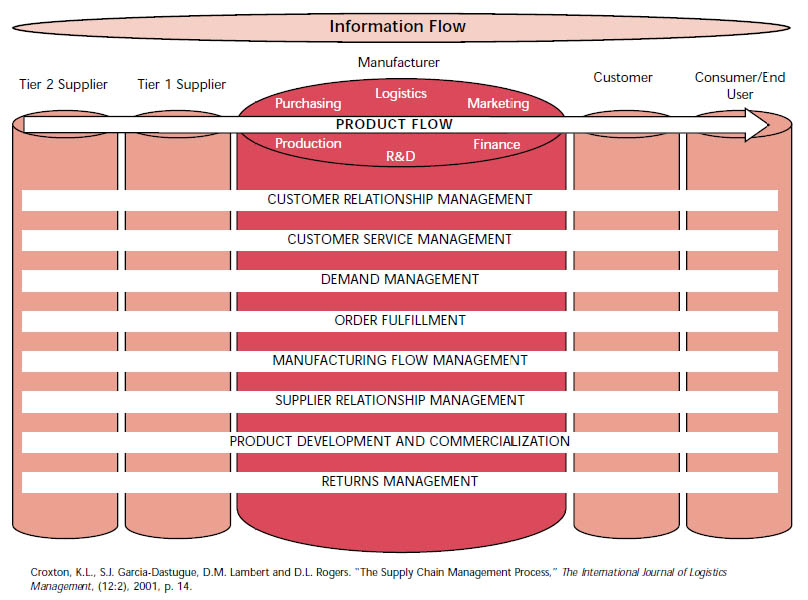

The figure 38 shows a framework of supply chain integration. It looks at the product flow that goes through a typical supply chain, which has the manufacturer as the focal company in the middle, involving two tiers of suppliers upstream and two tiers of customers downstream. On top of everything else, the information flow through the supply chain is the essential infrastructure for the integration. The contents of the integration are managed through 8 dimensions.

- Customer relationship management

- Customer service management

- Demand management

- Order fulfilment

- Manufacturing flow management

- Supplier relationship management

- Product development and commercialisation

- Returns management

Coordination among independent firms, such as raw-material suppliers, manufacturers, distributors, third-party logistics providers and retailers, is the key to attaining the flexibility necessary to enable them to progressively improve supply chain processes in response to rapidly changing market conditions. Poor coordination among the chain members can cause dysfunctional operational performance.

Some of the negative consequences of poor coordination include inventory costs, longer delivery times, higher transportation costs, higher levels of loss and damage, and lowered customer service.

Since the supply chain members are largely independent, the changes that occur in any of them are likely to affect the performance of the others and the supply chain as a whole. The performance of the supply chain thus is always the ‘integrated’ performance, with or without management influence, i.e. the supply chain is inter-linked one way or the other albeit very complex. However, to improve the overall supply chain performance to a desired level, a coordinated effort must be taken. A coordinated action not only has proven useful, but perhaps is the only effective approach to mitigate demand variability and excess inventories in the process.

If supply chain integration is about the process of planning, executing and controlling the interdependence of activities carried out by different supply chain members or business units in order to create value for the end consumer, then supply chain management is basically managing the supply chain integration.

Figure 38. Supply chain integration framework