Economics

In the dynamic world of economics, the competitive market stands as a fundamental concept that drives innovation, efficiency, and economic growth. Understanding the nuanced interactions between market players, their strategies, and the underlying economic principles is crucial for businesses, entrepreneurs, and economists alike. This comprehensive exploration delves into the multifaceted nature of competitive markets, examining everything from theoretical models to practical applications.

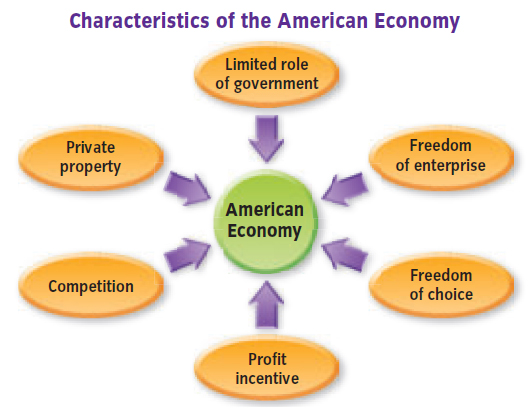

In a market economy, producers often spend large amounts to make sure that consumers—even very young children—know the names and logos of their products. This is because free-market consumers have freedom of choice, and they will often choose brand names they recognize. In this section, you’ll learn more about freedom of choice and the other major characteristics of a market economic system.

In today's consumer-driven world, shopping has transformed from a simple transaction into a complex decision-making process. With countless options available at our fingertips, understanding the fundamental principles of buying has never been more crucial. This article guide explores the essential strategies that can transform you from an impulsive buyer into a savvy consumer who makes informed, value-driven purchasing decisions.

In today's interconnected global landscape, understanding economic systems is more important than ever. From the free market capitalism of the United States to the centrally planned economy of North Korea, these systems fundamentally shape how societies allocate resources, distribute wealth, and meet the needs of their citizens.

If you have a part-time job, you may already be saving some of your income for a future use, such as buying the latest gaming system or continuing your education. Don’t be discouraged if you can save only a small amount, as saving something is better than saving nothing.